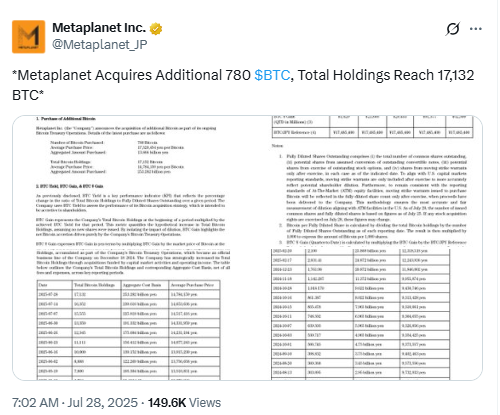

Japanese investment company Metaplanet purchased 780 Bitcoin (BTC), increasing its total holdings to 17,132 BTC.

The acquisition, valued at $92 million, was announced on Monday. The average price of the newly bought Bitcoin was 17,520,454 Japanese yen per BTC (around $118,145).

Metaplanet Bitcoin Acquisition Announcement. Source: Metaplanet Inc. on X

Metaplanet Bitcoin Acquisition Announcement. Source: Metaplanet Inc. on X

According to company data, Metaplanet has spent $1.7 billion to acquire its Bitcoin holdings at an average price of $99,640 per BTC.

At the time of reporting, Bitcoin traded at $118,171, slightly higher than Metaplanet’s latest purchase price. Nansen data also showed a 0.75% increase in Bitcoin’s price over the past 24 hours.

Metaplanet’s disclosure follows earlier reports that it plans to use its Bitcoin reserves for acquisitions of cash-generating businesses in Japan, potentially including a digital bank.

Metaplanet Leads Non-US Bitcoin Treasuries

With 17,132 BTC, Metaplanet remains the only non-US company in the top 10 Bitcoin corporate treasuries, based on BitcoinTreasuries.NET data. It is the seventh-largest Bitcoin corporate holder globally.

Metaplanet ranks below Trump Media & Technology Group, which holds 18,430 BTC, and above Galaxy Digital Holdings, owned by Michael Novogratz, which holds 12,830 BTC. The global leader, Strategy (formerly MicroStrategy ), holds 607,770 BTC worth over $72 billion.

Metaplanet recently overtook Cleanspark after a $108 million Bitcoin acquisition, reinforcing its position among the leading Bitcoin treasuries.

Metaplanet’s Stock Growth Linked to Bitcoin Holdings

Metaplanet’s Bitcoin purchases have aligned with a sharp increase in its stock price. The company’s shares rose 517% over the past year and 246% year-to-date, according to Google Finance. As of Monday, the stock traded at $8.36, reflecting a 5% increase on the day.

In an interview with Forbes Japan, Metaplanet CEO Simon Gerovich said,

“In just a year, we became the country’s top-performing stock, with record trading volume and a ¥1 trillion market cap.”

Localized Bitcoin Strategy in Japan

Gerovich stressed that Metaplanet is building a “Japan-native model” that complies with Japanese regulation, taxation, and capital markets.

He noted that the firm provides Bitcoin exposure compatible with Japan’s tax-free savings accounts, which follow local investment rules.

Metaplanet’s approach has positioned it as the leading non-US Bitcoin treasury and among the largest corporate Bitcoin holders globally.

Its focus on regulatory compliance aligns its Bitcoin holdings with Japan’s financial framework while maintaining a strong presence in global Bitcoin treasury rankings.