Ethereum (ETH) Nears Critical $4,000 Level, but Profit-Taking Risk Looms: Market Top?

Ethereum’s price rise to a 7-month high faces resistance at $4,000. The market top could lead to a pullback, but continued growth in new addresses may support a breakout toward $4,425.

Ethereum (ETH) has recently surged to a 7-month high, yet the cryptocurrency has yet to breach the psychological $4,000 level.

The altcoin has shown impressive growth, but overcoming this significant barrier may prove challenging. As investors watch closely, ETH’s next moves could determine the future price direction.

Ethereum is Noting A Market Top

Currently, 94% of Ethereum’s total supply is in profit. Historically, when the profitable supply surpasses 95%, it signals a market top. This has been followed by price corrections as investors begin to secure profits. As a result, Ethereum’s price could face a pullback if the trend continues, potentially reversing recent gains.

Market tops often indicate that bullish momentum has saturated, and many investors begin to sell their holdings. This shift could slow Ethereum’s upward movement, as the market reacts to potential saturation.

Ethereum Supply In Profit. Source:

Santiment

Ethereum Supply In Profit. Source:

Santiment

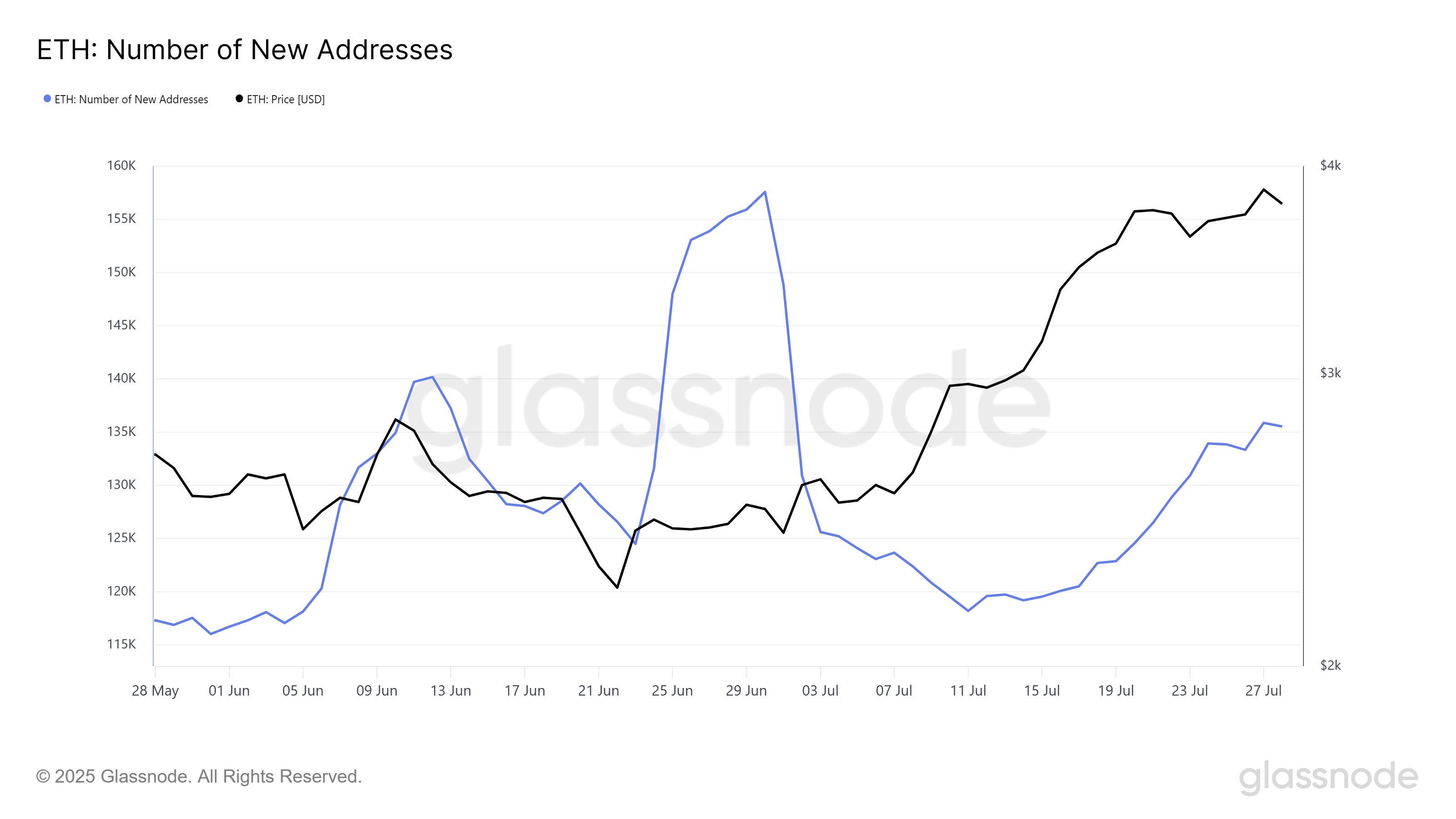

Ethereum’s macro momentum has seen a mixed trend, with new address activity being a focal point. Earlier this month, the number of new addresses spiked but then sharply declined. However, recent data shows a 13% increase in new addresses over the last 10 days, rising from 119,184 to 135,532.

