Bitget Daily Digest (7.129)|Trump Says Fed “Must” Cut Rates This Week; Bullish Treasury Moves for $BNB, $SUI & $HYPE; PayPal Rolls Out Crypto Payments

远山洞见2025/07/29 02:34

By:远山洞见

Today’s Preview

1、The Federal Open Market Committee (FOMC) kicks off a two-day monetary policy meeting.

2、UniSat Wallet plans to enable BRC-20 one-step transfers on Fractal Bitcoin.

3、U.S. May FHFA House Price Index MoM will be released today (prior: -0.40%).

Macro & Hot Topics

1、Trump: Fed “Must” Cut Rates This Week

President Donald Trump reiterated his call for lower rates. When asked if the Fed should cut rates this week, Trump said: “I think it must.” He added, “Even without rate cuts, America is doing well—rate cuts would make things even better.”

2、PayPal Launches Crypto Payments for U.S. Merchants — Over 100 Digital Currencies Supported

According to Fortune, PayPal has rolled out a new crypto payment service for U.S. small and medium-sized businesses, allowing over 100 digital assets—including Bitcoin and Ethereum—to be accepted at checkout. Payments are processed via PayPal’s platform at a 0.99% fee in the first year, rising to 1.5% the next year. Users can link existing crypto wallets to the payment page; PayPal converts crypto to its PYUSD stablecoin using Binance or DEXs, then pays merchants USD.

3、Hyperion DeFi Adds 108,594 HYPE, Total Now at 1,535,772 Tokens

Nasdaq-listed Hyperion DeFi (HYPD) announced a purchase of 108,594 HYPE (average $36.14), lifting its total HYPE holdings to 1,535,772. These tokens will be deployed into Kinetiq’s iHYPE institutional staking pool, making Hyperion the first public company to tap this level of institutional liquid staking.

4、CEA Industries & 10X Capital Complete $500M Private Fundraise for BNB Treasury

CEA Industries and 10X Capital, backed by YZi Labs, closed a $500M private round to establish a BNB treasury. More than 140 participants joined—including Pantera Capital, GSR, Arrington Capital, Blockchain.com, Hypersphere, Kenetic, Arche, and Borderless—making this PIPE offering among the largest of its kind.

5、Mill City Ventures to Launch $450M Private SUI Treasury Fund

Mill City Ventures III, Ltd. (NASDAQ: MCVT) will launch a $450M private raise for its SUI treasury strategy. Funds go to SUI token purchases (as core reserves), as Mill City expands short-term non-bank lending and specialty finance. Lead backers: Karatage Opportunities, Sui Foundation, Galaxy Digital, Pantera. The raise complies with U.S. Securities Act of 1933 rules.

Market Updates

1、BTC & ETH pulled back, dragging alts lower; $441M in liquidations (mostly longs) over 24H.

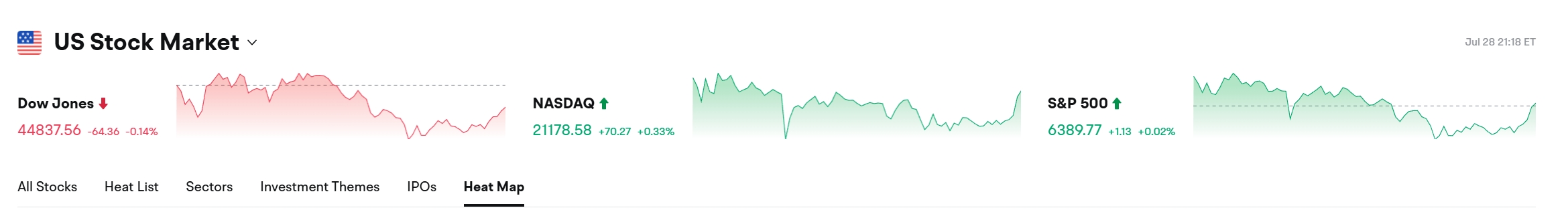

2、S&P 500 extended its record run for a sixth day, USD surged 1% for its biggest two-month gain, EUR slipped over 1%, gold fell for the fourth straight session, NY copper briefly dropped over 6%, coking coal futures down 10%.

