Bitget Daily Digest(8.5)|Fed’s Daly Says Rate Cuts Are Near, Potentially More Than Twice This Year; ETH ICO Whale Stops Year-long Selling, Starts Accumulating; Verb Technology Plans $558M Private Pla

远山洞见2025/08/05 02:59

By:远山洞见

Daily Outlook

-

Spectral (SPEC): Around 3.62 million tokens to be unlocked today, representing 17.57% of current circulating supply.

-

Ethena (ENA): Around 172 million tokens to be unlocked, equal to 2.70% of circulating supply.

-

US June Trade Balance: Data to be released today, previous figure: -$71.5 billion.

Macro & Hot Topics

1. Fed’s Daly: Rate Cuts Are Approaching, More Than Two Cuts Possible This Year

On August 5, San Francisco Fed President Mary Daly noted that mounting evidence of a weakening job market and the absence of persistent tariff-driven inflation mean the time for rate cuts is drawing near. Speaking on last week's FOMC decision, Daly said, “I’m willing to wait another cycle, but I can’t wait forever.” While a September cut isn’t a given, she emphasized, “Every meeting going forward should be considered a live one for policy adjustment.” Daly said two 25bps cuts this year look appropriate, stressing that it’s more about whether cuts come in September and December, not if cuts will happen at all.

2. Hyperliquid Achieves All-Time High Trading Volume in July, Nearing $32B

Hyperliquid hit a new all-time monthly trading record in July, reaching nearly $32 billion, up about 47% from June’s $21.6 billion and 28% above the previous May record of $24.8 billion. Throughout July, Hyperliquid commanded over 75% market share among perpetual contract DEXs. The Hyperliquid/Binance volume ratio also hit a record 11.89% in July. For reference, Binance perpetual volume reached $2.59 trillion in July, a 35% month-on-month increase.

3. Verb Technology Announces $558M PIPE, Plans First Listed TON Treasury Company

Verb Technology (Nasdaq: VERB) announced completion of a ~$558 million PIPE private placement in partnership with Kingsway Capital to establish the first publicly listed Toncoin (TON) treasury company. The company will be renamed TON Strategy Co. (TSC), with most funds used to acquire TON, aiming to become a leading holder globally. The transaction closes August 7, with TSC to hold TON as its primary reserve asset and generate income via staking. Investors include Kingsway, Vy Capital, Blockchain.com, and 110 other institutions.

4. ETH ICO Whale Switches from Selling to Accumulating, Adds 13,600 ETH in Three Weeks

After a full year of steady selling, an early ETH ICO whale has shifted to accumulation, withdrawing 13,600 ETH ($47M at $3,456/ETH average) from exchanges in the past three weeks—its largest accumulation in over two years. Previously, this whale deposited 6,000 ETH to OKX (much less than this recent round). The whale now holds 59,718 ETH ($210M) on-chain.

Market Performance

1、BTC & ETH: Up in the short term, sparking major altcoin rallies. Last 24 hours saw $209M liquidated, mostly short positions.

2、US Stocks: Dip-buying lifts Nasdaq nearly 2%; Nvidia up 3.6%. New IPO Figma down >27%. High tariffs weigh on Swiss markets and franc; oil down over 1%.

