Ethereum flips Costco, Johnson & Johnson as market cap grows by $150B this month

Key Takeaways

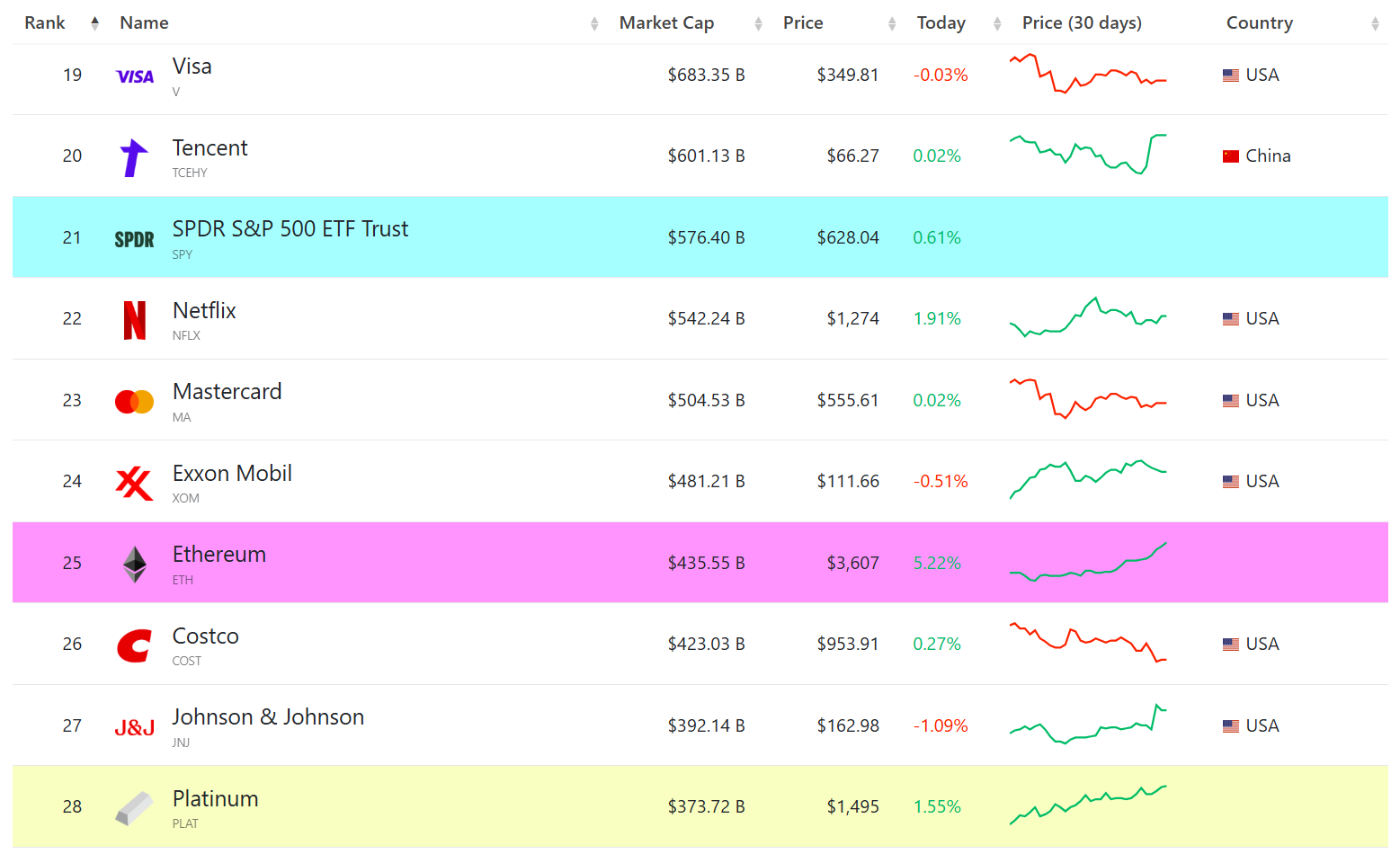

- Ethereum's market cap surged past $435 billion, overtaking major companies like Costco and Johnson & Johnson.

- US-listed spot Ethereum ETFs saw record inflows, with $726 million in a single day and $2.3 billion over nine consecutive days.

Share this article

Ethereum (ETH) has climbed 43% in a month, boosting its market cap past $435 billion and putting it ahead of retail giant Costco and healthcare heavyweight Johnson & Johnson in size, CompaniesMarketCap data shows. Ethereum’s market cap has climbed by over $150 billion since July 1.

The second-largest crypto asset is now closing in on Mastercard and Netflix, the next two giants ahead of it by market cap. Mastercard is valued at over $504 billion, while Netflix sits at around $542 billion.

Ethereum’s recent rally has been fueled by several factors, mainly market-wide optimism during “Crypto Week,” which ended favorably with the House passing three major crypto bills , and increased accumulation of ETH by institutions and corporations.

On the ETF front, US-listed spot Ethereum ETFs saw a record $726 million in daily inflows on Wednesday, their highest since launching nearly a year ago. Over the past nine consecutive trading days, the nine Ethereum funds have collectively attracted $2.3 billion.

SharpLink Gaming, meanwhile, has been actively accumulating Ethereum. The company has recently expanded its equity offering from $1 billion to $6 billion to support its crypto gaming initiative and growing ETH reserves.

Ethereum was changing hands at over $3,600 at press time, marking a 5% daily gain, CoinGecko data shows. Trading volume stood at a strong $70 billion.

The crypto asset is still 26% away from its all-time high of $4,878 set in November 2021.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.