Date: Sun, July 20, 2025 | 03:20 AM GMT

The cryptocurrency market remains firmly bullish, with Ethereum (ETH) leading the surge — gaining 22% over the past week and now trading above $3,600. This bullish momentum is spilling into major altcoins , and IOTA (IOTA) is showing signs of further upside.

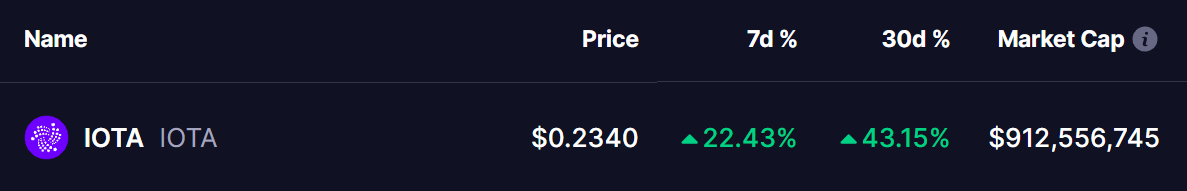

IOTA has risen 22% over the past week, extending its 30-day gains to 43%. Beyond the price appreciation, the formation of a harmonic pattern on the daily chart is signaling the potential for another strong upside move.

Source: Coinmarketcap

Source: Coinmarketcap

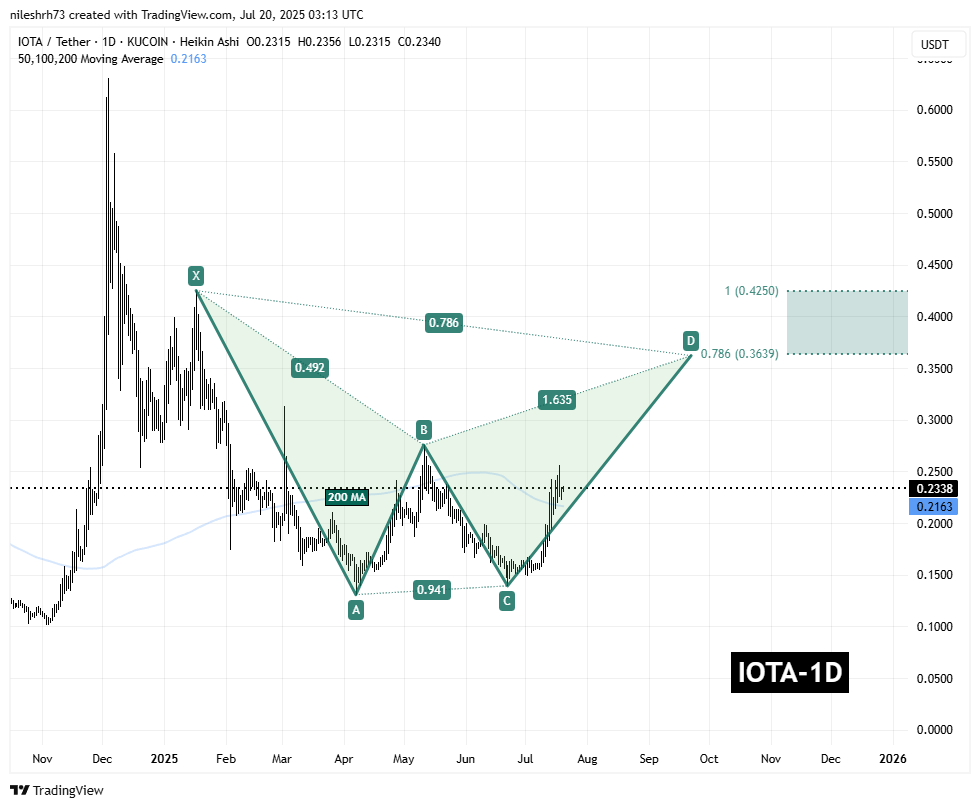

Harmonic Pattern Hints at Upside Continuation

On the daily timeframe, IOTA is tracing out a textbook Bearish Gartley harmonic pattern, often seen as a signal for a continuation rally before eventually hitting a reversal zone.

This specific Gartley pattern began at point X near $0.4250, dropped to point A, rallied to point B, and then retreated to point C around the $0.1393 level. Since that low, IOTA has sharply reversed and is now trading near $0.2343, holding a bullish trajectory and sitting comfortably above key short-term levels.

IOTA Daily Chart/Coinsprobe (Source: Tradingview)

IOTA Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for IOTA?

If this harmonic structure continues to play out, the Potential Reversal Zone (PRZ) lies between $0.3639 and $0.4250. These levels align with the 0.786 and 1.0 Fibonacci extensions, which are typical completion targets for this setup. From current levels, a rally into this zone represents up to 81% upside.

However, for this outlook to remain intact, IOTA must hold above the 200-day moving average (MA), currently near $0.2163. A brief retest of this support is possible, but maintaining that level would keep the bullish scenario valid.

With broader market momentum in favor and IOTA’s harmonic pattern pointing toward a clear upside zone, the altcoin could be primed for its next breakout leg.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.