Ozzy Osbourne’s NFT Collection Surges Over 400% Following His Death

Ozzy Osbourne’s death has reignited interest in his 2021 NFT collection, CryptoBatz, which surged over 400% on OpenSea. The digital bats, inspired by a legendary moment in Osbourne’s career, offer unique features like NFT fusion.

The death of Black Sabbath frontman and rock legend Ozzy Osbourne has sparked a dramatic spike in interest in his NFT project.

The “CryptoBatz” collection on OpenSea jumped over 400% in value shortly after the announcement of his passing.

Ozzy Osbourne’s Legacy Fuels a Digital Revival

Osbourne launched the 9,966-piece “CryptoBatz” collection at the height of the NFT boom in late 2021. Each token represents a digital bat — a nod to one of the most controversial moments of his career.

Since its release, CryptoBatz had already attracted fans of both heavy metal and crypto. But following Osbourne’s death, the NFTs surged in value, marking a sharp rise in market activity.

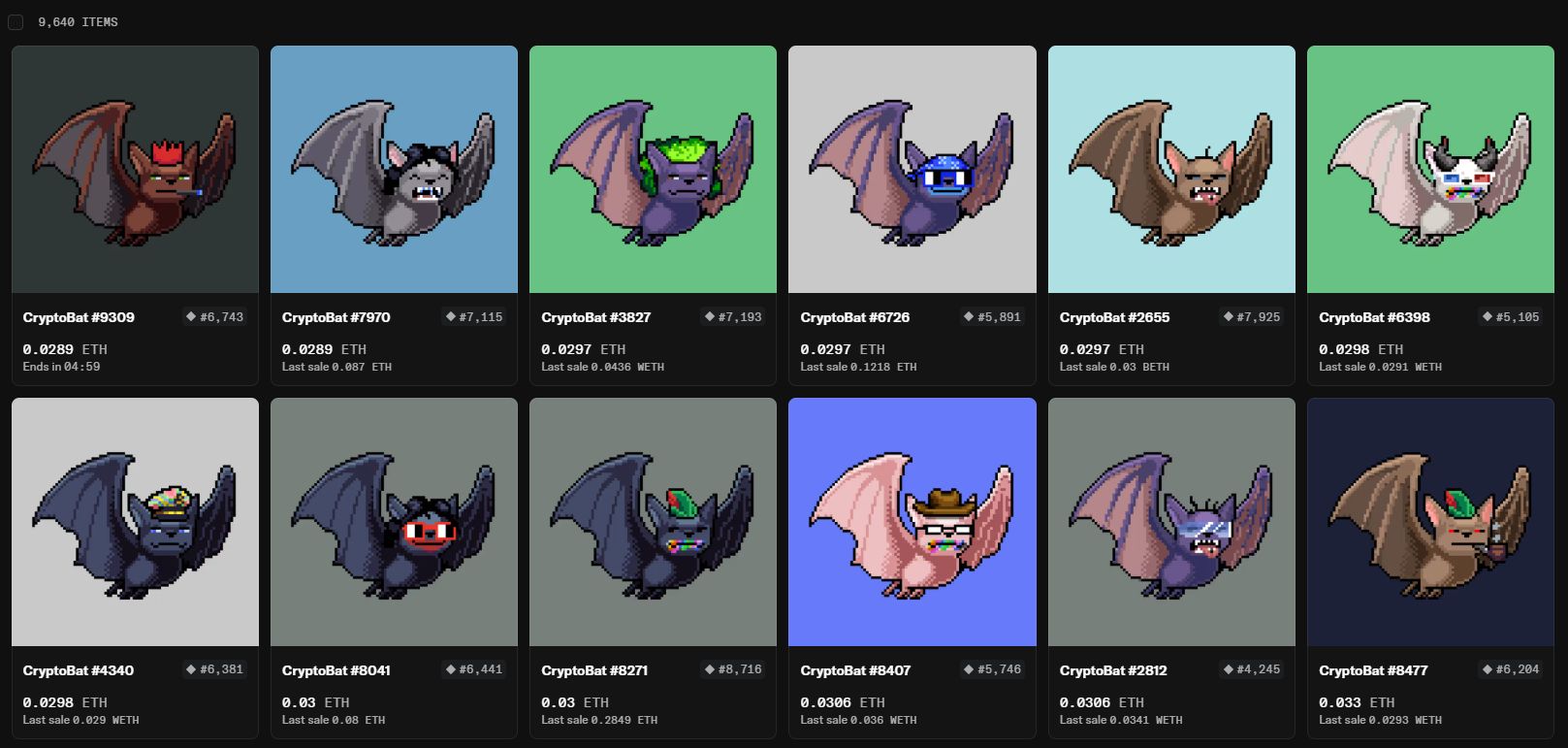

Ozzy Osbourne’s CryptoBatz Collection. Source:

OpenSea

Ozzy Osbourne’s CryptoBatz Collection. Source:

OpenSea

The project was Osbourne’s first official NFT collection, made in collaboration with digital artists.

Beyond being collectible images, CryptoBatz offered a unique feature: each bat could “bite” another NFT to form a hybrid known as “MutantBatz.”

This mechanic allowed holders to combine their CryptoBatz with NFTs from high-profile collections like Bored Ape Yacht Club, SupDucks, and Cryptotoadz.

CryptoBatz Floor Price Spikes. Source:

CoinGecko

CryptoBatz Floor Price Spikes. Source:

CoinGecko

A Tribute to a Wild Legacy

The concept was inspired by a 1982 incident during a concert in Des Moines, Iowa. Osbourne famously bit the head off what he thought was a rubber bat — a moment that became part of rock history.

Speaking on the launch, Osbourne once said he wanted a Bored Ape NFT for Christmas but was denied by his wife, Sharon.

Instead, he decided to create his own collection — a move that resonated with fans and NFT collectors alike.

Ozzy Osbourne’s Famous Bat Incident. Source:

Daily Mail

Ozzy Osbourne’s Famous Bat Incident. Source:

Daily Mail

Osbourne never publicly disclosed how much he earned from the project. However, the surge in value and trading volume suggests the collection has been financially successful.

Wider NFT Market Still in Decline

Despite CryptoBatz’s rebound, the broader NFT market remains far below its all-time high. As of now, the total market cap sits at $1.47 billion — a steep drop from the $507 billion recorded in April 2022.#

NFT Market Cap Chart. Source:

CoinGecko

NFT Market Cap Chart. Source:

CoinGecko

According to CoinMarketCap, daily trading volumes hover around $12.8 million, while average sales of digital collectibles reach just $71,900.

The market still shows signs of weakness, even as legacy-driven collections like Osbourne’s briefly revive interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes