Key Notes

- XRP daily active addresses have jumped 124% since the beginning of July.

- XRP’s Relative Strength Index (RSI) has entered overbought territory above 70, typically indicating strong momentum.

- Market sentiment is buoyed by the SEC’s approval of the ProShares Ultra XRP ETF (UXRP), which offers 2x daily leveraged exposure to XRP via futures.

Amid the broader crypto market upside on July 16, XRP XRP $2.93 24h volatility: 1.1% Market cap: $173.33 B Vol. 24h: $7.42 B price is showing strength with 3% upside, and eyeing a quick breakout past $3.0. Market analysts are turning bullish with the upcoming launch of the ProShares XRP futures ETF on July 18. XRP is currently standing at a crucial crossroads in what seems to be a make-or-break event.

What’s Driving the XRP Price Rally?

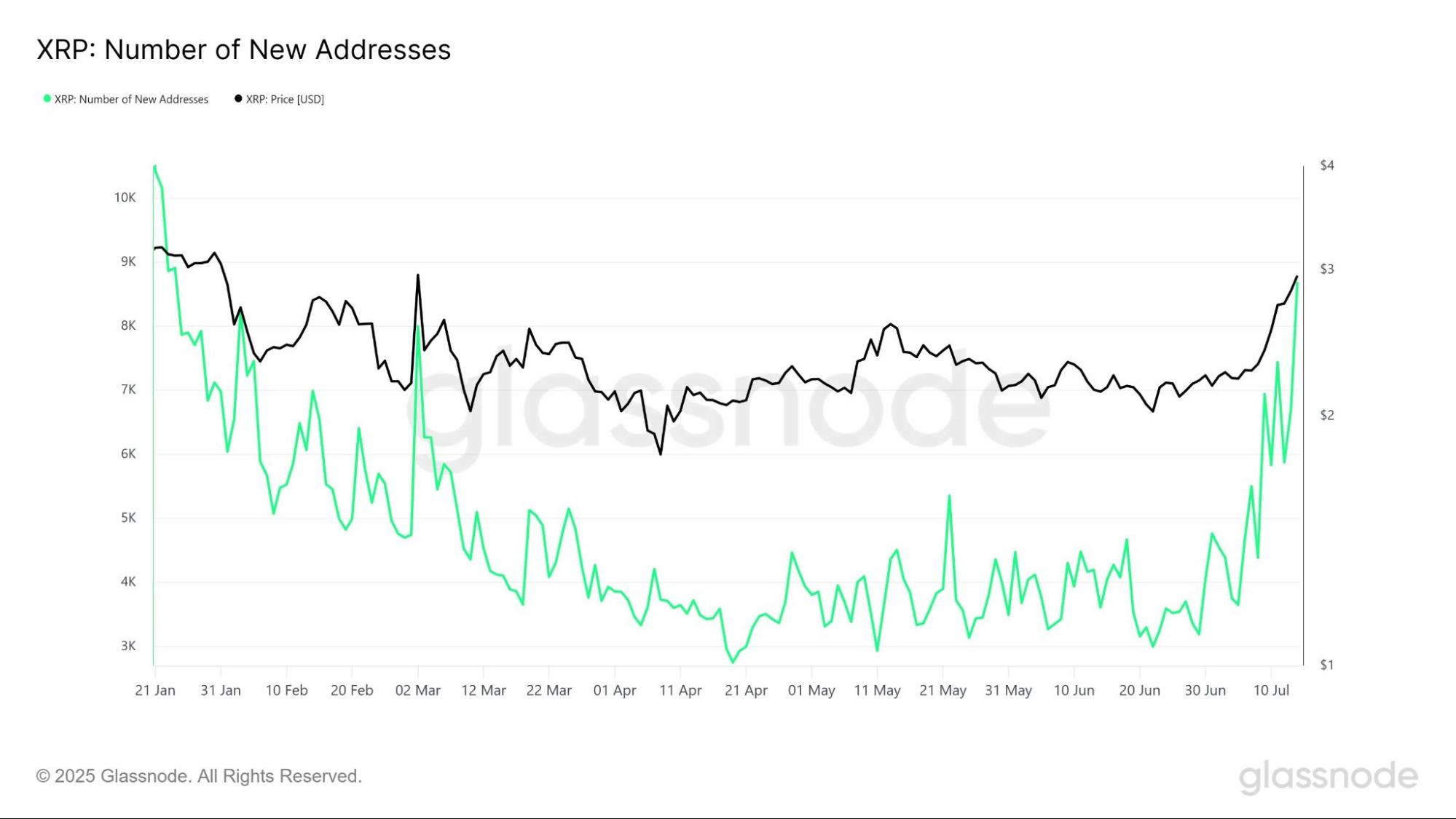

Over the past week, the XRP price has surged nearly 30% and is currently trading closer to its crucial resistance of $3.0. The recent rally in Ripple crypto is being driven by a sharp rise in network activity, with daily active addresses surging 124% since the start of July.

The number of active addresses has jumped from an average of 3,600 to 8,100, signaling renewed investor interest and heightened market optimism, according to data from Glassnode.

New XRP Addresses Rising | Source: Glassnode

This wave of new participation has provided strong momentum for XRP price, helping it outperform broader market trends. On the other hand, XRP technical indicators show XRP’s Relative Strength Index (RSI) has crossed above the 70.0 mark, signaling overbought conditions. This typically points to a strong ongoing rally and mirrors past instances when XRP saw extended upside momentum.

Notably, in November 2024, XRP rallied 387% before reversing. While such a steep surge is unlikely to repeat, current market signals suggest there may still be room for further gains before a potential cooldown.

XRP Relative Strength Index | Source: TradingView

Furthermore, the recent partnership of the California Government with Ripple is driving many eyeballs. The group, which convened for its inaugural meeting at Ripple headquarters on June 6, seeks to modernize public services, enhance transparency, and drive blockchain innovation across state government agencies.

All Eyes on ProShares XRP ETF Launch

Earlier this week, the US Securities and Exchange Commission ( SEC ) approved the listing of the ProShares Ultra XRP ETF on NYSE Arca, according to a regulatory filing dated July 14.

The leveraged futures-based fund, set to trade under the ticker UXRP, is designed to deliver 2x the daily performance of an XRP index. Rather than holding XRP directly, the ETF gains exposure through futures contracts and swap agreements.

The fund has also been added to the Depository Trust & Clearing Corporation (DTCC) eligibility list, a key prerequisite for trading. While a product page is now live, trading has yet to begin and is expected to happen on July 18.