SEC Chair Atkins debuts 'Project Crypto' to update rules and regulations, with a focus on onchain

Quick Take The project is building off a report released on Wednesday by the President’s Working Group. “Project Crypto will help ensure that the United States remains the best place in the world to start a business, develop cutting-edge technologies, and participate in capital markets,” Atkins said.

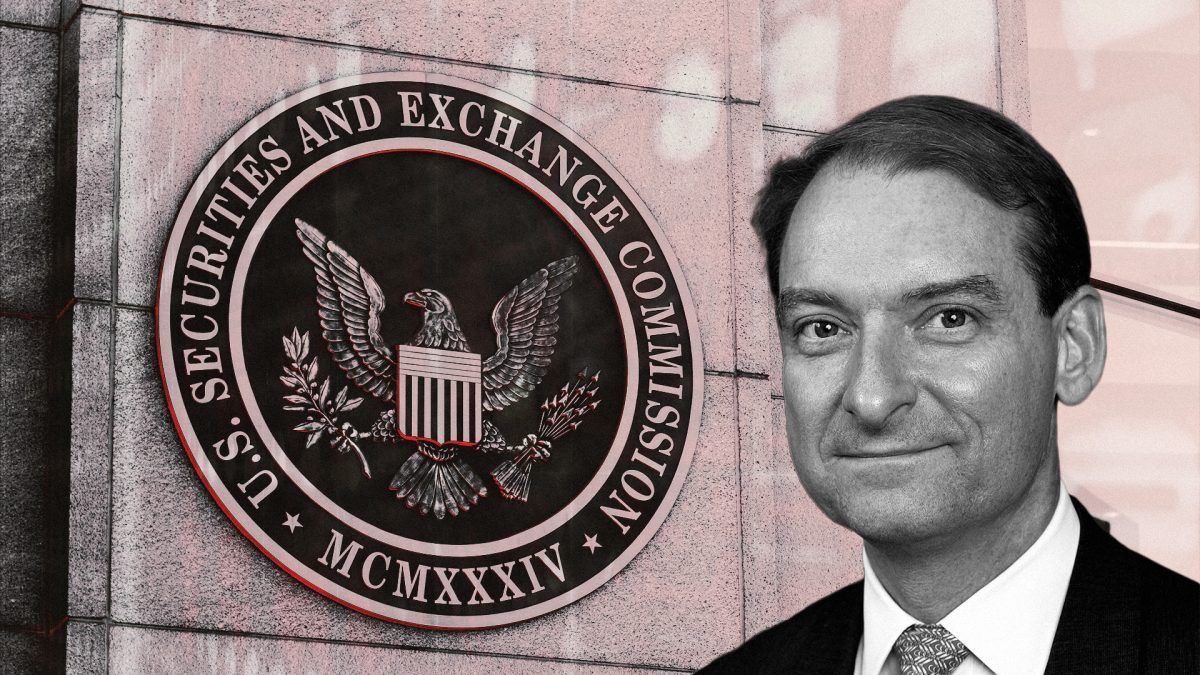

The U.S. Securities and Exchange Commission launched "Project Crypto," which its chair says will be an initiative to "modernize the securities rules and regulations to enable America’s financial markets to move on-chain."

SEC Chairman Paul Atkins announced the launch on Thursday during a speech, and said the project was building off a report released on Wednesday by the President's Working Group.

"That is why I am launching Project Crypto and directing the SEC’s policy divisions to work with the Crypto Task Force, led by Commissioner Peirce, to swiftly develop proposals to implement the PWG’s recommendations," Atkins said. "Project Crypto will help ensure that the United States remains the best place in the world to start a business, develop cutting-edge technologies, and participate in capital markets."

On Wednesday, a report was released detailing how federal agencies plan to approach crypto. The working group is made up of agency heads, including Atkins, Treasury Secretary Scott Bessent, and Commerce Secretary Howard Lutnick, among others.

"To achieve President Trump’s vision of making America the crypto capital of the world, the SEC must holistically consider the potential benefits and risks of moving our markets from an offchain environment to an on-chain one," Atkins said.

Atkins said he directed fellow SEC Commissioner Hester Peirce and her task force to create proposals going off of the President Working Group's recommendations. He also said agency staff will be working on drafting rules around crypto distributions, custody and trading and that those would go through public notice and comment.

"Our goal is to help market participants to slot crypto assets into categories, such as digital collectibles, digital commodities, or stablecoins, and assess the economic realities of a transaction," Atkins said.

Atkins also said he directed agency staff to refresh its rules to "unleash the potential of on-chain software systems in our securities markets."

"Decentralized finance and other forms of on-chain software systems will be part of our securities markets and not drowned out by duplicative or unnecessary regulation," he said.

Updated at 4:50 p.m. UTC on July 31 to include details from his speech throughout

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.