BTC Market Pulse: Week 32

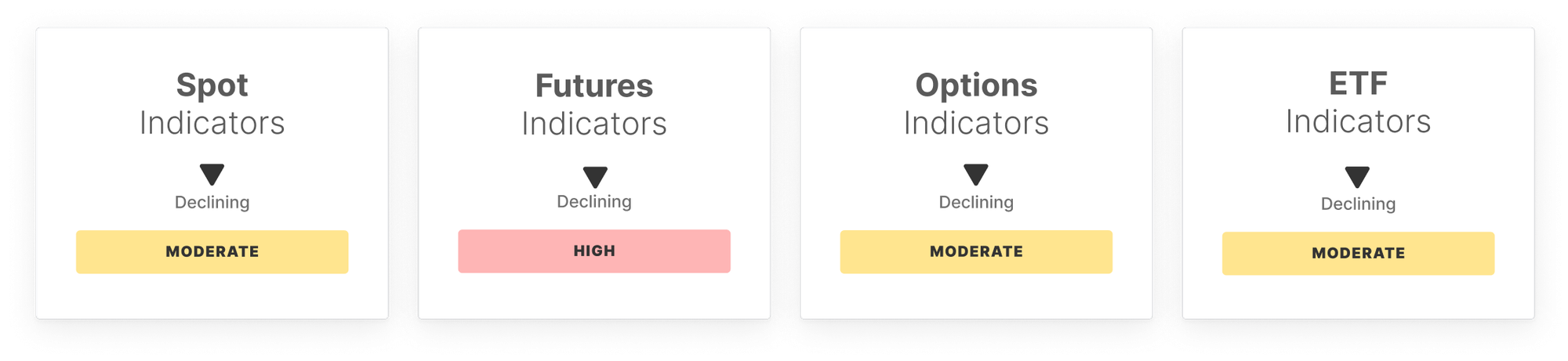

Bitcoin’s rally pauses as momentum cools across spot, futures, options, and ETF markets. With liquidity thinning and risk appetite moderating, signs of seller exhaustion emerge - yet fragile market structure leaves BTC vulnerable to further downside.

Overview

With the market retesting the low-liquidity range below the $114k threshold level, the euphoria phase is on pause as Bitcoin undergoes a period of recalibration. Signals across market sectors point to cooling momentum, cautious positioning, and a moderation in risk appetite.

In the Spot Market, conditions weakened notably as the RSI fell from 47.4 to 35.8, dipping below its low band and signaling oversold territory. Spot CVD deteriorated sharply from -$107.1M to -$220.0M, reflecting intensifying sell-side pressure. Spot volume also declined from $8.4B to $7.5B, suggesting softer participation and liquidity during the retest of support.

The Futures Market saw Open Interest ease from $45.6B to $44.9B, hinting at mild position unwinding. Long-side funding dropped 33% to $3.1M, marking a pullback in leveraged bullish demand. Perpetual CVD fell from -$1.2B to -$1.8B, deep below its low band, underscoring aggressive distribution and forced disengagement among traders.

In the Options Market, Open Interest contracted 8.4% to $39.8B, reflecting reduced speculative activity. The volatility spread narrowed from 23.84% to 16.26%, showing less risk being priced in. However, 25 Delta Skew surged above its high band to 5.51%, signaling heightened demand for downside protection and rising hedging sentiment.

The ETF Market saw net inflows drop 24.9% to $269.4M, well below the low band, indicating weak institutional demand. Trading volume rose 9.9% to $19.8B, suggesting a responsive but cautious environment. ETF MVRV eased from 2.4 to 2.3, showing slightly lower profitability but ongoing unrealized gains.

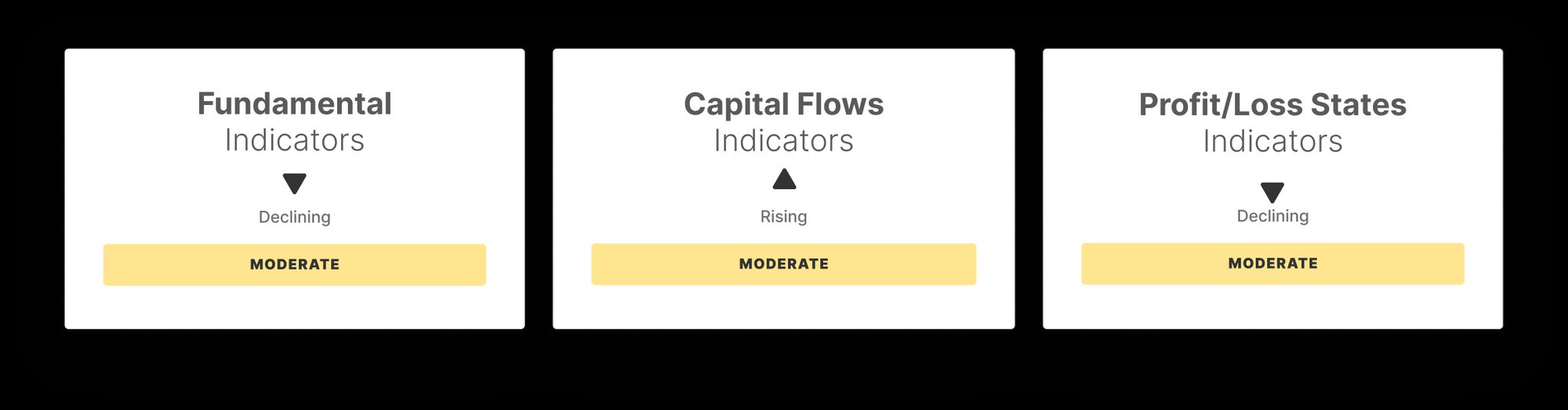

On-chain fundamentals were mixed: active addresses rose 3.6% to 729k, while transfer volume dropped 13.9% to $9.4B and fees declined 14.4% to $483.2K, signaling quieter network activity. Realized Cap Change stayed elevated at 6.3%, reflecting strong but cooling capital inflows.

Capital flows remained steady with the STH/LTH ratio at 17.3% and Hot Capital Share at 36.0%, showing balanced liquidity. Profitability metrics cooled as Percent Supply in Profit fell to 93.6%, NUPL dropped to 8.6%, and Realized P/L Ratio contracted to 1.9, reflecting more cautious sentiment.

In sum, the market has shifted from euphoria to reassessment, with oversold conditions and seller exhaustion hinting at potential for a bounce. However, fragility is growing, and the structure remains vulnerable to external negative catalysts or delayed demand revival.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Faces Vitalik Buterin’s Challenge: What Lies Ahead?

In Brief Vitalik Buterin warns Zcash against token-based governance. Zcash community is divided over future governance approach. ZEC Coin struggles with market negativity and volatile price movements.

70M$ inflows this week: Bitcoin ETFs rise again

BlackRock Downplays IBIT Outflows as Bitcoin ETF Market Shows Signs of Recovery