Cryptocurrencies surpass $4 trillion and overtake the UK economy

- Cryptocurrency market reaches $4 trillion market cap

- Digital assets surpass UK in economic value

- Altcoins and Regulation Drive Global Crypto Growth

The global cryptocurrency market surpassed the $4 trillion market cap mark for the first time, temporarily surpassing the estimated size of the UK economy, which is valued at around $3,8 trillion. The milestone was reached during the Asian trading session on July 18.

Despite a slight decline to $3,9 trillion later, the feat represents significant progress in the sector's recovery, having regained the $3 trillion level just two months earlier. Recent growth has been driven primarily by the appreciation of altcoins, increased institutional involvement, and the advancement of clearer regulatory frameworks in several jurisdictions.

With this new level, the crypto sector, if classified as a national economy, would rank among the six largest in the world. Only the United States, China, Germany, Japan, and India maintain higher economic output. This prominence reinforces the growing role of crypto assets within the global economy.

According to an analysis by CryptoRank, the capitalization of cryptocurrencies already surpasses economies like France ($3,2 trillion) and Italy ($2,4 trillion). This growth can also be compared to global companies: while the sector as a whole would be comparable to a corporation with a trillion-dollar valuation, it would still lag slightly behind Nvidia, the artificial intelligence giant, which also recently reached the $4 trillion milestone.

The market's evolution has been accompanied by a renewed interest in low-cap tokens and consistent institutional investment flows. At the same time, the advancement of bills aimed at regulating cryptocurrencies, especially in the United States, has created a more stable and reliable environment for large-scale investors.

This context not only favored the growth of Bitcoin and Ethereum, but also led to a broad appreciation among several altcoins, solidifying the position of cryptocurrencies as a growing global economic force.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

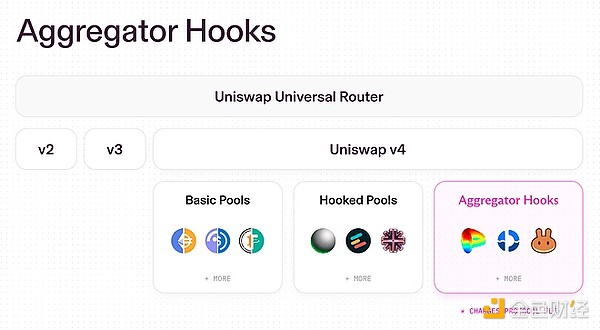

UNI surges nearly 50%: Details of the Uniswap joint governance proposal