Ethereum Staking Liquidity Accelerates as Exits and Entries Reach Highs of Approximately $2 Billion and $1.3 Billion Respectively

According to Jinse Finance, driven by Ethereum’s surge of over 160% since April, there has been a large-scale wave of profit-taking among ETH stakers, with the number of validators in the exit queue climbing to 519,000 ETH, valued at approximately $1.92 billion. The queue time has exceeded 9 days, reaching its highest level since January 2024. Meanwhile, heightened institutional staking enthusiasm has pushed the number of ETH in the entry queue to 357,000, worth about $1.3 billion, with a queue time of over 6 days—the longest since April 2024. Since companies such as Sharplink Gaming shifted to an ETH treasury strategy in May, staking demand has risen sharply. Analysis indicates that the exits are mainly driven by early stakers taking profits, while the entries have been boosted by regulatory tailwinds after the SEC clarified on May 29 that “staking does not violate securities laws.” As of now, the number of active Ethereum validators has surpassed 1.09 million, an increase of more than 54,000 since the end of May. Andy Cronk, co-founder of Figment, noted that institutional staking delegation has grown by over 100%, and validator queue times have increased by more than 360%, in line with ETH’s price rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Suspected BitMine address increases holdings by 20,532 ETH

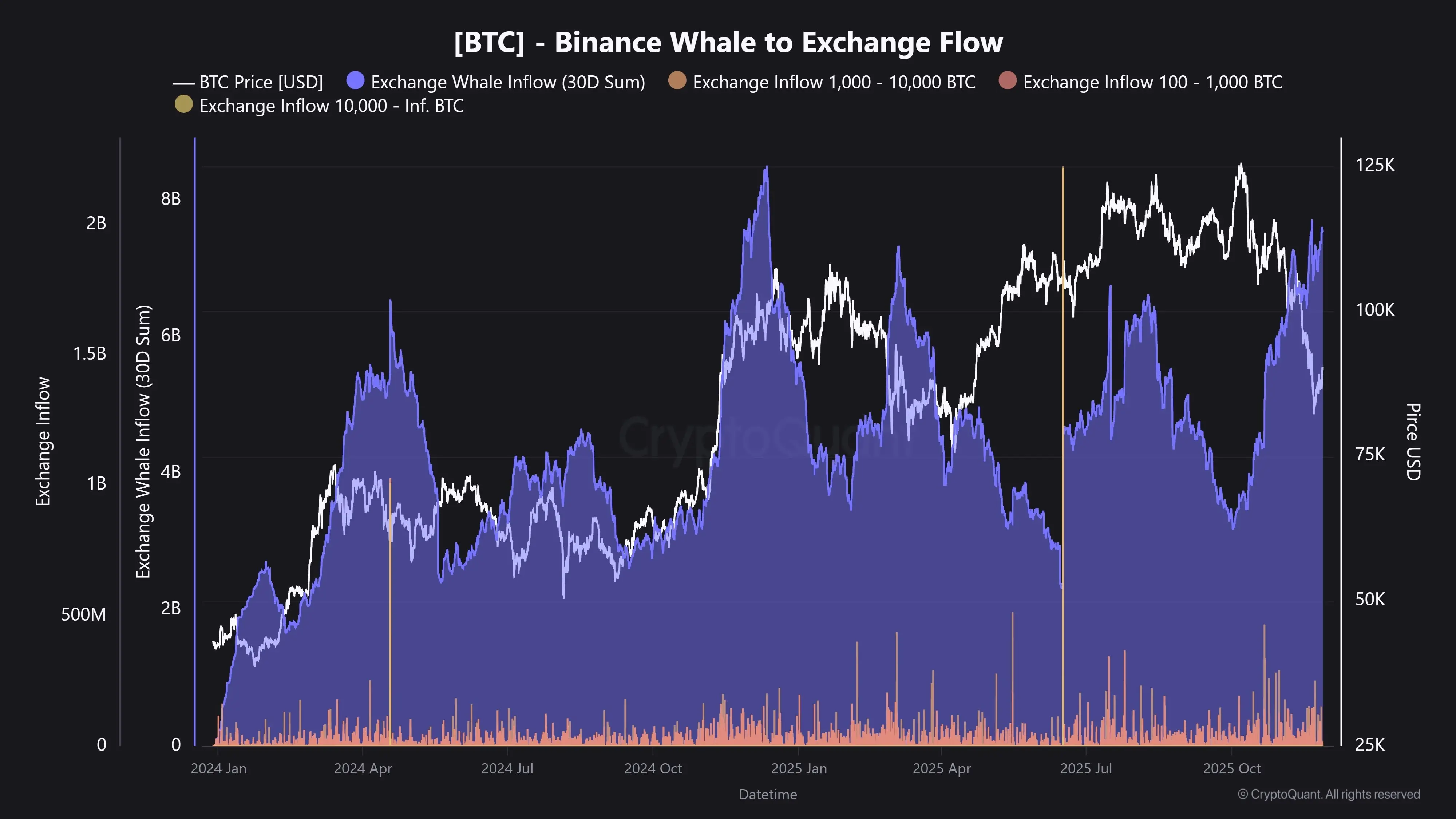

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month