Why Selling Crypto in August Could Be a Costly Mistake — Experts Explain

Despite August's crypto pullback, experts argue it's a healthy correction—not a collapse. Altcoins show promise, and sentiment remains stable.

The crypto market capitalization in August has not continued the streak of new highs like in July. The rally has stalled as long-dormant whales awaken and traders lean toward profit-taking.

This raises an important question: Should investors sell in August and wait for new lows? Recent expert analysis offers deeper insight.

Why Selling in August Might Be a Big Mistake

Compared to the $4 trillion market cap peak in July, the market has corrected by 6.7%, now at $3.67 trillion.

Although this isn’t a major correction, new developments in August have sparked concern. These include awakened whales, a slowdown in ETF inflows, renewed tariff pressure, and a rebound in the DXY (US Dollar Index). Together, these elements raise fears of a stronger August correction.

However, for Bitcoin, Swissblock’s latest report sees the recent price drop as a positive phase. It views the pullback as a necessary cooldown after the previous price surge.

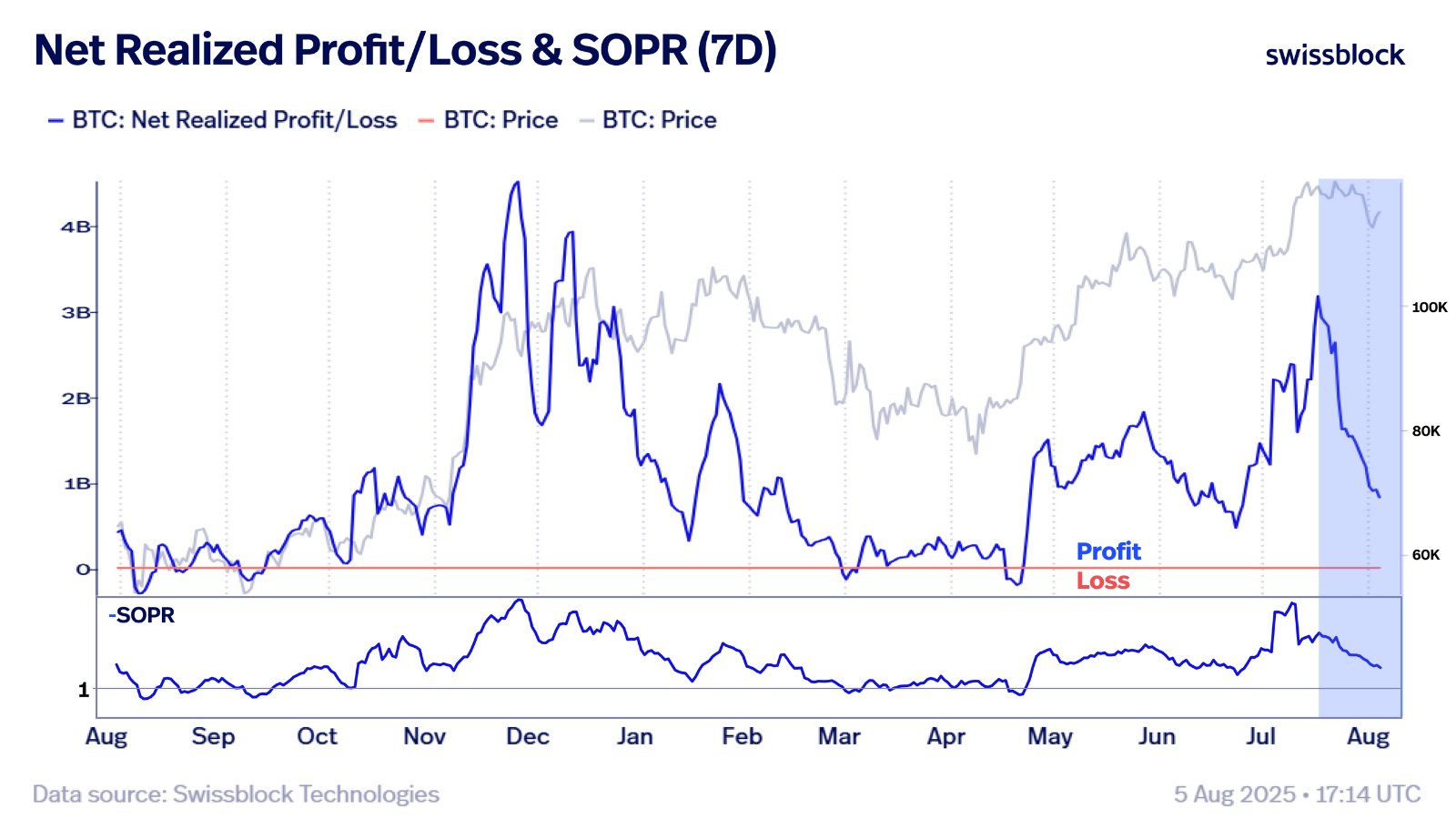

The report focuses on two key indicators: Net Realized Profit/Loss (PnL) and 7-Day SOPR (Spent Output Profit Ratio). Both metrics have been falling, but not alarmingly.

Bitcoin Net Realized Profit/Loss (PnL) vs 7-Day SOPR. Source:

Swissblock

Bitcoin Net Realized Profit/Loss (PnL) vs 7-Day SOPR. Source:

Swissblock

“This correction is a healthy cooldown, not structural weakness. Net Realized PnL is dropping sharply, selling intensity is low. SOPR is drifting lower, not collapsing. Investors are taking profits, not exiting in fear—they want to sell higher. This is a constructive reset,” Swissblock noted.

Although the report doesn’t predict a specific price level for a Bitcoin rebound, other analysts believe BTC might correct to around $95,000 before recovering.

