What Did Crypto Whales Buy and Sell During the Weekend?

Crypto whales executed opposing strategies amid weekend volatility, with major ETH and BTC movements and surging interest in altcoins like HYPE.

The crypto market experienced fluctuating performance over the weekend, with the total market capitalization dipping on Saturday before rebounding on Sunday and maintaining gains into Monday.

Amid this volatility, whale activity highlighted various strategies, with notable buying and selling across multiple crypto assets, including Ethereum (ETH), Bitcoin (BTC), and more.

Crypto Whales Execute Divergent Strategies Amid Market Volatility

Ethereum has been capturing significant market attention lately amid a bullish rally, and whales are no exception. As it experienced a dip over the weekend, one seller, whale address 0x3c9E, continued its aggressive divestment of ETH.

Lookonchain reported that the whale offloaded a total of 33,682 ETH valued at around $119 million in early August. Arthur Hayes, Maelstrom Fund’s Chief Investment Officer (CIO), also sold 2,373 ETH worth $8.32 million. In addition, the executive liquidated:

“7.76 million ENA ($4.62 million) and 38.86 billion PEPE ($414,700),” Lookonchain posted.

This selling spree could likely suggest a profit-taking strategy amid market uncertainty. In contrast, other whales adopted a bullish stance.

BeInCrypto reported that a whale acquired $300 million of ETH. Furthermore, SharpLink Gaming purchased 30,755 ETH for 108.57 million USDC. The firm now holds 480,031 ETH, which is valued at around $1.65 billion.

OnChain Lens highlighted that another whale received 25,540 ETH from FalconX.

“Previously, the whale received 35,615 ETH, worth $130.11 million, which was sent for staking with ETH2.0 in 2 wallets, now facing a $10 million loss,” the post read.

These acquisitions indicated confidence in ETH’s long-term value despite short-term fluctuations. Meanwhile, crypto whales also adjusted their Bitcoin positions.

Today, Metaplanet announced the addition of 463 BTC to its holdings. The firm spent around $53.7 million to buy this stack, which averaged approximately $115,895 per coin.

“As of 8/4/2025, we hold 17,595 BTC acquired for ~$1.78 billion at ~$101,422 per bitcoin,” Metaplanet CEO, Simon Gerovich, wrote.

Moreover, El Salvador increased its national Bitcoin reserves to 6,258.18 BTC, now worth approximately $718 million, reinforcing its commitment to the asset as a treasury reserve. Additionally, a dormant address holding 306 BTC, inactive for 12.4 years, was reactivated, sparking speculation about the intentions of long-term holders.

Other tokens also drew whale attention. An on-chain analyst highlighted that a Hyperliquid (HYPE) whale (0x7BE…480D8) increased their position by depositing 4.07 million USDC into the Hyperliquid exchange and purchasing more HYPE tokens. This significant buy pushed the wallet up eight places in the ranking of the top holders.

“Currently, including the staked portion, he holds 487,209.95 HYPE (approximately $18.65 million), with an unrealized profit of $1.535 million,” the analyst stated.

Meanwhile, Nansen identified MAGICIAN, AIPEPE, and CHILLHOUSE as the tokens with the largest net inflow of smart money over the weekend.

Wake up. Ask a question. Wait a few secs. Get real-time onchain answers. All from the comfort of your bed.Top tokens by Smart Money net inflows in the past 24h:$MAGICIAN (ETH): +$132K$AIPEPE (ETH): +$126K$CHILLHOUSE (Solana): +$67K pic.twitter.com/9hTUh73z07

— Nansen(@nansen_ai) August 3, 2025

The weekend’s whale movements revealed a polarized market outlook. Selling pressure from some crypto whales, with aggressive buying by other entities, highlighted diverging investment strategies.

However, the market’s rebound on Sunday and sustained gains today suggest that buying pressure may be outweighing sell-offs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$RAVE unveils tokenomics, igniting the decentralized cultural engine of global entertainment

$RAVE is not just a token; it represents a sense of belonging and the power of collective building. It provides the community with tools to create together, share value, and give back influence to society.

Interpretation of the ERC-8021 Proposal: Can Ethereum Replicate Hyperliquid's Developer Wealth Creation Myth?

The ERC-8021 proposal suggests embedding builder code directly into transactions. Along with a registry, developers can provide wallet addresses through the registry to receive revenue.

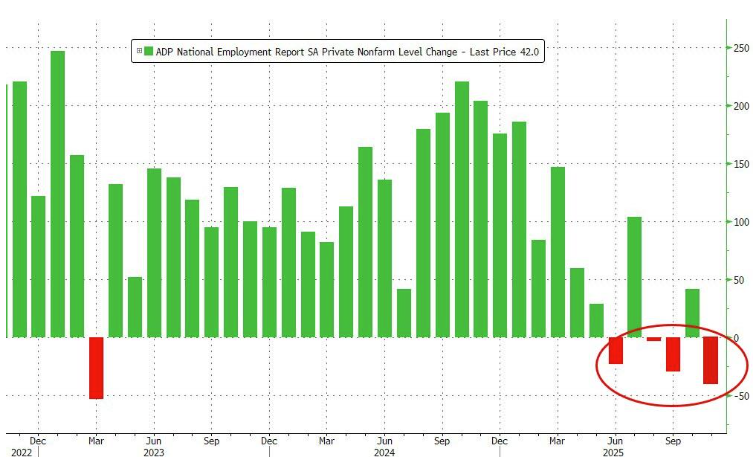

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.