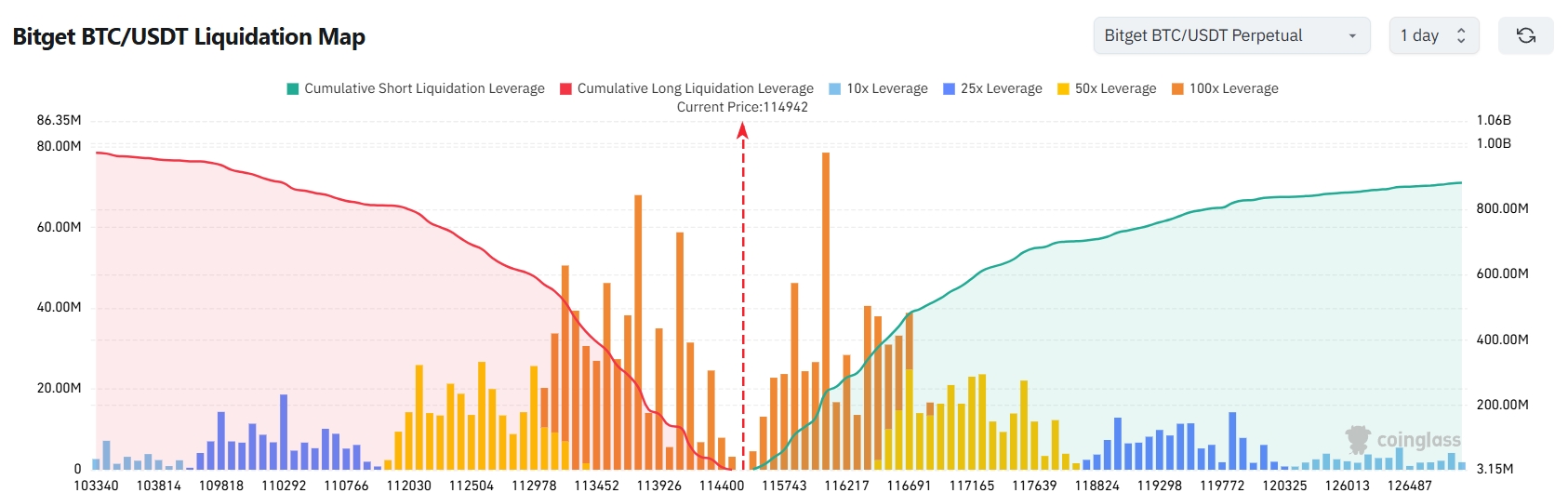

3、Bitget BTC/USDT Liquidation Map: With current price at $114,942 USDT, a 2,000-point drop to ~$112,942 triggers cumulative long liquidations over $600M; a 2,000-point rise to ~$116,942 triggers cumulative short liquidations worth $527M. Long-side liquidation far outweighs short. Leverage management advised to avoid cascading liquidations during volatility.

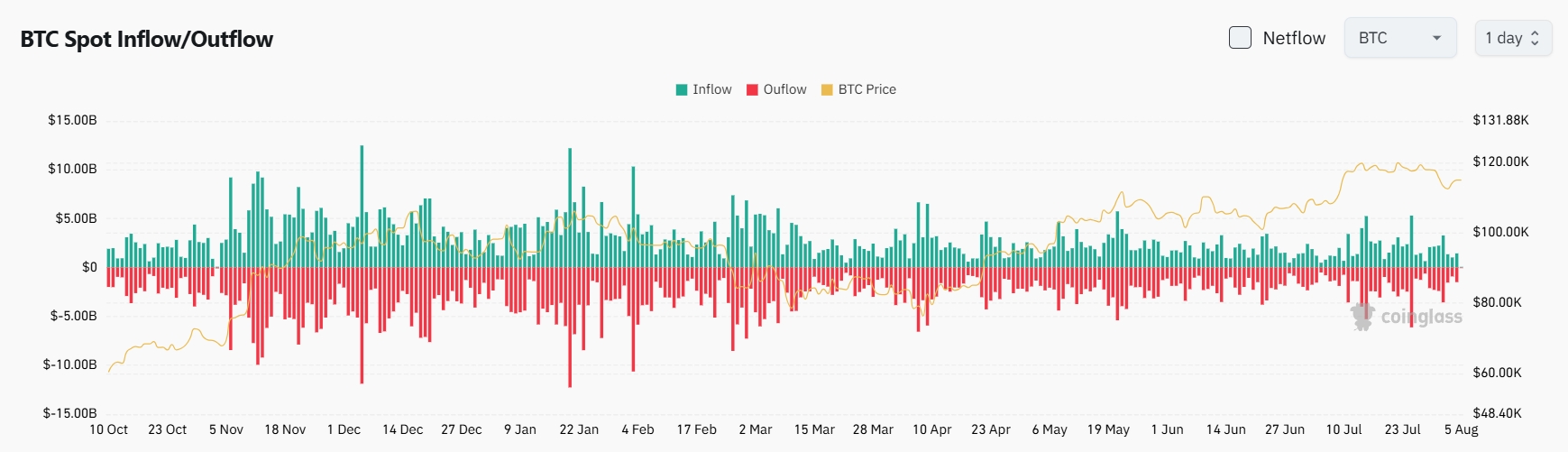

4、BTC Spot Flows (24h): $1.44B influx, $1.5B outflow, net outflow $60M.

