Bitcoin Prices Dip Below $118,000 Amid Market Correction

- Bitcoin drops below $118,000 amid market corrections.

- Institutional adjustments drive these changes.

- ETF outflows reflect investor cautionary moves.

Bitcoin has fallen below $118,000, trading between $117,800 and $118,200, as part of a market correction affecting major cryptocurrencies.

The recent fall of Bitcoin below $118,000 represents a key moment in a broader market correction. After reaching an all-time high above $123,000 ten days ago, Bitcoin joins other major cryptocurrencies in facing price adjustments, in part due to institutional influences in market dynamics.

Major players like Binance and investment managers are now pivoting towards these changes. Werner Brönnimann, an investment manager, emphasizes the institutional capital shift rather than past retail-led cycles:

“Bitcoin’s recent push to over $123,000 and breaching $4 trillion market cap appears to represent a fundamental shift in market dynamics. This shift is driven primarily by institutional capital, not ‘the retail-led manias of previous cycles.’

Spot Bitcoin ETFs have experienced two consecutive outflow days.

These market shifts have led to Bitcoin’s 0.50% drop, affecting major cryptocurrencies. Ethereum has fallen 3.7%, while altcoins like XRP, DOGE, and ADA plunge further. This marks a significant movement within the cryptocurrency arena , reflecting investor repositioning.

As the crypto market adapts, recent changes hint at strategic responses from institutional investors and regulatory considerations. Continued outflows from ETFs signify the potential for broader market impacts, setting a precedent for future price actions amid the latest trends.

The present correction might signal a consolidation phase rather than a bear market onset. Analysts note historical trends where Bitcoin prices correct yet do not reverse sharply. As institutional adoption grows, market observers focus on technological developments and regulatory shifts that could alter future dynamics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin is still in a good place, but short-term holders might be a problem

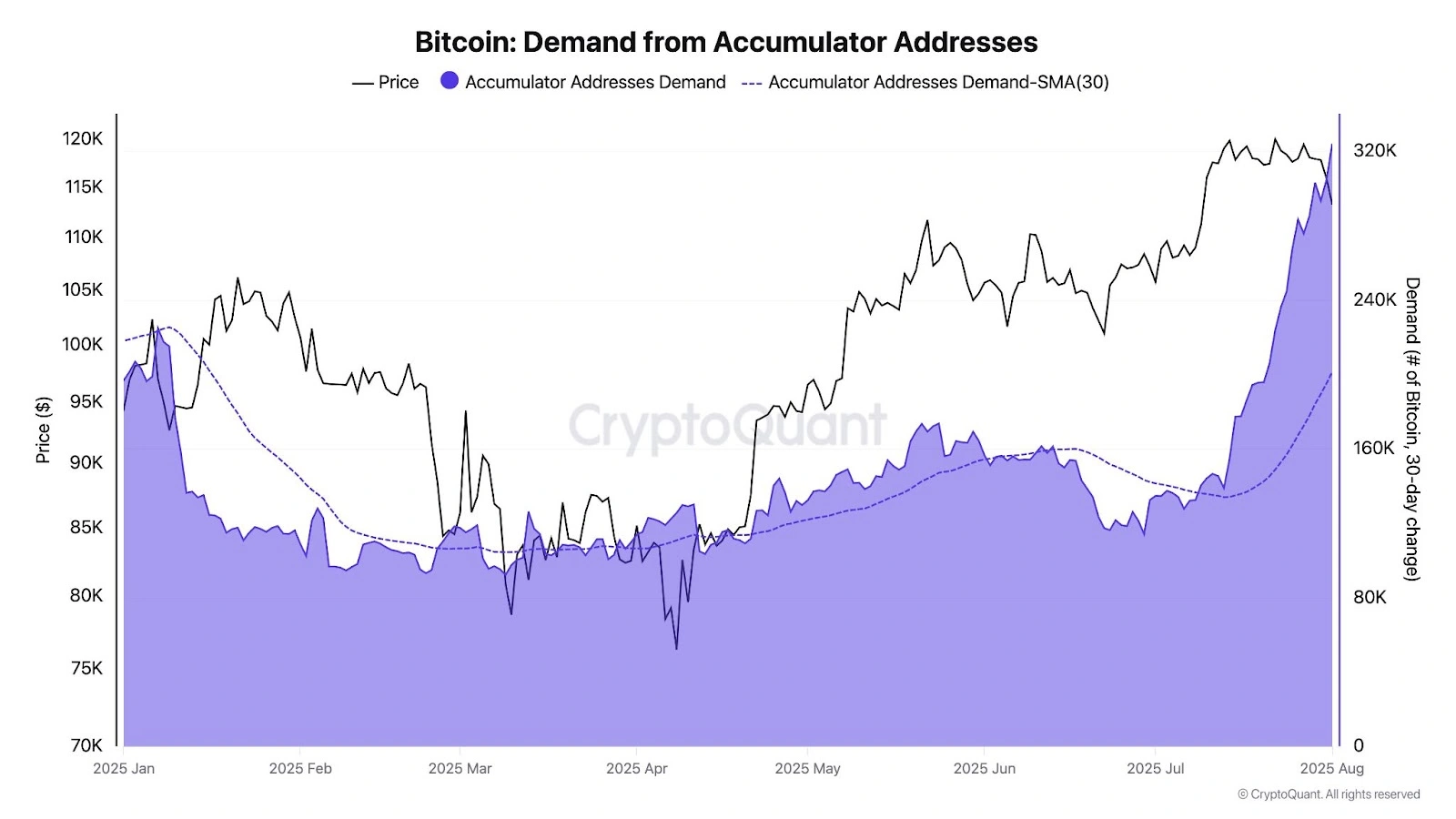

Share link:In this post: Accumulator wallets continue to buy without selling, reinforcing the bullish sentiment around the Bitcoin market. Declining OTC reserves hint at tightening supply and rising institutional demand. Short-term holders are nearing breakeven, increasing the risk of panic selling.

Sharplink and The Ether Machine lead as whales continue to stack ETH

Share link:In this post: Whales had a field day today, as on-chain data revealed that two Whale addresses received nearly 43K Ether worth over $153M. SharpLink Gaming also bought 18.68K ETH worth over $66.6M, while The Ether Reserve LLC acquired 10.6K ETH valued at around $40M. The Kobeissi Letter noted that ETH added a market cap of over $150 million since July 1.

Google to limit AI data center power usage during peak demand periods

Share link:In this post: Google has signed its first formal agreements to reduce AI data center power usage during peak electricity demand. The agreements with U.S. utilities, Indiana Michigan Power and Tennessee Valley Authority, address the rising energy demand from AI workloads straining power grids. Google’s agreement has introduced AI into demand-response programs and may set a precedent for other tech companies to deal with blackout concerns and higher electricity bills.

SEC Appeals in Ripple XRP Case Nears Deadline