MNT Explodes as Stablecoin Liquidity Hits All-Time High on Mantle

MNT has experienced a strong rally, driven by a 23% increase in stablecoin liquidity, pushing its price to a five-month high. The token's bullish trend looks poised to continue as key technical indicators show buying pressure.

Mantle’s native token, MNT, is today’s top gainer. Its value has climbed 4% in the past 24 hours, extending a strong weekly rally that has seen its price surge nearly 30% over the last seven days.

The rally comes as the network’s stablecoin supply climbs, signaling an influx of liquidity into the Mantle ecosystem.

Stablecoin Inflow and Bullish Indicators Signal More Upside

Over the past week, liquidity inflow into the Mantle network has soared. According to data from DeFiLlama, the network’s stablecoin market capitalization has risen by 23% in the past seven days, reaching an all-time high of $654 million on Tuesday.

MNT Stablecoin MarketCap. Source:

DefiLlama

MNT Stablecoin MarketCap. Source:

DefiLlama

Higher stablecoin liquidity means traders have more immediate buying power. When market sentiment is positive, this can amplify demand and drive an asset’s price momentum.

This has been the case for MNT, whose seven-day price rally has been driven by the surge in liquidity on the network amid the broader market’s lackluster performance.

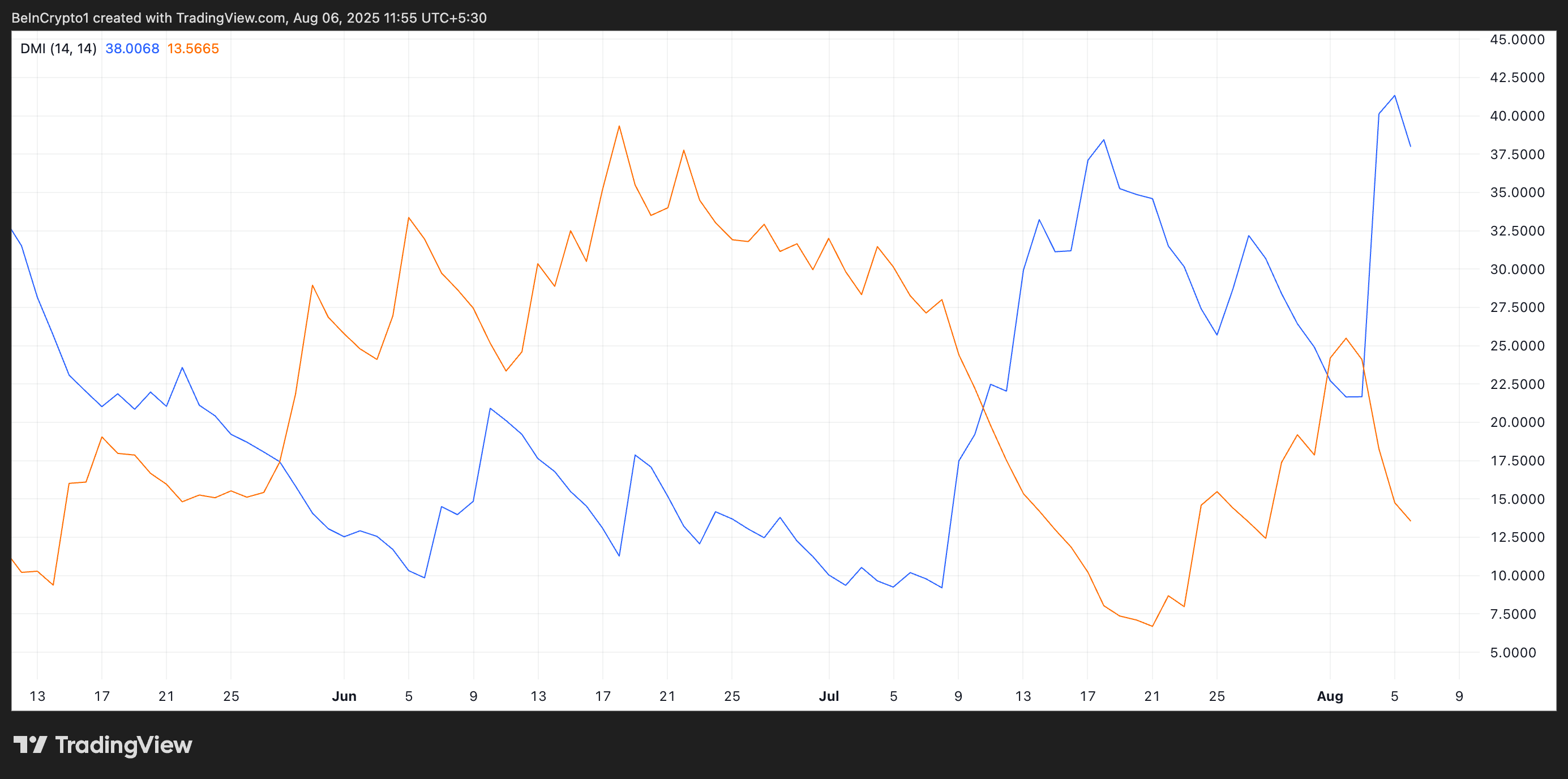

Readings from the MNT/USD daily chart paint an equally optimistic picture. For example, MNT’s Directional Movement Index shows its positive directional index (blue; +DI) resting above the negative directional index (orange; -DI) at press time, highlighting the strength of the buy-side pressure.

