- RSI has climbed to almost 85, flagging potential overbought conditions.

- Volume has risen sharply, driven by retail trader participation.

- Technical breakout from ascending triangle remains intact.

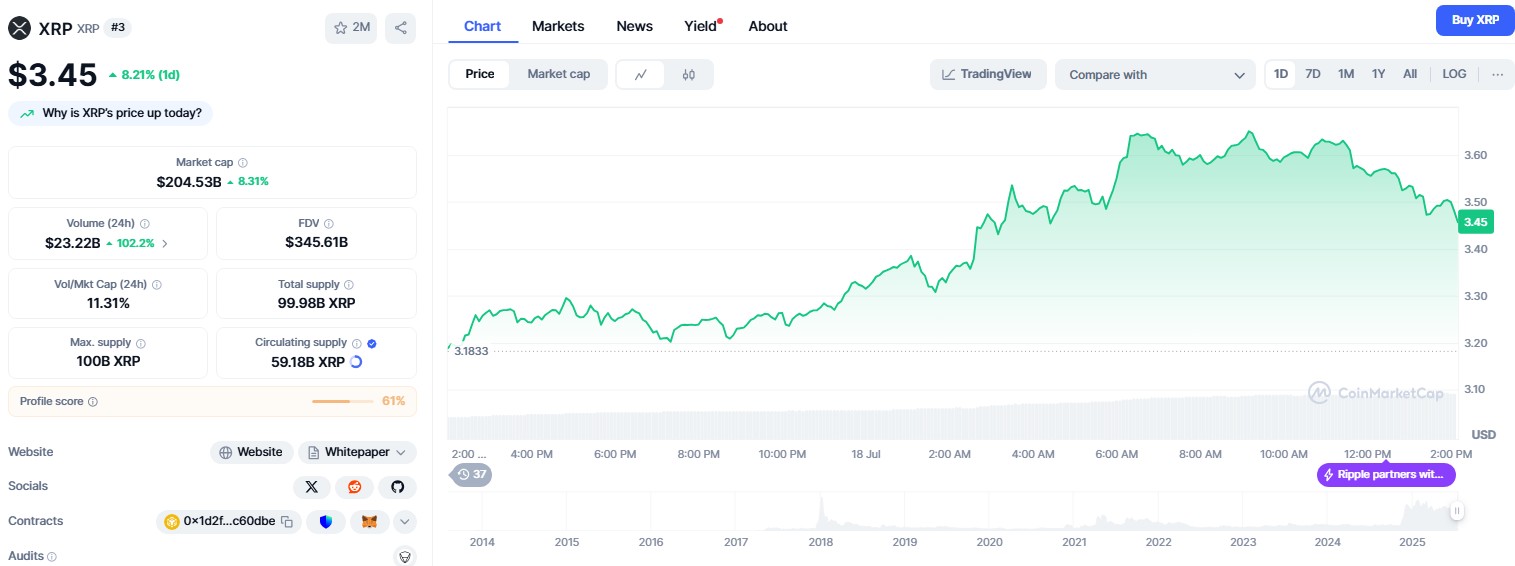

XRP has staged a powerful rally, climbing to $3.45 after months of subdued price action.

The Ripple-affiliated token, which had remained below $2.20 for a prolonged period, has now broken through key resistance levels with strong momentum.

Source: CoinMarketCap

Source: CoinMarketCap

The recent price action has captured market attention, as technical indicators, surging volume, and a bullish structure continue to support further upside—though overbought signals are beginning to emerge.

XRP rally led by price breakout above key resistance levels

The sharp move came after XRP broke out of a textbook ascending triangle pattern earlier this month, clearing major resistance points with little pushback.

The rally accelerated after the token crossed $3.20, continuing its upward trajectory to the current $3.45 level. This breakout confirms a significant shift in market structure.

Technically, XRP’s moving averages remain aligned in a bullish formation, with the 50, 100, and 200-day exponential moving averages stacked in favour of continued upside.

This alignment acts as a support base for the token and could cushion any short-term pullbacks, provided sentiment remains strong.

However, the pace of the recent rally raises the possibility of increased volatility.

RSI climbs to almost 85

While price action remains positive, the relative strength index (RSI) has reached almost 85, indicating overbought territory.

Traditionally, such levels suggest that an asset may be overheated, though this alone does not imply an immediate reversal.

Assets in bullish phases can remain overbought for extended periods, especially during momentum-driven runs.

XRP appears to be following that pattern, with price strength fuelled by increased interest and speculative activity.

Nevertheless, traders may remain cautious as indicators begin to flash early warnings of potential exhaustion.

Trading volume spikes as retail interest surges

XRP’s recent gains have been accompanied by a notable increase in trading volume, suggesting broad market participation.

The rally is not solely driven by large holders, as retail traders have stepped in with renewed enthusiasm.

This wider involvement adds weight to the price action and distinguishes it from earlier, less sustainable breakouts.

The current momentum appears supported by fear of missing out, but sustaining it will require continued inflows and market confidence.

XRP eyes $3.60 as next upside target

With the token now trading at $3.45, market participants are watching the $3.60 mark as the next key level.

This aligns with Fibonacci extension levels and round-number resistance.

If volume and sentiment remain strong, XRP could continue its upward push toward this zone.

The technical setup still appears constructive, with the breakout pattern intact and moving averages acting as support.

However, the rapid ascent means that XRP remains vulnerable to any sudden shifts in sentiment or broader market pullbacks.

A retracement could occur if traders begin booking profits at current levels.