If this growth in new addresses continues, it could counter the impact of the market top, providing Ethereum with support to sustain its price gains. New investors could help strengthen the demand for Ethereum, reducing the risk of a market pullback.

Ethereum New Addresses. Source:

Glassnode

Ethereum New Addresses. Source:

Glassnode

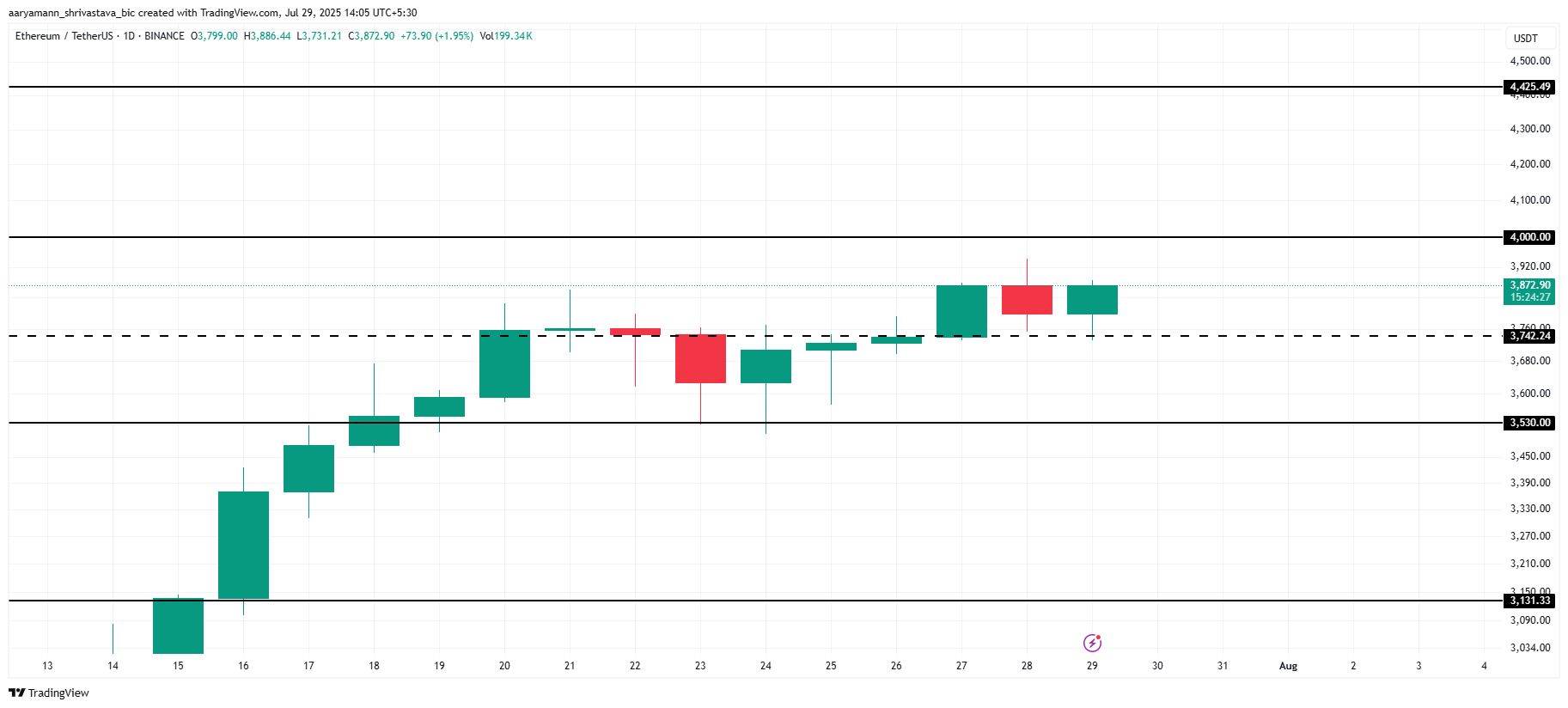

ETH Price Needs A Push

Ethereum’s current price stands at $3,872, holding above its local support level of $3,742. While ETH is approaching the $4,000 mark, it has not yet managed to breach it. This resistance could continue to hold, limiting Ethereum’s immediate potential for further gains.

If the market top signals a reversal, Ethereum’s price could drop to $3,530 or lower. A sharp decline to $3,131 is also a possibility, erasing much of the recent gains made in the past month. Such a move would invalidate the bullish sentiment that has driven Ethereum’s growth.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

On the other hand, if the influx of new addresses continues and strengthens, Ethereum may finally break through the $4,000 resistance. Should this happen, ETH could rise towards $4,425, with a renewed surge in price. This would invalidate the bearish thesis and push Ethereum into a new bullish phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.