MNT Directional Movement Index. Source:

TradingView

MNT Directional Movement Index. Source:

TradingView

The DMI indicator gauges the strength and direction of a trend by analyzing recent highs and lows.

MNT’s DMI setup indicates that buying pressure outpaces selling activity, keeping the current uptrend intact. As long as the +DI stays above the -DI and the gap between them widens or holds steady, the bullish momentum behind MNT’s rally will likely persist.

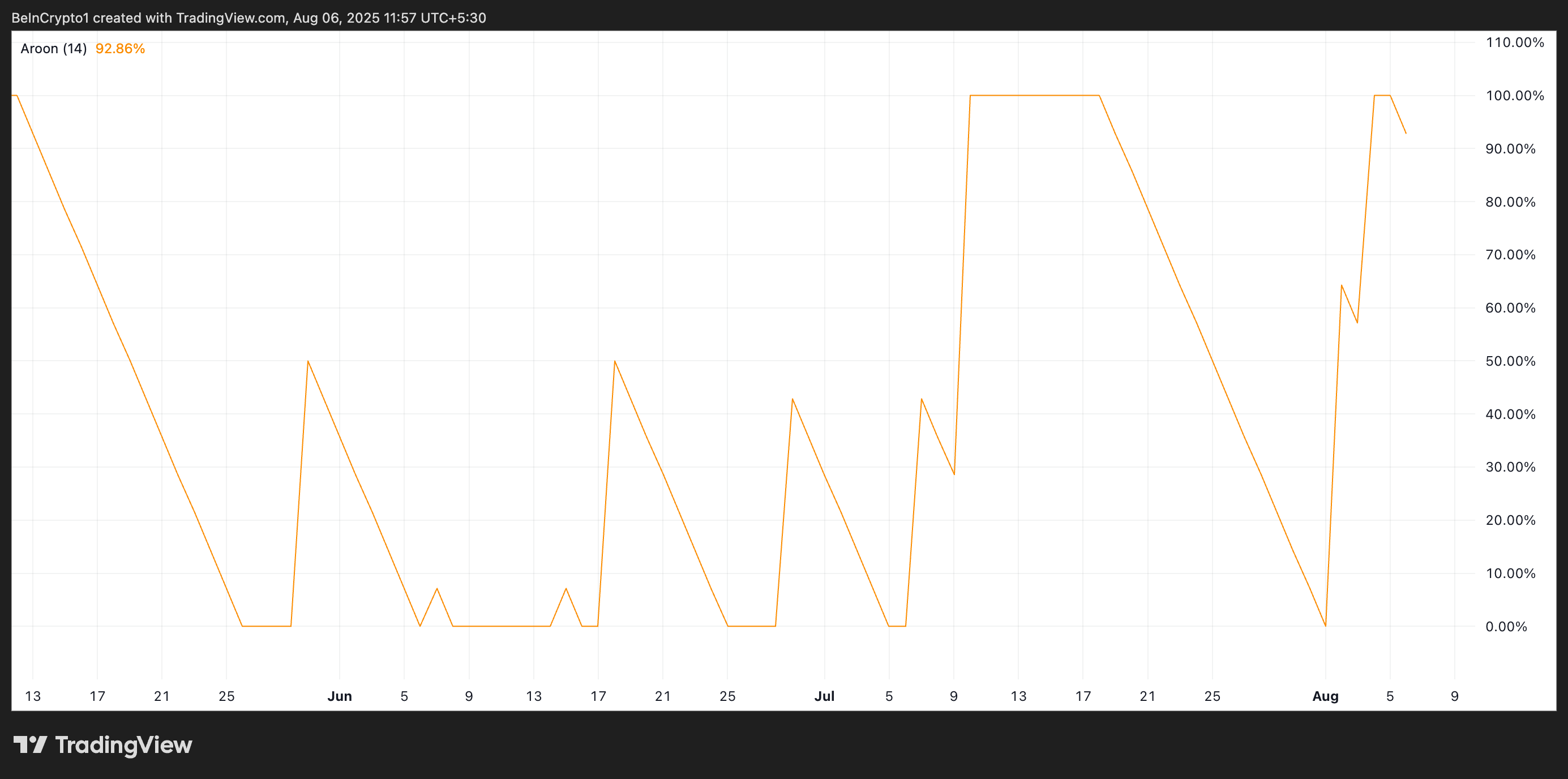

Furthermore, MNT’s Aroon Up indicator, which currently reads 92.86%, supports this bullish outlook. The Aroon indicator is a technical analysis tool used to identify trend direction and strength by measuring the time elapsed since the most recent highs or lows.

MNT Aroon Indicator. Source:

TradingView

MNT Aroon Indicator. Source:

TradingView

When the Aroon Up line is at or close to 100%, it suggests that recent price action has consistently hit new highs, indicating strong bullish momentum. This is true of MNT, whose price has rocketed to a five-month high over the past three days.

MNT Battles to Cement $0.86 as Rally Base

MNT’s 4% uptick has pushed its price above the key resistance at $0.86. MNT could extend its rally to $0.99 if this level strengthens as a support floor.

MNT Price Analysis. Source:

TradingView

MNT Price Analysis. Source:

TradingView

On the other hand, if profit-taking resumes, MNT could lose strength and attempt to test the new $0.86 support. Should it fail to hold, the token’s price could fall to $0.71.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.