SEC official warns liquid staking guidance adds confusion, raising Lehman-like risks

US Securities and Exchange Commission (SEC) Commissioner Caroline Crenshaw has criticized recent staff guidance on liquid staking, warning that it fails to reflect the practice’s complexities.

On Aug. 5, the SEC’s Division of Corporation Finance asserted that certain liquid staking arrangements, specifically those involving receipt tokens, do not fall under securities regulations.

However, Crenshaw pushed back, arguing that the statement adds confusion rather than clarity to the legal treatment of liquid staking.

“Instead of clarifying the legal landscape, today’s statement, like other recent staff statements before it, only muddies the waters.”

Crenshaw pointed to two major flaws in the SEC staff’s position. First, she said the guidance relies on a long list of questionable assumptions about how liquid staking operates. Second, the staff’s legal conclusions are heavily caveated, making them unreliable for firms trying to navigate compliance.

She noted that any staking activity not fitting the precise conditions described in the document would fall outside its scope. Because of this, she argued, the guidance offers little protection or direction to those involved in staking-related services.

Crenshaw also reminded investors that the guidance represents the opinion of SEC staff, not the official stance of the Commission itself. As such, she believes it should have been framed as a cautionary alert, not a position of regulatory clarity.

Lehman-like risks in crypto staking

Adding to the concerns, Amanda Fischer, a former SEC Chief of Staff under Gary Gensler, drew parallels between liquid staking and the risky financial practices that led to Lehman Brothers’ collapse in 2008.

In a post on X (formerly Twitter), Fischer warned that liquid staking could expose crypto markets to cascading failures. She explained that the practice allows users to deposit digital assets and receive a synthetic version of the same token, which can be reused to earn additional rewards.

According to Fischer, this mirrors how Lehman reused client assets to back high-risk trades. She argued that liquid staking could replicate the same vulnerabilities without strong regulatory oversight.

The former SEC official also highlighted the risks of relying on token issuers, the possibility of long delays when unstaking, and the threat of technical failures or hacks. Together, these factors could amplify systemic risk across the crypto sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

RootData Crypto Calendar Fully Upgraded: Say Goodbye to Information Delays and Build Your 24/7 Trading Alert System

Only with information transparency can wrongdoers be exposed and builders receive their deserved rewards. The RootData calendar section has evolved into a more comprehensive, accurate, and seamless all-weather information alert system, aiming to help crypto investors penetrate market uncertainties and identify key events.

Major Overhaul in US Crypto Regulation: CFTC May Fully Take Over the Spot Market

The hearing on November 19 will determine the final direction of this long-standing dispute.

As economic fissures deepen, Bitcoin may become the next "pressure relief valve" for liquidity

Cryptocurrencies are among the few areas where value can be held and transferred without relying on banks or governments.

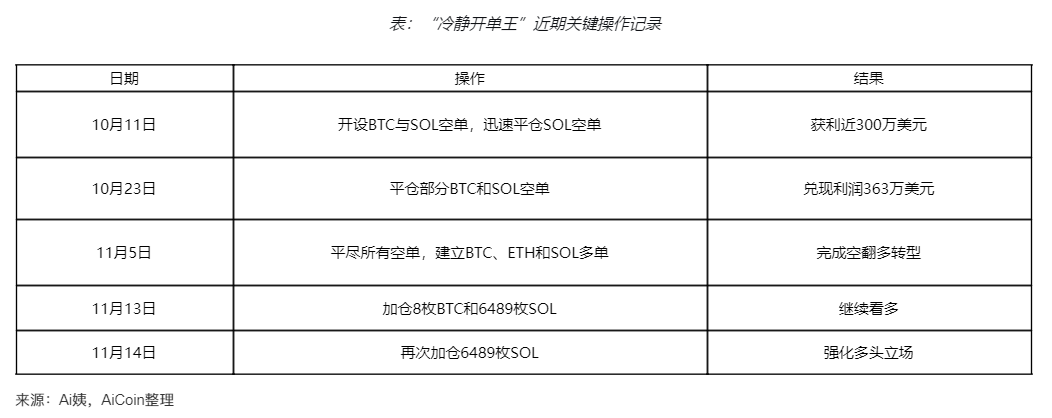

"The Calm Order King" increases positions against the trend, strengthening the bulls!