XRP Price Faces Pressure as Key Holders’ Outflows Reach 7-Month High

XRP struggles to regain momentum as key holders’ outflows rise and market sentiment weakens. The altcoin's future hinges on reclaiming $2.95 and $3.00.

XRP has faced a minor drawdown in recent days, losing the support of $3. The altcoin is now struggling to regain that level.

The next phase of recovery will depend heavily on investor sentiment, as their actions could determine whether XRP will continue to struggle or stage a rebound.

XRP Investors Are Selling

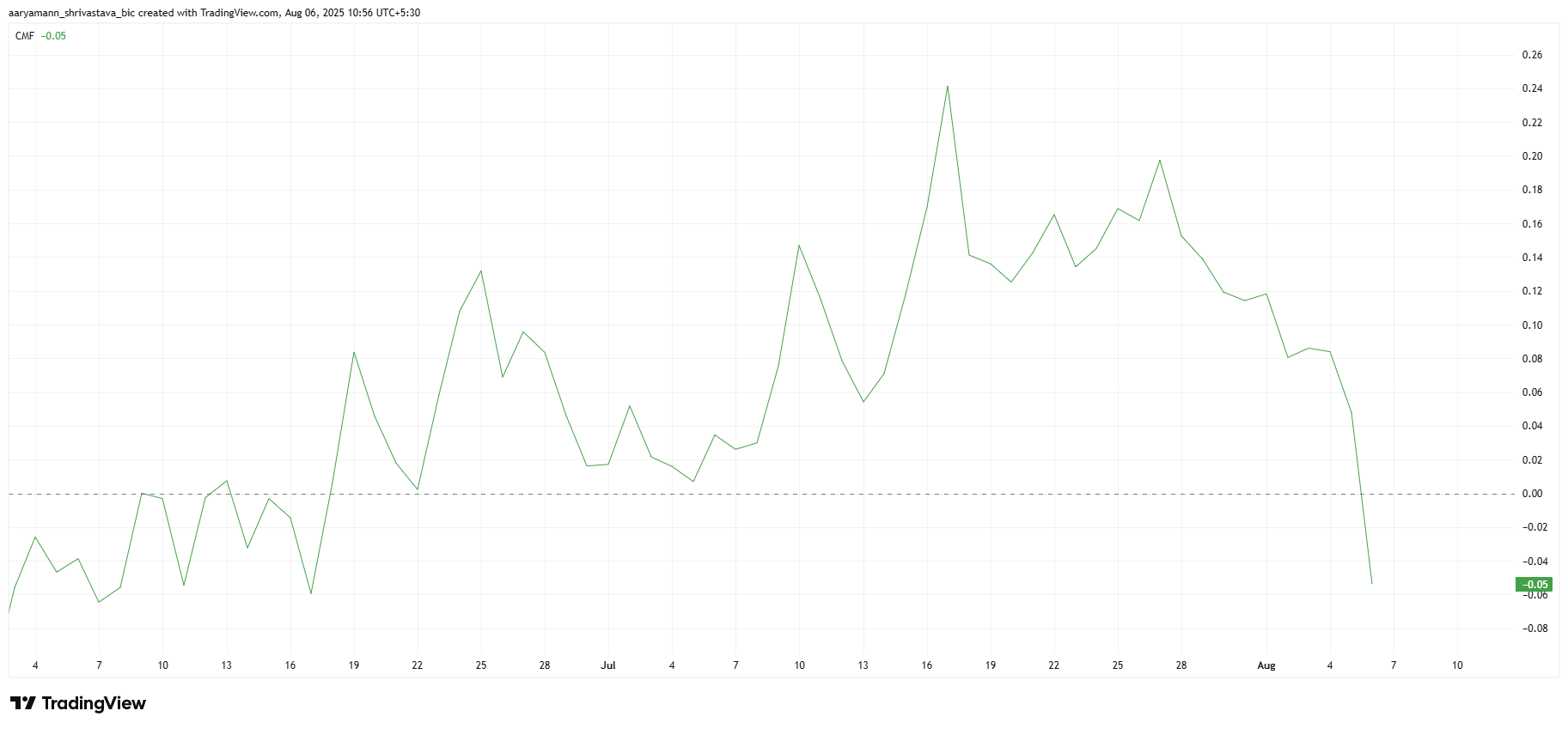

The Chaikin Money Flow (CMF) has recently shown a sharp downtick, indicating a decline in investor confidence. This drop signals that investors are pulling money out of XRP, reflecting a growing skepticism about the altcoin’s price trajectory. The sharp decline in CMF is concerning, as it suggests that outflows could continue unless a shift in sentiment occurs.

This skepticism is contributing to the recent bearish pressure on XRP’s price. As the outflows continue to increase, XRP’s ability to reclaim key levels becomes more difficult, potentially leading to further declines.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP CMF. Source:

TradingView

XRP CMF. Source:

