Bitcoin Holders Exhibit Confidence with Low Exchange Inflows

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Low exchange inflows reflect strong investor confidence.

- Institutional demand continues driving Bitcoin accumulation.

Main Content

Bitcoin inflows to exchanges remained low in 2025, indicating strong market confidence. Major players such as BlackRock , Grayscale, and Fidelity continue to influence investor behavior, with sustained interest from both institutional and retail sectors.

Bitcoin’s historically low inflows signify robust investor faith, affecting market dynamics and guiding retail and institutional strategies toward accumulation.

“Bitcoin has continued to flow out of centralized exchanges over the past few months. This trend reflects the growing confidence of investors in the long term.” – Darkfost, On-Chain Analyst, via X (Twitter)

Institutional demand remains potent, with major inflows noted in Bitcoin ETFs, such as BlackRock’s $893 million increase in one day. Major ETF issuers and whales lead the market, driving confidence across the board.

Bitcoin continues to be the primary asset impacted, seeing significant accumulation trends. Retail holders and institutional investors are retaining Bitcoin, reinforcing its role as a long-term asset despite market corrections.

Financial implications are clear, with liquidity consolidating around large ETFs like Grayscale , indicating a shift in market sentiment. Investor activity has been rising, suggesting a rebound in interest post-correction.

According to on-chain data, the historical trend of low exchange inflows typically precedes price increases. Analysts highlight these patterns, indicating sustained institutional and retail confidence.

The ongoing low inflow trend suggests potential long-term stability in Bitcoin’s valuation. On-chain analysts observe a pattern reminiscent of past cycles, hinting at growth possibilities as confidence sustains amidst broader macroeconomic conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin is still in a good place, but short-term holders might be a problem

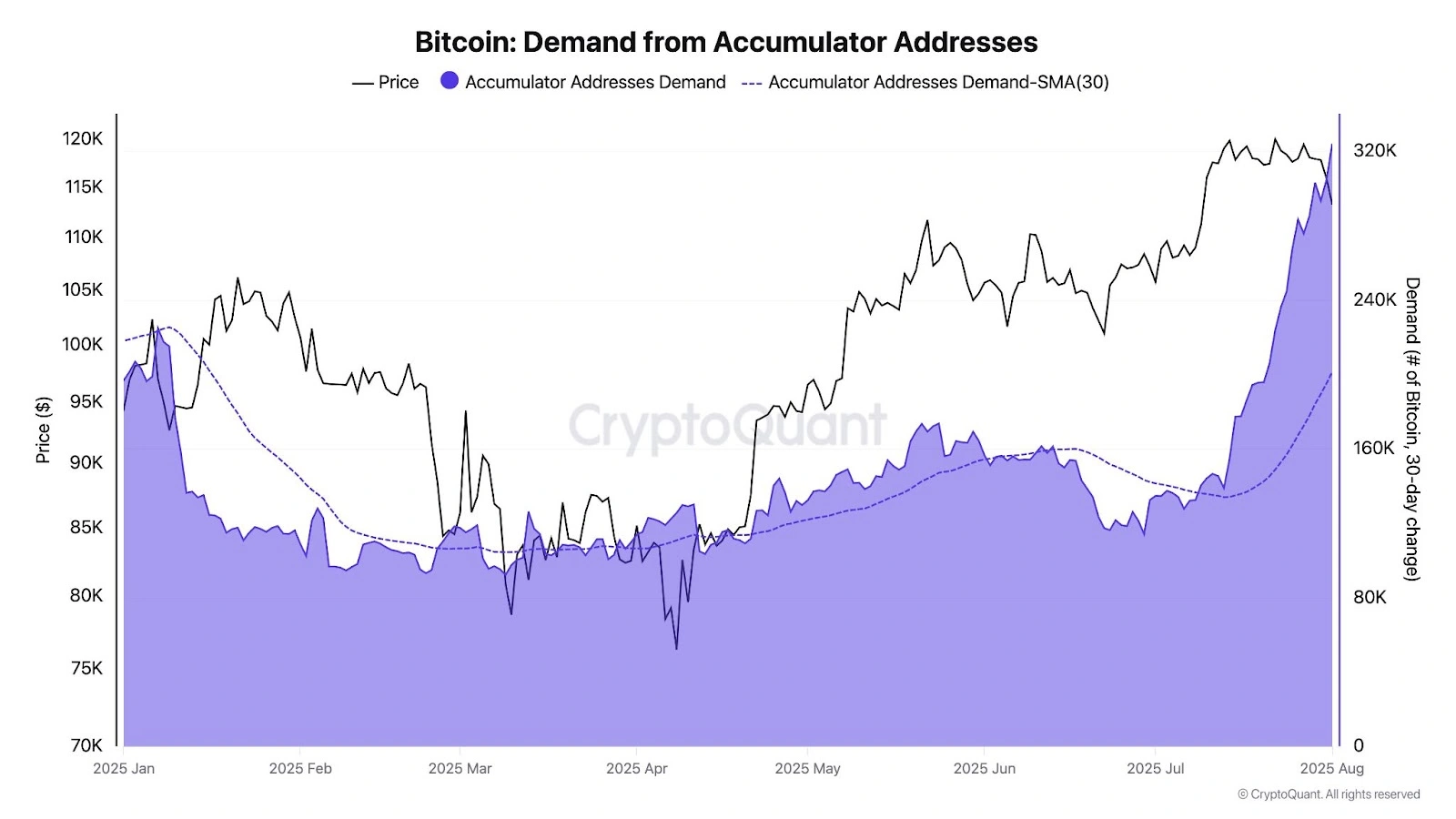

Share link:In this post: Accumulator wallets continue to buy without selling, reinforcing the bullish sentiment around the Bitcoin market. Declining OTC reserves hint at tightening supply and rising institutional demand. Short-term holders are nearing breakeven, increasing the risk of panic selling.

Sharplink and The Ether Machine lead as whales continue to stack ETH

Share link:In this post: Whales had a field day today, as on-chain data revealed that two Whale addresses received nearly 43K Ether worth over $153M. SharpLink Gaming also bought 18.68K ETH worth over $66.6M, while The Ether Reserve LLC acquired 10.6K ETH valued at around $40M. The Kobeissi Letter noted that ETH added a market cap of over $150 million since July 1.

Google to limit AI data center power usage during peak demand periods

Share link:In this post: Google has signed its first formal agreements to reduce AI data center power usage during peak electricity demand. The agreements with U.S. utilities, Indiana Michigan Power and Tennessee Valley Authority, address the rising energy demand from AI workloads straining power grids. Google’s agreement has introduced AI into demand-response programs and may set a precedent for other tech companies to deal with blackout concerns and higher electricity bills.

SEC Appeals in Ripple XRP Case Nears Deadline