BTC Market Pulse: Week 31

Bitcoin ETF inflows dropped 80% while futures positioning and on-chain profitability remain elevated. This week’s Market Pulse analyzes the divergence between traditional and crypto-native flows, assessing where market pressure may emerge next

Overview

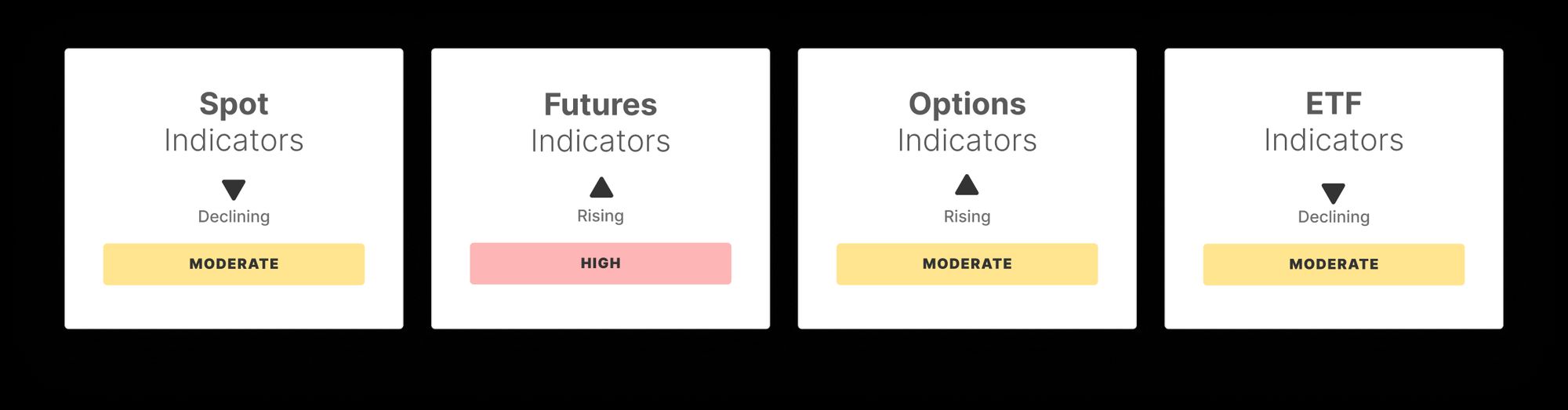

Throughout the past week, Bitcoin's spot price explored the upper boundaries of a newly formed air gap between $104k and $114k, with price retracing after tagging its all-time high. This pullback triggered a market-wide cooldown, with mixed signals across key sectors.

In the Spot Market, momentum has eased as the RSI fell sharply from 74.4 to 51.7, indicating buyer exhaustion. Spot volume declined to $8.6B, showing weaker participation, though Spot CVD improved notably, suggesting some dip-buying has returned.

The Futures Market remains elevated, with Open Interest rising slightly to $45.6B, holding above the high band. Long-side funding payments also increased, reinforcing leveraged optimism, while Perpetual CVD showed reduced selling pressure, pointing to cautious stabilization.

In the Options Market, Open Interest pulled back 2.2%, but the volatility spread jumped 77%, implying rising expectations of price swings. The 25 Delta Skew flipped from negative to slightly positive, showing diminished demand for downside protection and a shift toward neutral to mildly bullish sentiment.

The ETF Market saw a steep decline in flows, with net inflows down 80% to $496M and trade volume dropping to $18.7B. Yet, ETF MVRV remains elevated at 2.4, indicating strong unrealized gains and potential for profit-taking.

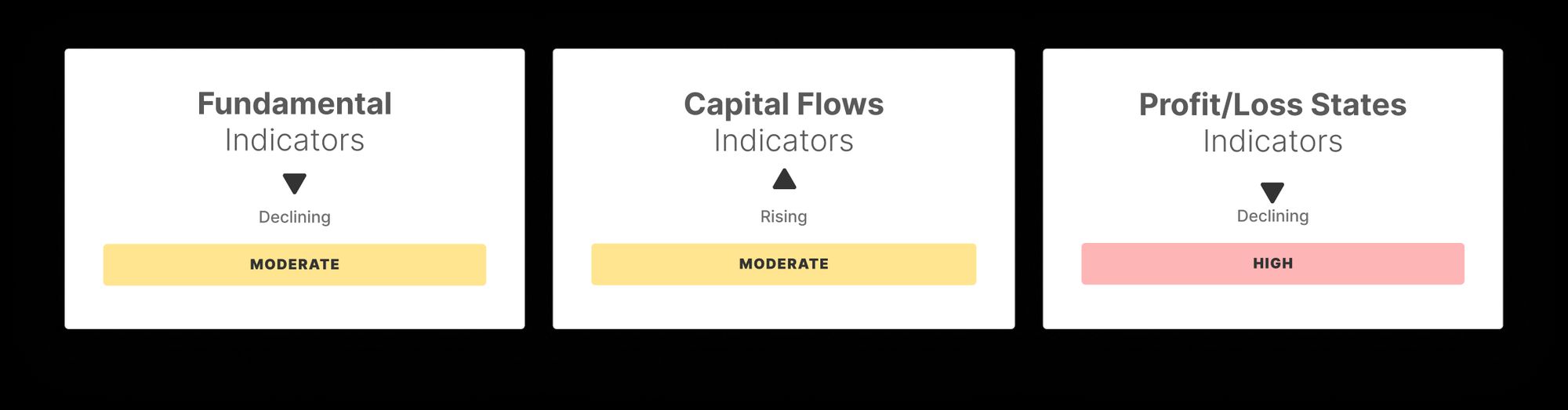

On-chain activity softened: active addresses fell to 708k, and transfer volume dropped 23%. However, fees rose and Realized Cap Change surged to 6.6%, suggesting persistent capital inflows despite the cooldown.

Capital rotation shows slightly higher speculative presence, with the STH/LTH ratio and Hot Capital Share both ticking upward, though still within normal bounds.

Across Profit and Loss metrics, most holders remain in the green, with 96.9% of supply in profit. NUPL and the Realized P/L Ratio both dipped, signaling reduced profit-taking as sentiment cools.

In sum, the market has cooled after its ATH, entering a reassessment phase. With signs of seller exhaustion building, a bounce is possible, though fragility remains if negative catalysts emerge.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Crypto bull" Tom Lee: The crypto market correction may be nearing its end, and bitcoin is becoming a leading indicator for the US stock market.

"Crypto bull" Tom Lee stated that on October 10, an abnormality in the cryptocurrency market triggered automatic liquidations, resulting in 2 million accounts being liquidated. After market makers suffered heavy losses, they reduced their balance sheets, leading to a vicious cycle of liquidity drying up.

Besant unexpectedly appears at a "Bitcoin-themed bar," crypto community "pleasantly surprised": This is the signal

U.S. Treasury Secretary Janet Yellen made a surprise appearance at a bitcoin-themed bar in Washington, an act regarded by the cryptocurrency community as a clear signal of support from the federal government.

Solana founder shares eight years of behind-the-scenes stories: How he recovered from a 97% crash

What doesn’t kill it makes it legendary: How Solana was reborn from the ashes of FTX and is now attempting to take over global finance.

What’s next for the strongest altcoin of this round, ZEC?

There is a fierce debate between bullish and bearish views on ZEC.