Tesla misses out on massive Bitcoin gains after selling at $20K

Key Takeaways

- Tesla missed out on billions in potential profits by selling 75% of its Bitcoin holdings too early.

- The company's early Bitcoin sale coincided with challenges in its core auto business and impacted financial results.

Tesla could have made billions if it had held onto Bitcoin (BTC) instead of selling the bulk of it when prices crashed in 2022.

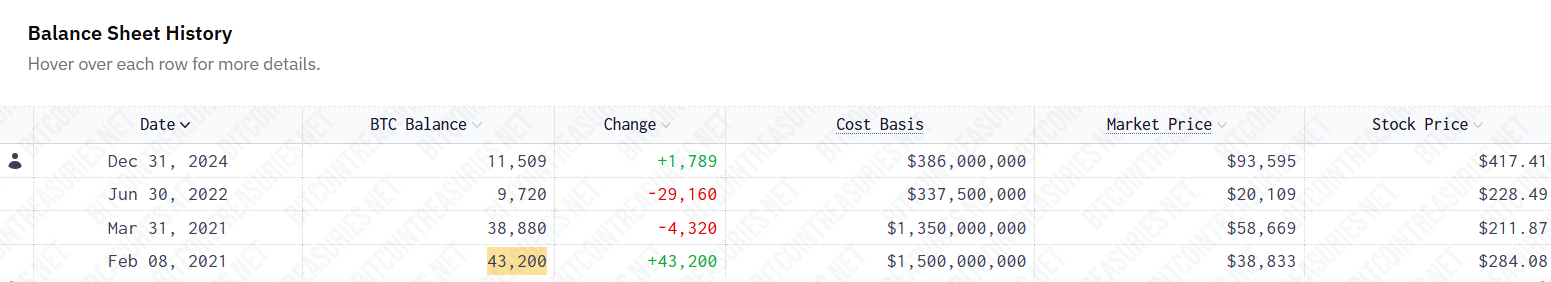

In early 2021, Tesla acquired 43,200 Bitcoin worth $1.5 billion as part of its treasury diversification strategy, data from BitcoinTreasuries.net shows.

Soon after, the company began accepting the asset as payment for its cars, but then suspended the option due to environmental concerns related to Bitcoin mining’s energy usage.

In March of that year, Elon Musk’s electric vehicle company made its first Bitcoin sale, offloading 4,320 BTC when Bitcoin was trading above $58,000. Bitcoin reached a high of $61,500 during the 2021 cycle, so Tesla’s initial sale was not entirely unreasonably timed.

By the end of June 2022, Tesla had sold another 29,160 BTC, representing 75% of its remaining holdings. At that time, Bitcoin was trading around $20,000 and later dropped to a yearly low of $16,500.

Source: BitcoinTreasuries.net

Source: BitcoinTreasuries.net

However, the second sale was less favorable. It resulted in massive missed gains.

Bitcoin has exploded since Wall Street stepped in, with major players like BlackRock, Grayscale, and other fund managers pushing to bring Bitcoin to institutional investors through ETFs. Grayscale’s court victory over the SEC paved the way for the landmark debut of spot Bitcoin funds in the US.

Following that, Bitcoin has left the $20,000 level well behind. The digital asset crossed $100,000 last December and extended its rally to $122,000, its latest high.

With Bitcoin trading at around $116,300 at the time of reporting, Tesla’s initial holdings would be valued at about $5 billion. The BTC it offloaded would be worth over $3.5 billion now.

Tesla now holds 11,509 BTC worth around $1.4 billion. The company has not adjusted its Bitcoin portfolio since its last purchase.

Tesla’s auto revenue dropped for the second quarter in a row, and the company missed Wall Street’s projections. The stock plunged 8% on Thursday before bouncing back 3.5% on Friday. It’s still down more than 21% so far this year, per Yahoo Finance .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Consensus Layer Reconstruction Beam Chain: The Ultimate Path or a Technical Maze?

Is the 5-year implementation timeline for Beam Chain reasonable? What does the community think?

November 21 Key Market Information Gap, A Must-See! | Alpha Morning Report

1. Top News: Base Co-founder Jesse's jesse Token Released, Currently Valued at $14 Million 2. Token Unlock: $DMC, $ID

Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone

Trending news

MoreEthereum Consensus Layer Reconstruction Beam Chain: The Ultimate Path or a Technical Maze?

[Bitpush Daily News Highlights] Goldman Sachs: Stock sell-off expected to reach $40 billion next week; Jefferies report: Tether's gold reserves reach 116 tons, making it one of the world's largest non-sovereign gold holders; TechCrunch: Prediction market Kalshi raises $1 billion, valuation reaches $11 billion

![[Bitpush Daily News Highlights] Goldman Sachs: Stock sell-off expected to reach $40 billion next week; Jefferies report: Tether's gold reserves reach 116 tons, making it one of the world's largest non-sovereign gold holders; TechCrunch: Prediction market Kalshi raises $1 billion, valuation reaches $11 billion](https://img.bgstatic.com/multiLang/image/social/266a4eb2f52d42906f0b432a905d6ba81763665562274.png)