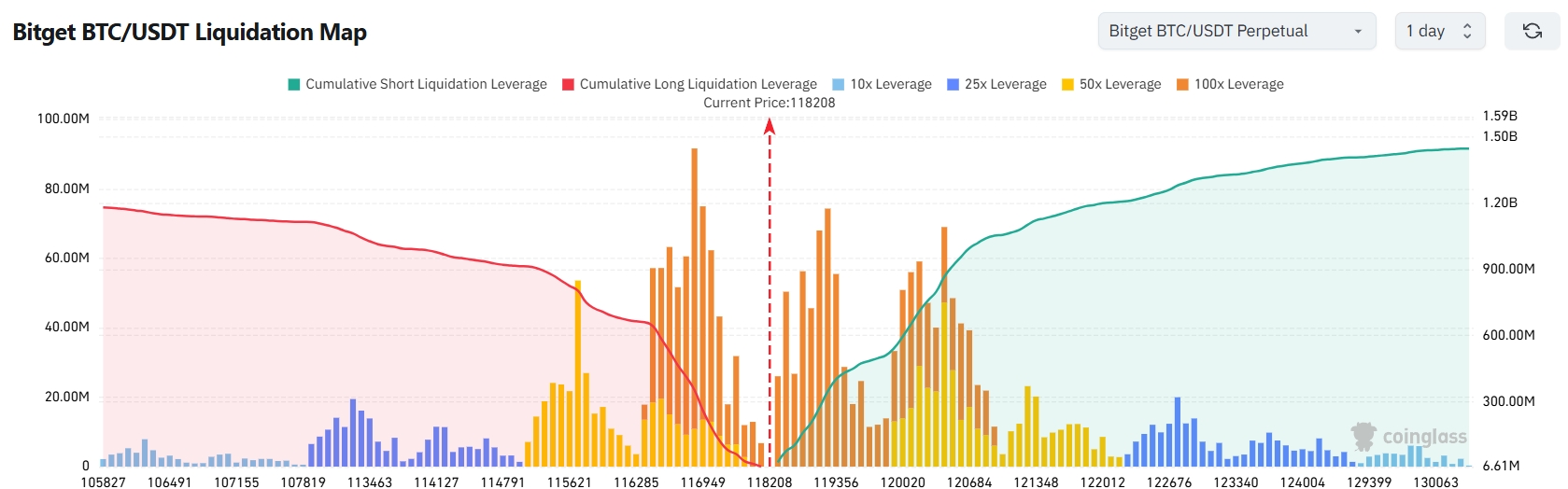

3、Bitget BTC/USDT liquidation map: At 118,208 USDT, a 2,000-point drop to 116,208 could trigger $665M in long liquidations; a 2,000-point rise to 120,208 could trigger $795M in short liquidations. Short risk far above long—manage leverage appropriately.

