Hong Kong Opens Stablecoin Licensing: Banks and Brokers Rush In

As Hong Kong's stablecoin licensing takes effect, banks and brokers race to apply under strict guidelines. However, regulators caution against speculative risks, urging careful evaluation of asset-backed projects.

On August 1, Hong Kong’s Stablecoin Ordinance officially came into effect. The HKMA released detailed licensing guidelines covering capital, custody, KYC, reserves, and governance requirements.

Banks Lead the Race

Top banknote-issuing banks like BOCHK and Standard Chartered are expected to apply first. They hold regulatory and institutional advantages under Hong Kong’s currency system. Each stablecoin must maintain full fiat backing under strict bank custody.

HKMA will only issue a few licenses in the first batch. Applicants must submit by September 30 to be considered. Issuers not applying within three months face shutdown by November.

Many players are preparing applications now. State-owned enterprises, sandbox firms, and fintech giants are all participating. Application success will depend on real-world use cases and sustainability.

Target scenarios include asset tokenization, cross-border payments, and crypto trading. These use cases will determine which firms get approval.

Securities firms will initially focus on stablecoin trading, custody, and consulting services. They are also exploring tokenized asset portfolio services. So far, 44 brokers have upgraded their Type 1 licenses.

Hong Kong’s top brokers are racing to secure crypto licenses now. Failure to do so risks losing competitiveness in digital finance. Major Chinese brokers like Guotai Junan and Eastmoney have already upgraded.

Regulatory Warnings

HK regulators warn of hype and speculative risks ahead. Investors must evaluate asset backing and project viability carefully. Concept tokens without substance could still re-emerge despite new rules.

Some firms are exploring CNH-backed stablecoins for cross-border payments. For Instance, China Asset Management Company (Hong Kong) launched multiple tokenized funds this year. The Hua Xia RMB Digital Currency Fund became the first on-chain offshore RMB fund. Industry experts view this as a landmark event exploring offshore RMB stablecoin possibilities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

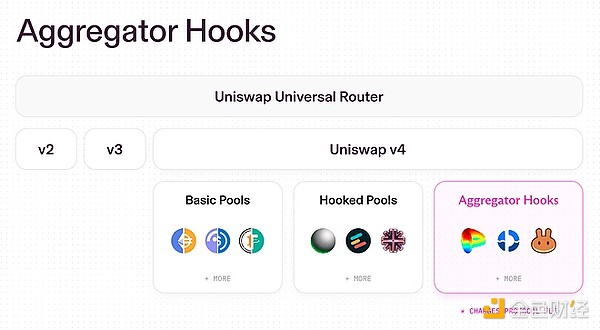

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.

The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.