Trump Administration Reaffirms Support for Minimum Tax Exemption on Crypto Transactions, Advancing Legislation to Facilitate Everyday Payments

According to ChainCatcher, citing The Block, the Trump administration has expressed support for a minimum tax exemption policy on small-scale crypto transactions. Although this provision was not included in the recently signed "Great American Bill," White House Press Secretary Levitt stated that the administration will continue to push for relevant legislation to lower the tax threshold for users making everyday payments with cryptocurrencies.

In addition, the Trump team plans to promote the signing of the GENIUS Act to improve the regulatory framework for stablecoins and aims to establish the United States as the "global crypto capital." Currently, the IRS still requires all crypto transactions to be truthfully reported. If the exemption policy is implemented, it is expected to greatly simplify compliance procedures and boost mainstream user adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin OG opens 5x ETH short position worth $15.04 million

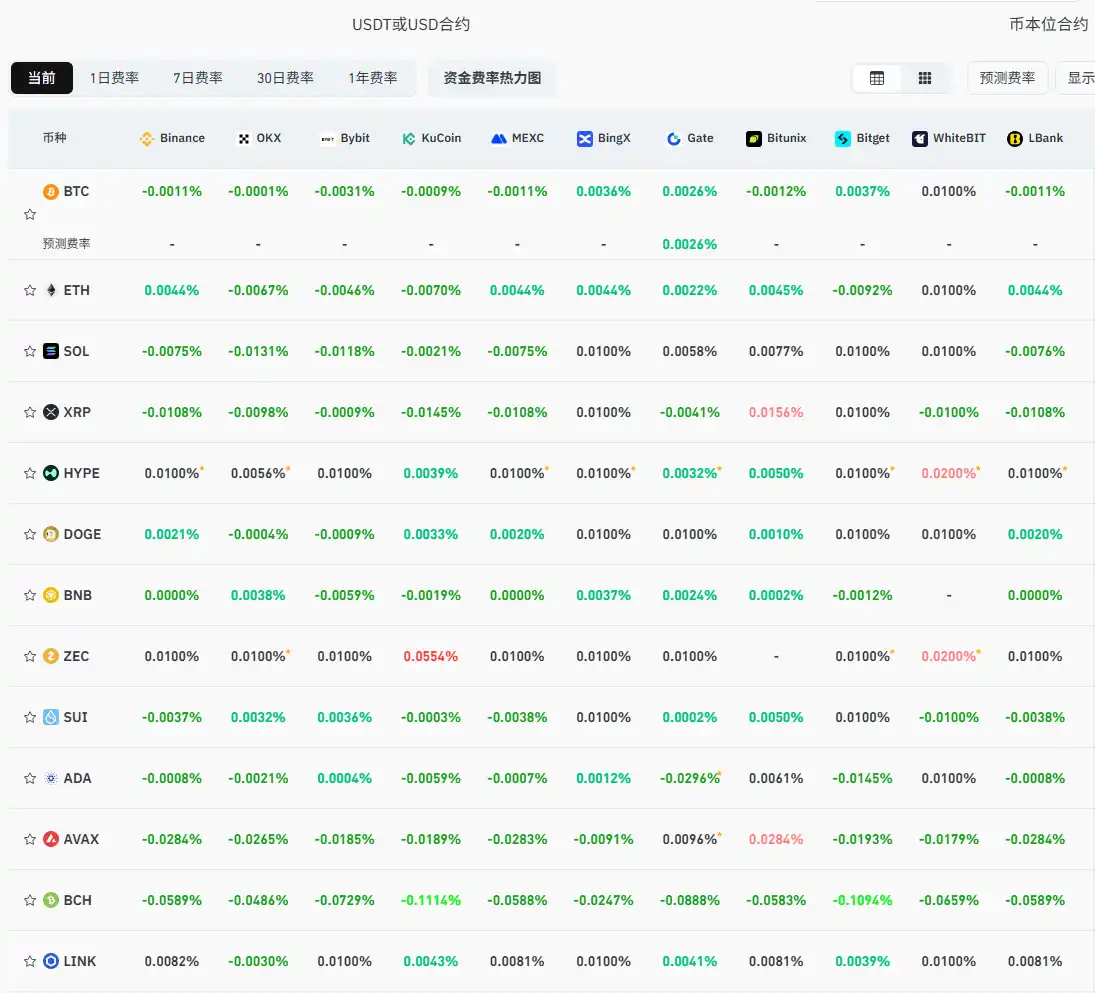

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

The Crypto Fear Index rises to 28, escaping the "Extreme Fear" zone

Analyst: The current macro environment is similar to the pandemic period, and bitcoin still has room to rise