Bank of America: Trade War Challenges the "American Exceptionalism" Narrative, U.S. Stocks' Share of Global Capital Drops Sharply

Odaily Planet Daily – Strategists at Bank of America have stated that as the trade war sparks doubts about the so-called “American exceptionalism,” the proportion of global equity market funds flowing into the U.S. will drop sharply in 2025. Citing data from EPFR Global, the Bank of America team noted in a report that so far this year, U.S. equity funds have attracted less than half of global inflows, compared to 72% in 2024. Over the past three months, foreign inflows have slowed to less than $2 billion, down from $34 billion in January this year. Trump’s unpredictable trade policies, the ballooning fiscal deficit, and the depreciating U.S. dollar have dampened investor enthusiasm for U.S. assets. Some asset management firms have warned that, due to the political risks brought by the Trump administration, the U.S. is no longer a safe investment destination for foreign investors. (Jin10)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

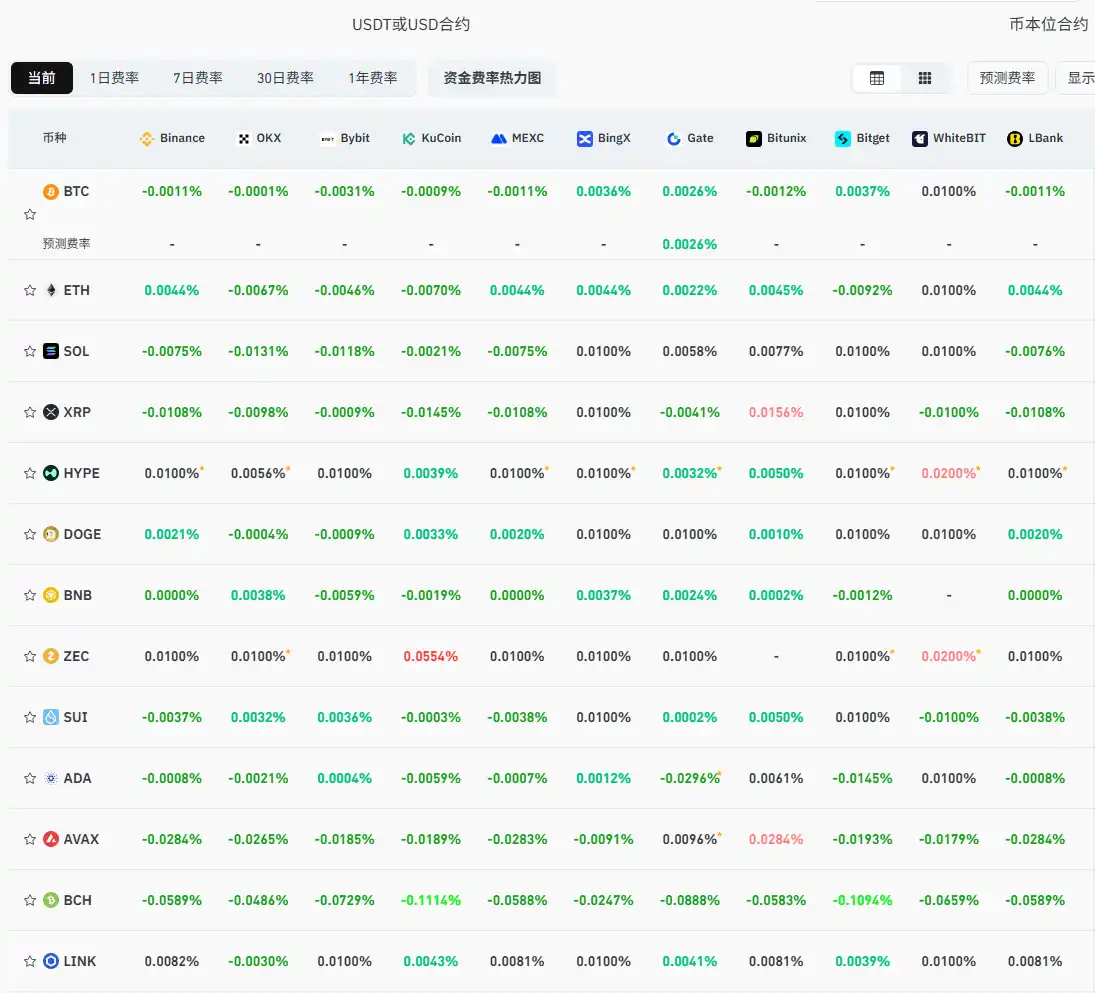

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish