Cardano ADA Surges Amid Bullish Breakout Pattern

- Cardano’s price increase targets higher resistance zones.

- Institutional inflows boost price confidence.

- Historical breakouts show significant past gains.

Cardano’s ADA token has surged over 15% after a breakout from a months-long bullish pennant pattern, retesting $0.85 as a support level. Analysts suggest potential targets at $1.03 and above.

Cardano’s latest price surge reflects increased market interest and possible further gains. Analysts predict resistance levels that could influence trading strategies.

Cardano (ADA) has experienced a significant price hike, breaking out from a longstanding bullish pattern. Analysts are now focusing on potential future resistance levels, notably the $1.03 to $1.60 range.

The ADA price movement involves key market analysts and has drawn significant attention. Institutional investment is notable, with ADA seeing $73 million in inflows. No recent public comments from Cardano founder Charles Hoskinson were noted.

Bitcoin’s current activity supports Cardano’s momentum. With over 15% growth, it holds above $0.85. While ADA benefits directly, the ripple effects on Ethereum or other layer-1s seem minimal currently.

Cardano’s historical price trends suggest possible substantial future gains if current patterns mimic past cycles. Potential impacts on DeFi projects within Cardano’s ecosystem could be observed, though specifics are yet undetermined.

“Cardano has broken out of the bullish pennant formation on the daily timeframe. After a retest of the $0.85 level, expect continued upward movement with targets at $1.03, $1.17, $1.33, and $1.60.” – Jonathan Carter, Analyst

Analysts suggest ADA’s breakout could prompt broader market shifts and increased investor engagement. With Bitcoin at all-time highs, Cardano could see enhanced interest, but main resistance levels remain key for future assessments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin is still in a good place, but short-term holders might be a problem

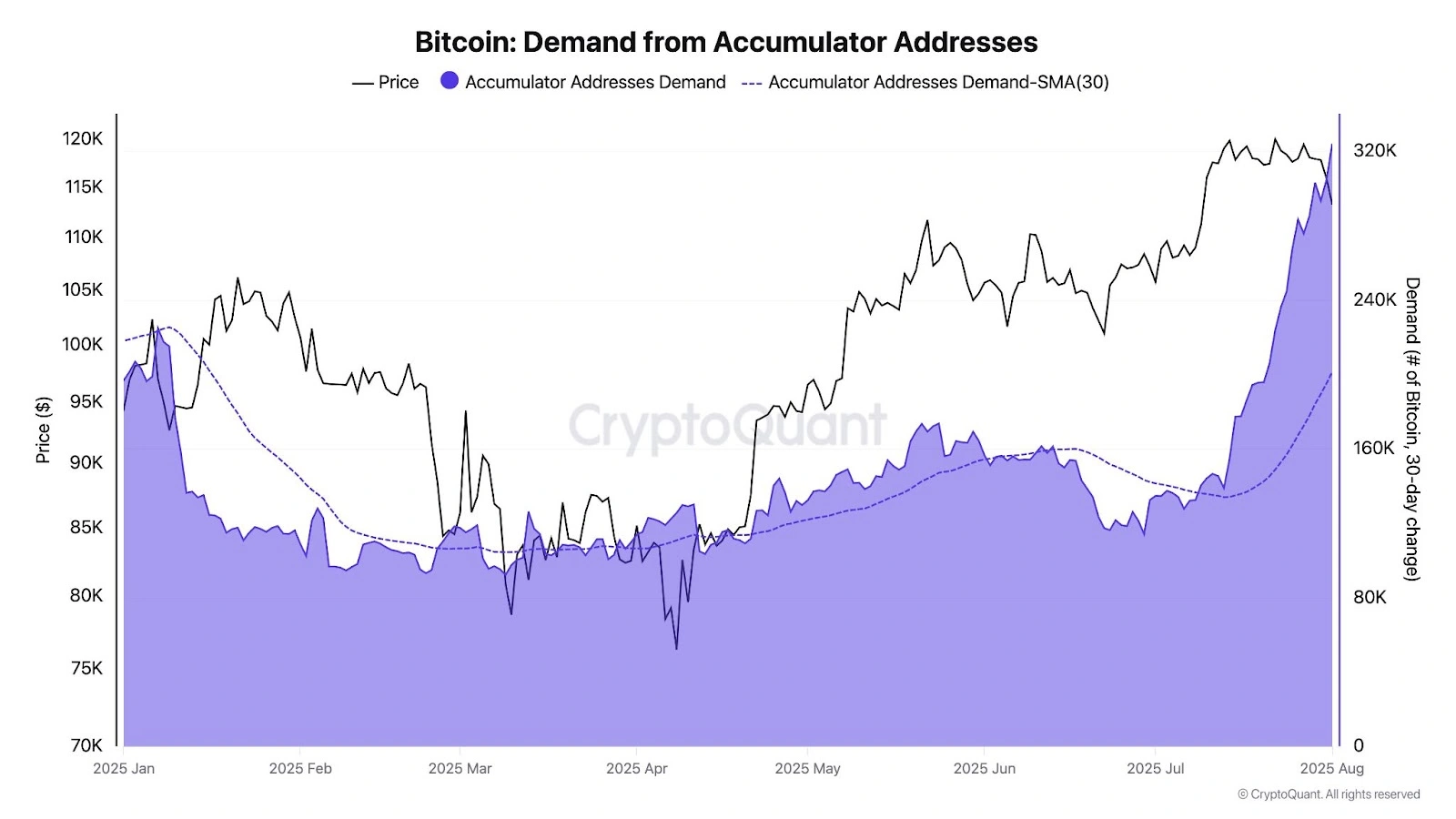

Share link:In this post: Accumulator wallets continue to buy without selling, reinforcing the bullish sentiment around the Bitcoin market. Declining OTC reserves hint at tightening supply and rising institutional demand. Short-term holders are nearing breakeven, increasing the risk of panic selling.

Sharplink and The Ether Machine lead as whales continue to stack ETH

Share link:In this post: Whales had a field day today, as on-chain data revealed that two Whale addresses received nearly 43K Ether worth over $153M. SharpLink Gaming also bought 18.68K ETH worth over $66.6M, while The Ether Reserve LLC acquired 10.6K ETH valued at around $40M. The Kobeissi Letter noted that ETH added a market cap of over $150 million since July 1.

Google to limit AI data center power usage during peak demand periods

Share link:In this post: Google has signed its first formal agreements to reduce AI data center power usage during peak electricity demand. The agreements with U.S. utilities, Indiana Michigan Power and Tennessee Valley Authority, address the rising energy demand from AI workloads straining power grids. Google’s agreement has introduced AI into demand-response programs and may set a precedent for other tech companies to deal with blackout concerns and higher electricity bills.

SEC Appeals in Ripple XRP Case Nears Deadline