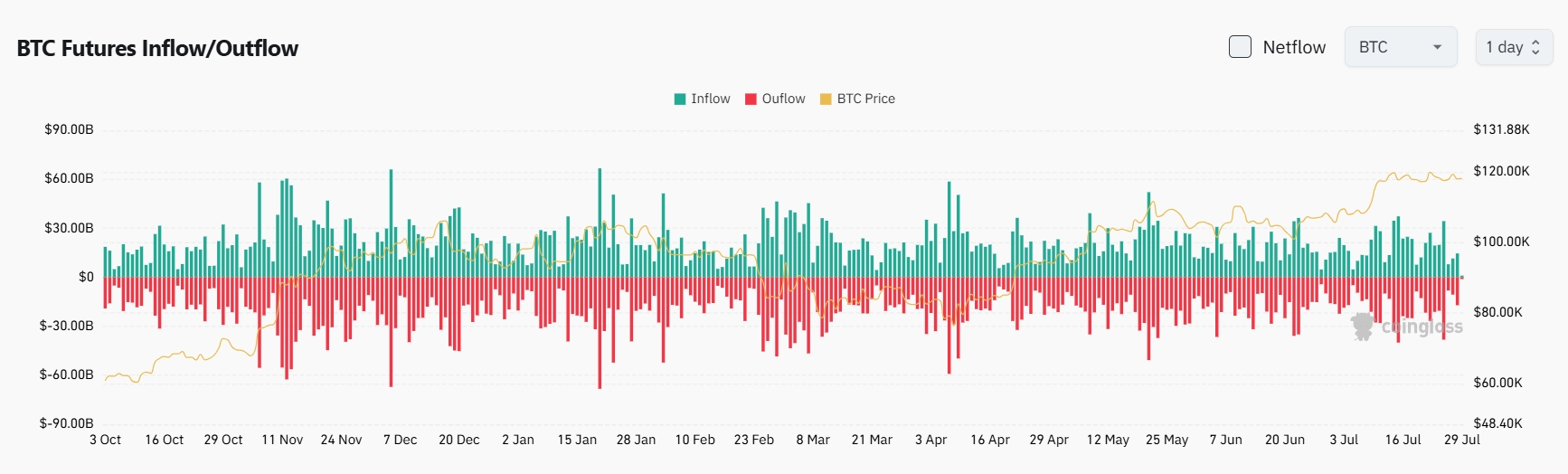

4、Past 24H BTC spot flows: $1.2B in, $1.4B out—net outflow $200M.

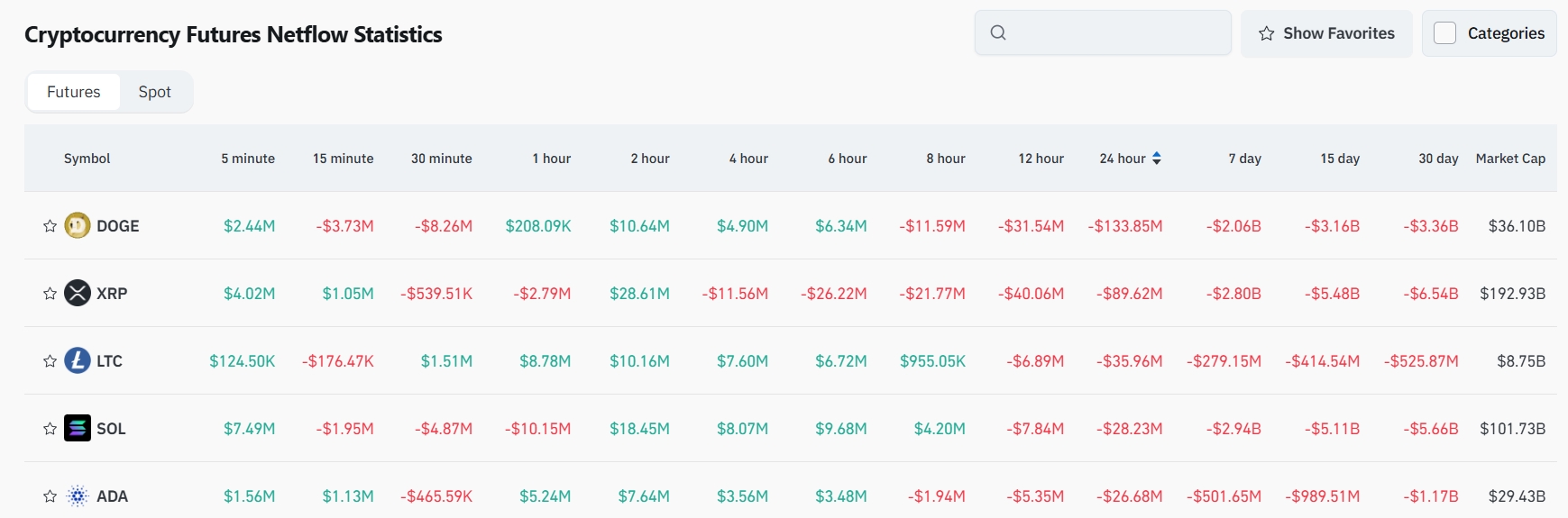

5、Top contract net outflows: $BTC, $ETH, $SOL, $XRP, $DOGE—potential trade opportunities.

Institutional Views

1、Glassnode: Major tokens like ETH see futures open interest rebound.

Source

2、Greeks.live: Market shows strong bullish sentiment on ETH, eyeing $4,800 resistance.

Source

3、Ray Dalio (Bridgewater): Advises investors to allocate 15% to gold and Bitcoin.

