Key Market Intelligence for July 21st, how much did you miss?

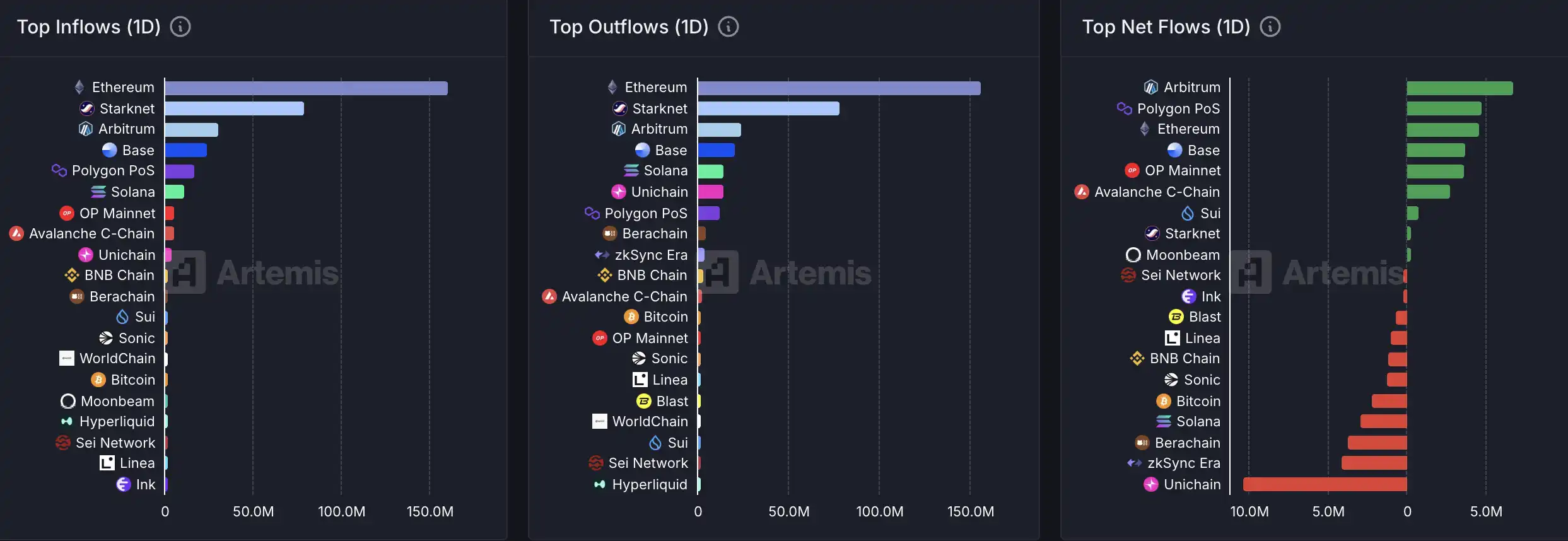

1. On-chain Funds: $31M Flows into Arbitrum; $14.6M Flows out of Unichain 2. Biggest Price Swings: $DIA, $ELX 3. Top News: Total NFT Trading Volume Surpasses $31M in the Past 24 Hours, Marking a Nearly 200% Increase

Featured News

1. NFT Wholesome News: Total Network NFT Trading Volume Surpasses $31 Million in the Past 24 Hours, Nearly 200% Increase

2. ZORA Market Cap Exceeds $77 Million, Surging Over 56% in 24 Hours

3. PENGU Market Cap Surpasses TRUMP, Becoming the Second-Largest Meme Coin on the Solana Blockchain by Market Cap

4. Linea, Consensys, and Nile Collaborate to Launch the Decentralized Exchange Platform Etherex

5. Solana Market Cap Surpasses Intel, Rising to 218th Place in Global Asset Market Cap Ranking

Featured Articles

1. "Next Hundredfold Opportunity? Review of the Most Anticipated Unreleased Coin Perp DEX Dark Horse in 2025"

This is undoubtedly the major racetrack of 2025. Since the airdrop of the Hyperliquid token on November 29, 2024, which set off a frenzy across the network, this racetrack has entered the fast lane. As the representative of the new generation of order book Perp DEX, the token HYPE once surged to $50 and has since stabilized around $47, becoming one of the most attractive and high-impact projects of the year.

The Perp DEX track not only has high revenue but also has significant room for growth, posing an unprecedented threat to CEXs. The daily trading volume of crypto derivatives is typically 4-5 times that of spot trading, and the penetration rate of the on-chain derivatives market is currently less than 10%, indicating a growth potential of at least 10 times in the future. Just as there is not just one centralized exchange, more and more teams are joining the race, raising the ceiling of the track and intensifying the competition. Major projects continue to upgrade in technology, liquidity, depth, user experience, and incentive mechanisms, stepping up their game. With the influx of projects and frequent innovations, a stronger "wealth overflow" effect has emerged, attracting continuous attention from a large amount of funds and users, especially in the new wave of unreleased coin Perp DEX players.

Currently, the second season airdrop of Hyperliquid is about to commence, and other rapid-growth projects with strong team backgrounds and high coin issuance expectations are also emerging rapidly. This article by BlockBeats will review five unreleased coin Perp DEX dark horses—whether they are rapidly growing, well-resourced, or have strong VC backing, they are key projects that this round of "scalping" troops and contract players cannot afford to miss.

2.《Is the NFT Summer Back Again? Check Out What the Veteran Project Is Up To》

After 4 years, the "Punk Sweep" reappeared, with a single address spending $8 million to sweep 46 CryptoPunks in one go, igniting the NFT community's enthusiasm. Not only CryptoPunks, but in recent days, the overall trading volume of the NFT market has rekindled, even surpassing the high point in February this year in one fell swoop. According to data from the Coingecko platform, the total market value of the NFT sector has risen by 29% within 24 hours, surpassing a $6.7 billion market cap. The trading volume has soared by 372%, reaching $45 million.

Crypto seems to have abandoned the NFT sector for a long time, but the "notorious" MoonBird has recently made a move again, seemingly preparing to follow the "Pudgy Penguins" IP path. With the overall warming of the NFT market and the repeated mentions of Opensea, which has not issued coins for a long time after its official announcement, can we ask that question, "Is NFT Summer back again?"

On-chain Data

On-chain Fund Flow for the Week of July 21

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The New York Times: $28 Billion in "Black Money" in the Cryptocurrency Industry

As Trump actively promotes cryptocurrencies and the crypto industry gradually enters the mainstream, funds from scammers and various criminal groups are continuously flowing into major cryptocurrency exchanges.

What has happened to El Salvador after canceling bitcoin as legal tender?

A deep dive into how El Salvador is moving towards sovereignty and strength.

Crypto ATMs become new tools for scams: 28,000 locations across the US, $240 million stolen in six months

In front of cryptocurrency ATMs, elderly people have become precise targets for scammers.