Key Notes

- Current market structure indicates healthy growth without excessive profit-taking.

- New investor activity is rising steadily while old holders remain restrained.

- Institutional buying nears historic highs, mirroring pre-2020 rally trends.

According to recent CryptoQuant data, Bitcoin BTC $118 554 24h volatility: 0.7% Market cap: $2.36 T Vol. 24h: $44.67 B is entering the late stage of its current bull market cycle.

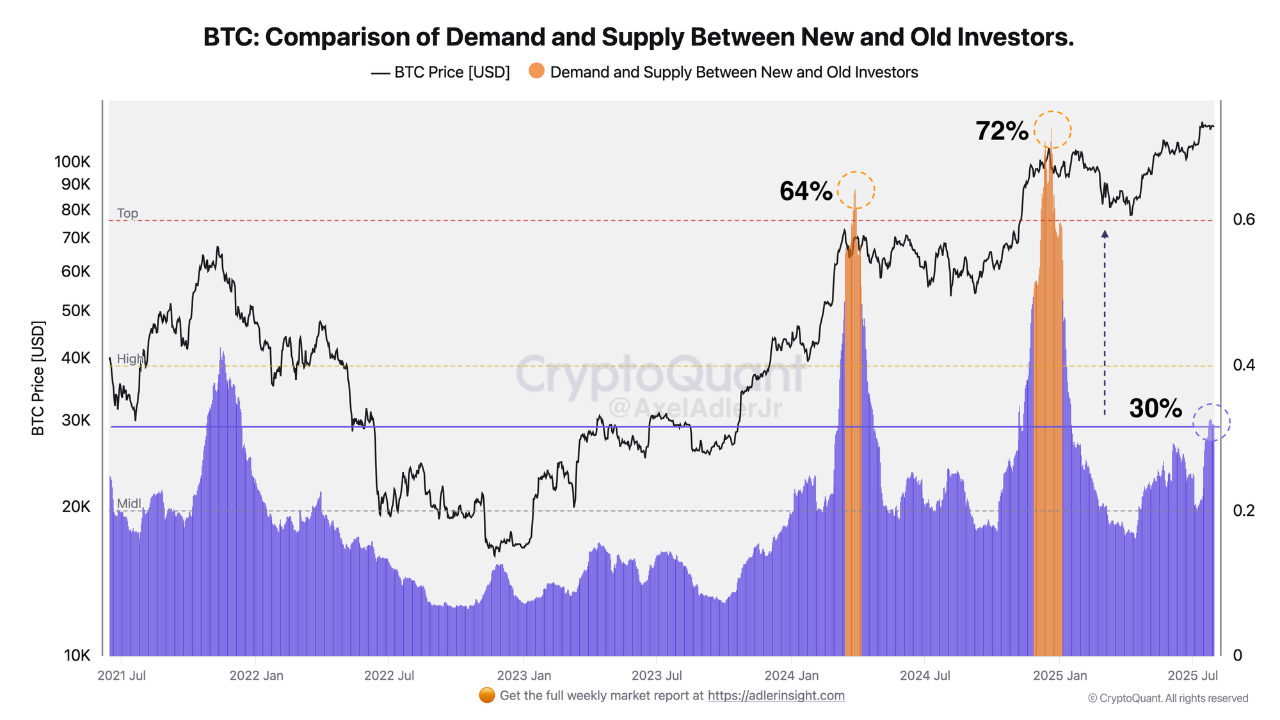

Popular crypto analyst Axel Adler Jr. recently compared the demand and supply between new and old investors to determine that the current rally has more room to grow.

Historical data suggests that previous cycle tops in March 2024 and December 2024 occurred when new investor dominance reached above 65% levels. As of July 2025, that number stands at just 30%.

Comparison of demand and supply between new and old Bitcoin investors | Source: CryptoQuant

There has been a steady rise in fresh capital entering the market. However, old holders have not yet begun selling aggressively. This suggests that supply from long-term wallets is being absorbed gradually, keeping the market in balance.

SoSoValue data further supports this outlook. In the past two months, spot Bitcoin ETFs saw outflows on only seven days, showing strong and consistent interest from both institutional and retail investors.

Bitcoin Consolidates While Institutions Load Up

Technical analyst Ali Martinez recently shared the Short-Term Holder Cost Basis model on X. He suggested as long as BTC holds the $105,450 support, it could be targeting $125,230 and potentially $141,770.

As long as the $105,450 support holds, Bitcoin $BTC could be on track for a move to $125,230 and potentially $141,770, based on the Short-Term Holder Cost Basis. pic.twitter.com/AHk2e3YHT3

— Ali (@ali_charts) July 31, 2025

Meanwhile, macroeconomic pressure from the Federal Reserve continues to affect the momentum. Fed Chair Jerome Powell refrained from giving clarity on potential rate cuts after the recent FOMC meeting, leading to a cautious stance among traders.

Despite Bitcoin’s slow movement amid investor capital rotation to new crypto projects, whales continue to accumulate. On-chain analytics firm Santiment reported that whales have acquired 218,570 BTC, about 0.9% of the circulating supply, since late March.

Capriole Investments founder Charles Edwards highlighted the magnitude of recent institutional buys, noting that treasury purchases on July 29–30 alone totaled nearly 30,000 BTC.

While you were worrying about the Fed, Bitcoin Treasury Companies just had one of their biggest buying days ever yesterday. pic.twitter.com/ajj2T9PTYR

— Charles Edwards (@caprioleio) July 31, 2025

Institutional net buying accounted for 97% of all transactions, a level last seen in August 2020, right before Bitcoin surged more than 5x in value. If history repeats, Bitcoin could set a theoretical price target of over $500,000.

nextInstitutional net buying just breached 97% of all transactions. The last time net buying by the pros was this high was August 2020. Those who know, know.

Unique alpha indicators only available at . pic.twitter.com/7CYH5TNPU7

— Charles Edwards (@caprioleio) July 31, 2025