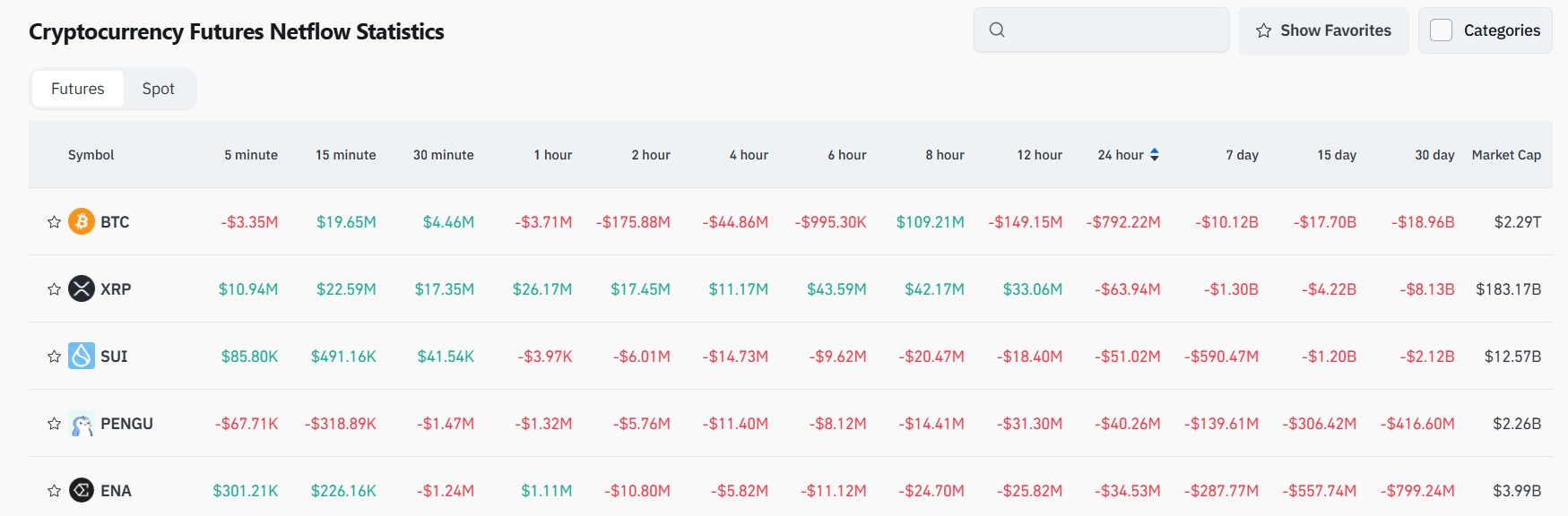

5、Top Net Outflows (24h contracts): $BTC, $XRP, $SUI, $PENGU, $ENA—all leading in net contract outflows, potentially indicating trading opportunities.

Institutional Views

-

Greeks.Live: “ETH breaking $4,000 in the next two months will be key to sustaining the bull market.” Source

-

CryptoQuant: “We expect two more rate cuts this year, which should provide two more major upside opportunities in this cycle’s bull market.” Source

News Highlights

-

CME FedWatch: Odds of a September Fed rate cut rise to 94.4%.

-

WSJ: White House to issue executive order to penalize banks discriminating against crypto companies and conservatives.

-

Fed’s Daly: Rate cuts likely imminent, with odds of more than two cuts this year.

-

Trump: Vows to significantly raise tariffs on Indian goods.