TradingView

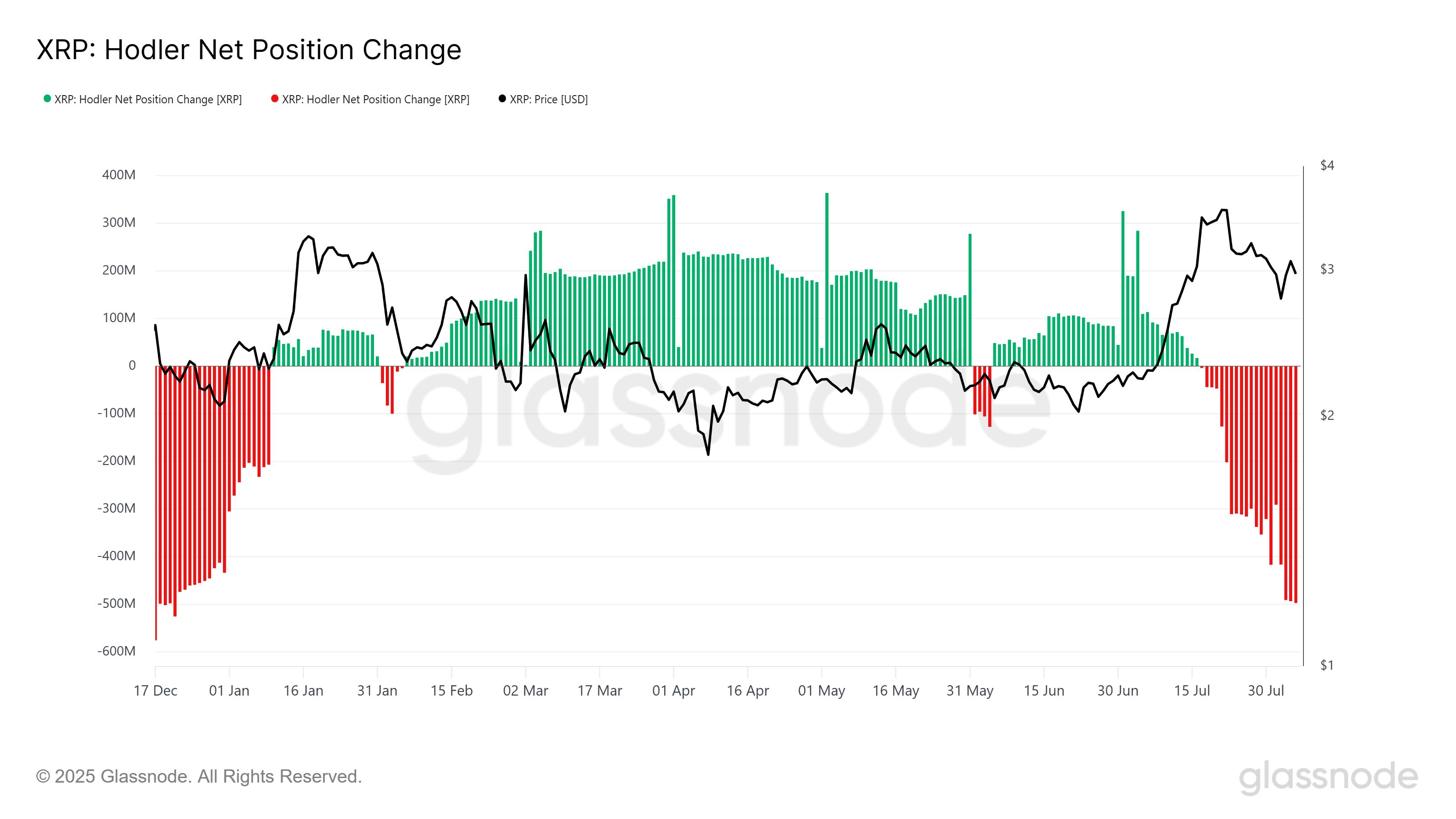

XRP’s longer-term outlook is also influenced by its HODLer net position change, which has reached a seven-month low. This metric indicates that long-term holders (LTHs) are also selling, contributing to the downtrend. The consistent selling from LTHs, which has been ongoing since mid-July, has intensified over the past few days, amplifying the downward pressure on XRP’s price.

The LTHs, who have a significant impact on the price of XRP, are seeing their positions decrease. This continuous selling behavior is leading to a growing sense of bearishness among the broader holder base. As these influential holders reduce their positions, other investors may follow suit, further driving down the price.

XRP HODLer Net Position Change. Source:

Glassnode

XRP HODLer Net Position Change. Source:

Glassnode

XRP Price Needs To Reclaim Support

XRP is currently priced at $2.92, sitting just below the $2.95 resistance. The bearish market sentiment and outflows are evident, making it difficult for the altcoin to break through this resistance. A continuation of the current trend may lead to further downward pressure on the price.

XRP is likely to test the support of $2.65 in the coming days, unless investors shift their sentiment. If this support level fails to hold, XRP may experience further losses, putting additional strain on the altcoin and its investors.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

To recover, XRP will need to reclaim $2.95 as support and break through the $3.00 mark. A successful breach of these levels could pave the way for XRP Price recovery towards $3.41, ultimately invalidating the current bearish outlook and offering hope for a potential recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Every country is heavily in debt, so who are the creditors?

As national debts rise, the lenders are not external forces, but rather ordinary people who participate through savings, pensions, and the banking system.

If Bitmain is sanctioned, which American mining company will fall first?

The U.S. government is conducting a stress test on Bitmain, with the first casualties likely to be domestic mining farms in the United States.

Aethir unveils strategic roadmap for the next 12 months, accelerating the construction of global AI enterprise computing infrastructure

Aethir's core vision has always been to drive the realization of universal, decentralized cloud computing capabilities for users worldwide.

Elon Musk Calls Bitcoin a "Fundamental" and "Physics-Based" Currency

Elon Musk stated, "In a future where anyone can have anything, I believe you will no longer need currency as a database for the allocation of labor."