For altcoins, the altcoin market capitalization (TOTAL3) has dropped over 10%, falling from $1.1 trillion in July to $963 billion in August.

Yet a report from Altcoin Vector maintains that altcoins remain highly promising.

Altcoins Quadrants. Source:

Altcoin Vector

Altcoins Quadrants. Source:

Altcoin Vector

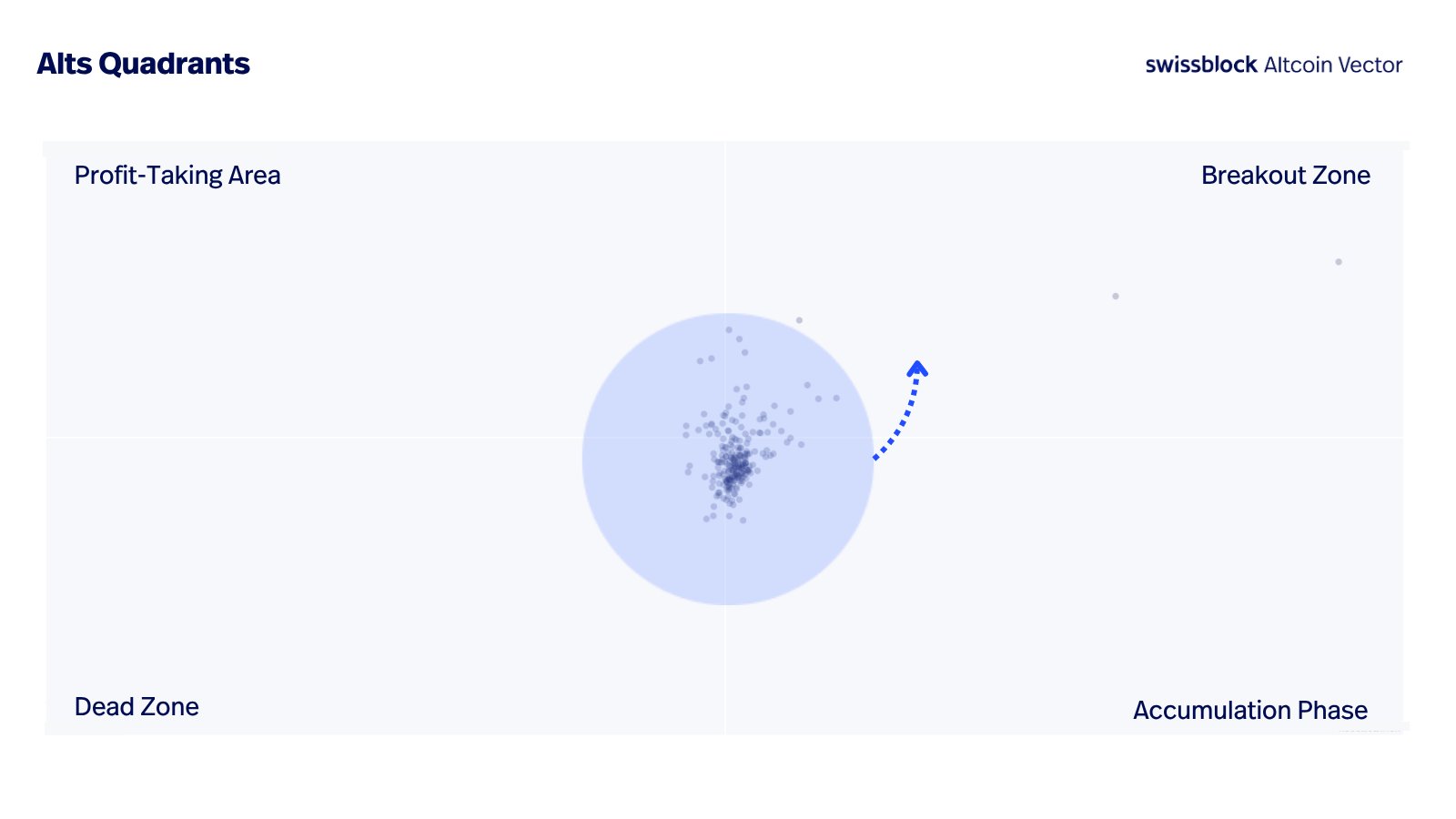

The report uses a quadrant chart that segments the altcoin cycle into four phases. Since July, the chart has moved counterclockwise and is now heading toward the “Breakout Zone.”

“Smart capital rotates here, before the crowd sees it. Momentum is turning, structure is stabilizing. This isn’t a breakout: now pre-positioning begins,” according to Altcoin Vector.

Crypto analyst VirtualBacon also explained why selling in August could be a costly mistake.

— VirtualBacon (@VirtualBacon0x) August 5, 2025

Why Selling in August is a Big Mistake

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.Here’s why I’m staying patient and what I’m doing instead

He acknowledged that while some events may seem concerning, there’s no need to panic because:

- The tariff announcement on August 7 might be nothing more than short-term noise, similar to past events.

- Weak labor data may increase the Fed’s chances of cutting interest rates.

- The US Treasury may withdraw $500 billion, causing short-term volatility, but not a full-blown liquidity crisis.

Moreover, market sentiment has cooled down. In July, it was firmly in the “Greed” territory, but now it has retreated to a “Neutral” zone. Since February, the market has not entered a state of “extreme greed,” which is generally regarded as the ideal time for making selling decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.

MSTR, the leading Bitcoin concept stock, plunges up to 12% intraday after first signaling possible "coin selling"

MicroStrategy has announced the establishment of a $1.44 billion cash reserve to "weather the winter," and for the first time has acknowledged the possibility of selling bitcoin under certain conditions.