Will Bitcoin Fall to $100,000? Arthur Hayes Thinks So

BitMEX co-founder Arthur Hayes attributes his bearish Bitcoin and Ethereum outlook to weak global credit expansion and a looming U.S. tariff bill.

BitMEX co-founder Arthur Hayes has forecasted a sharp downturn for the crypto market, predicting that Bitcoin could fall to $100,000 and Ethereum to $3,000.

His warning follows a combination of macroeconomic pressures and weak credit creation across global economies.

Crypto Market Hit by $372 Million Losses Following Hayes’ Warning

In an August 2 post on X (formerly Twitter), Hayes attributed his prediction to the upcoming US tariff bill, expected in the third quarter. He also pointed to broader economic challenges as a contributing factor.

Additionally, the BitMEX co-founder pointed out that no major economy is expanding credit quickly enough to boost nominal GDP. According to him, this could lead to a correction in the cryptocurrency market.

Y? US Tariff bill coming due in 3q … at least the mrkt believes that after NFP print. No major econ is creating enough credit fast enough to boost nominal gdp. So $BTC tests $100k, $ETH tests $3k. Come see my @WebX_Asia Tokyo keynote Aug 25 for more info. Back to the beach.

— Arthur Hayes (@CryptoHayes) August 2, 2025

Hayes’ bearish stance seems to align with the broader market sentiment. The total cryptocurrency market capitalization has dropped by more than 3% in the last 24 hours, now standing at $3.76 trillion.

According to BeInCrypto data, Bitcoin experienced significant volatility during the last 24 hours, dipping from nearly $114,000 to a multi-week low of $112,113. However, it has slightly recovered to $113,494 as of press time.

Ethereum followed a similar trend, falling from over $3,500 to $3,373, only to regain some ground.

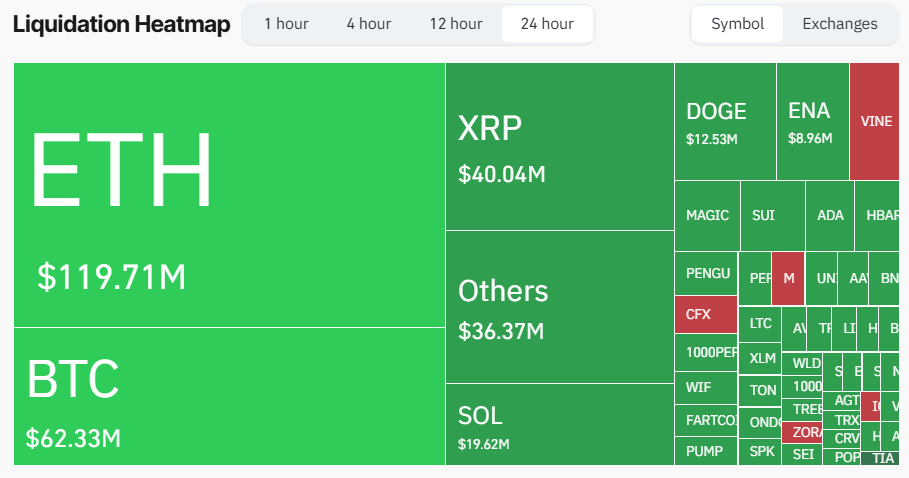

This sharp market downturn has triggered nearly $372 million in liquidations over the past 24 hours, affecting more than 115,000 traders.

Crypto Market Liquidation. Source:

CoinGlass

Crypto Market Liquidation. Source:

CoinGlass

Long traders, betting on a market rebound, dominated the liquidation volume, accounting for around $322 million of the losses.

On the other hand, Short traders, who expected further price declines, saw only $65 million in liquidations.

Across assets, Ethereum led the liquidation sweep, with around $119 million liquidated, followed by Bitcoin at $62 million.

Despite the pullback, Eric Trump, son of US President Donald Trump, encouraged Bitcoin and Ethereum investors to take advantage of the lower prices. He suggested that now is a good time to buy the dip.

Let me say it again: ₿uy the dips!!! $BTC $ETH

— Eric Trump (@EricTrump) August 2, 2025

Notably, his previous advice to purchase Bitcoin during price corrections saw the asset rise by 15%, while Ethereum increased by 20%.

Investors now hope that Trump’s current call will similarly mirror the positive market outcomes of the past.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What major moves have mainstream Perp DEXs been making recently?

Perp DEXs are all unveiling major new features.

After a 1460% surge, re-examining the value foundation of ZEC

History has repeatedly shown that extremely short payback periods (super high ROI) are often precursors to mining disasters and sharp declines in coin prices.

Tom Lee reveals: The crash was caused by the 1011 liquidity crunch, with market makers selling off to fill a "financial black hole"

Lee stated directly: Market makers are essentially like the central banks of crypto. When their balance sheets are damaged, liquidity tightens and the market becomes fragile.

Boxing champion Andrew Tate's "Going to Zero": How did he lose $720,000 on Hyperliquid?

Andrew Tate hardly engages in risk management and tends to re-enter losing trades with higher leverage.