-

France’s Right-wing Party: Proposes using surplus nuclear energy to mine Bitcoin.

Project Updates

-

BONK: Burned 300B tokens early this morning.

-

PUMPFUN: Testing “Rewards” on its website, volume incentives coming soon.

-

Sky: Repurchased 16.55M SKY tokens with 1.39M USDS in the past week.

-

SharpLink Gaming: Increased ETH holdings by 18,680 to total 498,884 ETH.

-

Solana: Launches Seeker mobile device in 50+ countries/regions.

-

Hyperliquid: July trading volume hits all-time high, near $32B.

-

WOOFi: Burned over 2M WOO tokens.

-

Cardano: Community approves “IOE Roadmap.”

-

Lido Co-Founder: Contributor team to be reduced by about 15%.

-

SEC vs Ripple: Legal experts say SEC response in the XRP case due in days.

X Trends

1. Crypto_Painter: BTC Spot Premium Drops, Bearish Sentiment Rising, but Technicals Remain Pressured

Ahead of Monday’s US equity open, BTC spot premium remained positive, indicating weekend inflows have faded. The funding rate, after staying above 0.01% for three weeks, dropped last Friday and occasionally dips below 0.01% now. This, together with the change in spot premium, reveals building bearish force. Despite BTC’s technical breakdown and an uptick in shorts, a sharper “washout” is needed for a true bear entry. Patience is key.

Source

2. Millionaire Eric: Don’t Chase Breakouts—The Real Buy is on the Retest

Avoid impulsive entry at the breakout: high-probability trades come on the post-breakout retest. Retest confirmation requires at least one of: revisiting prior highs, neckline, trendline, or range boundary; a close above the key level after the retest; or lack of a sudden spike in volume/volatility. Enter after confirmation, set stop below the confirmation candle or recent low; trade is invalid if price closes back below key level. Take profit per structural targets and keep your stops moving up as new higher lows form. Remember: quality trade signals rarely occur on the breakout itself, but rather during the confirmation retest.

Source

3. AB Kuai.Dong: Ethereum in Institutional Accumulation Mode as SEC and Wall Street Backing Rises

Ethereum’s bullish outlook is driven by Project Crypto, a joint SEC-White House push to bring US financial markets fully on-chain and maintain global dominance. Leading Wall Street banks picked ETH—thanks to stability and smart contract capabilities—after extensive L1 research. While institutions hold 12% of BTC supply, only 5.2% of ETH is institutionally held, well below their targets. Current sideways consolidation paves the way for retail-distribution and institutional accumulation. The market is quietly entering the “ETH harvest period.”

Source

4. Phyrex: US Stocks Recover as Trump’s Aggressive Policies Gain Focus; BTC Stable, All Eyes on September FOMC

US markets rebounded strongly Monday, erasing last Friday’s losses as sentiment turned upbeat. Key driver: Trump’s growing sway on Fed appointments and bets that his aggressive policies favor rate cuts; US 10-year yields dipped below 4.2%. BTC saw higher turnover with some short-term losers exiting, but underlying support remains strong and the major support level is intact. No systemic risk is evident, but September’s FOMC remains a pivotal event for BTC’s next directional move.

Source

7

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Kiyosaki Predicts Massive Money Printing

Cointribune•2025/11/16 14:27

ETF Canary Launch Has Little Impact On XRP

Cointribune•2025/11/16 14:27

Chainlink Dominates RWA With Technical Strength

Cointribune•2025/11/16 14:27

Bitcoin Price Prediction: Short-Term Bounce On Cards, But With a Twist

Coinpedia•2025/11/16 14:09

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,338.13

-0.88%

Ethereum

ETH

$3,151.83

-1.02%

Tether USDt

USDT

$1

+0.06%

XRP

XRP

$2.21

-2.34%

BNB

BNB

$930.88

-0.58%

Solana

SOL

$139.58

-1.22%

USDC

USDC

$1

+0.02%

TRON

TRX

$0.2946

+0.51%

Dogecoin

DOGE

$0.1608

-1.66%

Cardano

ADA

$0.4914

-3.42%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now