Source

News Updates

1、Trump: Has “never visited Epstein’s island.”

2、Trump: Fed “must” cut rates this week.

3、Thailand and Cambodia ceasefire agreement takes effect.

Project Developments

1、ARK Invest partners with SOL Strategies for staking.

2、Cboe files for Canaray Staking INJ ETF and Invesco Galaxy Solana ETF.

3、Movement: 50M MOVE tokens deposited to CEX from buyback address.

4、TRON INC files $1B mixed securities offering with SEC.

5、Arbitrum Foundation: $14M in ecosystem security audit subsidies planned.

6、PayPal: Launches crypto payments for U.S. merchants with 100+ digital assets supported.

7、Hyperion DeFi: Adds 108,594 HYPE to treasury, total at 1,535,772 tokens.

8、Mill City Ventures: $450M raise for SUI treasury fund strategy.

9、CEA Industries & 10X Capital: $500M BNB treasury round complete.

10、Immutable Holdings pursues HBAR treasury strategy and announces management changes.

X Highlights

1. Viki_Nan.mp3: Understanding Web3 Fundraising & Valuations—How to Avoid Overvalued VC Pitches

Using rootdata on 615 Web3 projects, the median “valuation/fundraising” multiple is 10x, the average is 12x—$10M raised means a typical $100M valuation. Anything far above this likely signals overvaluation risk and a post-TGE drop is probable. Retail investors should treat this multiple as a risk anchor and beware of eye-catching VC-backed projects with inflated numbers. Web3 funding is far more opaque than traditional VC—the better your data and benchmarks, the less likely you’ll be exit liquidity.

Source

2. Murphy: SOL On-chain Data Deep Dive—Strong Hand Accumulation, What’s the Trigger for Next Breakout?

SOL’s on-chain data now shows an “olive-shaped” chip concentration around $165, with 35M coins forming solid support. No overhang or big profits at the top or bottom means most early holders are gone and whales control the middle. CEX net inflows suggest whales have not started a big push yet, but when BTC makes a move, SOL will likely follow. Downside is limited unless BTC tanks; if SOL breaks $200, resistance is thin above. Watch whale wallet moves closely for breakout signals.

Source

3. Lipa: InfoFi's True On-Chain Attention Rankings—Native Competition Era Arrives

KaitoAI, cookiedotfun, shoutdotfun are shaking up InfoFi as Layer3 releases its true on-chain Signal rankings—based ONLY on real wallet activity, not social hype or bot tasks. You can now see at a glance which chains/projects are heating up or cooling off—zkSync Era, HyperEVM, Base surging; Ink, BOB, Soneium in breakout; Polygon, Unichain, Plume fading. For projects, exchanges, and investors, Signal is THE source of genuine on-chain engagement and alpha hunting. Pro version adds minute-level trend alerts and conversion rate analysis.

Source

4. Phyrex: Macro Event Cluster—BTC in Range, Focus Shifts to Powell’s Speech

BTC and U.S. stocks are moving in tandem, rangebound with rising risk-off sentiment as the week is packed: earnings, PCE, NFP, and the Fed’s rate decision. Tariff storylines have faded; focus is back on monetary policy. With turnover low and mostly short-term trading dominant, keep eyes on FOMC this Thursday and Friday’s NFP. Real volatility may hinge on Powell’s guidance about a potential September rate cut.

Source

10

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

Coinpedia•2025/11/29 04:57

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Coinpedia•2025/11/29 04:57

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes

Coinpedia•2025/11/29 04:57

Ethereum’s Layer‑2 Surge Signals Next ETH Price Rally—But a Key Hurdle Remains

Coinpedia•2025/11/29 04:57

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,911.74

-0.66%

Ethereum

ETH

$3,040.22

+0.52%

Tether USDt

USDT

$1

+0.03%

XRP

XRP

$2.19

-0.52%

BNB

BNB

$883.41

-1.48%

Solana

SOL

$137.55

-2.00%

USDC

USDC

$0.9998

-0.01%

TRON

TRX

$0.2816

+0.46%

Dogecoin

DOGE

$0.1501

-0.41%

Cardano

ADA

$0.4177

-2.20%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now