Two Reasons Why Ethereum’s Rally Is on Hold This August

Ethereum's recent price stagnation is driven by diminishing leverage and whale activity, suggesting a prolonged period of consolidation or a possible price drop.

Over the past two weeks, the broader crypto market has shown lackluster performance, keeping Ethereum within a tight trading range.

Since July 21, the altcoin has repeatedly tested resistance near $3,859 while finding support at $3,524, struggling to break clear of this zone. With momentum fading, key on-chain metrics now suggest that ETH may face an extended period of sideways consolidation or a potential price breakdown.

Ethereum’s Big Players Step Back

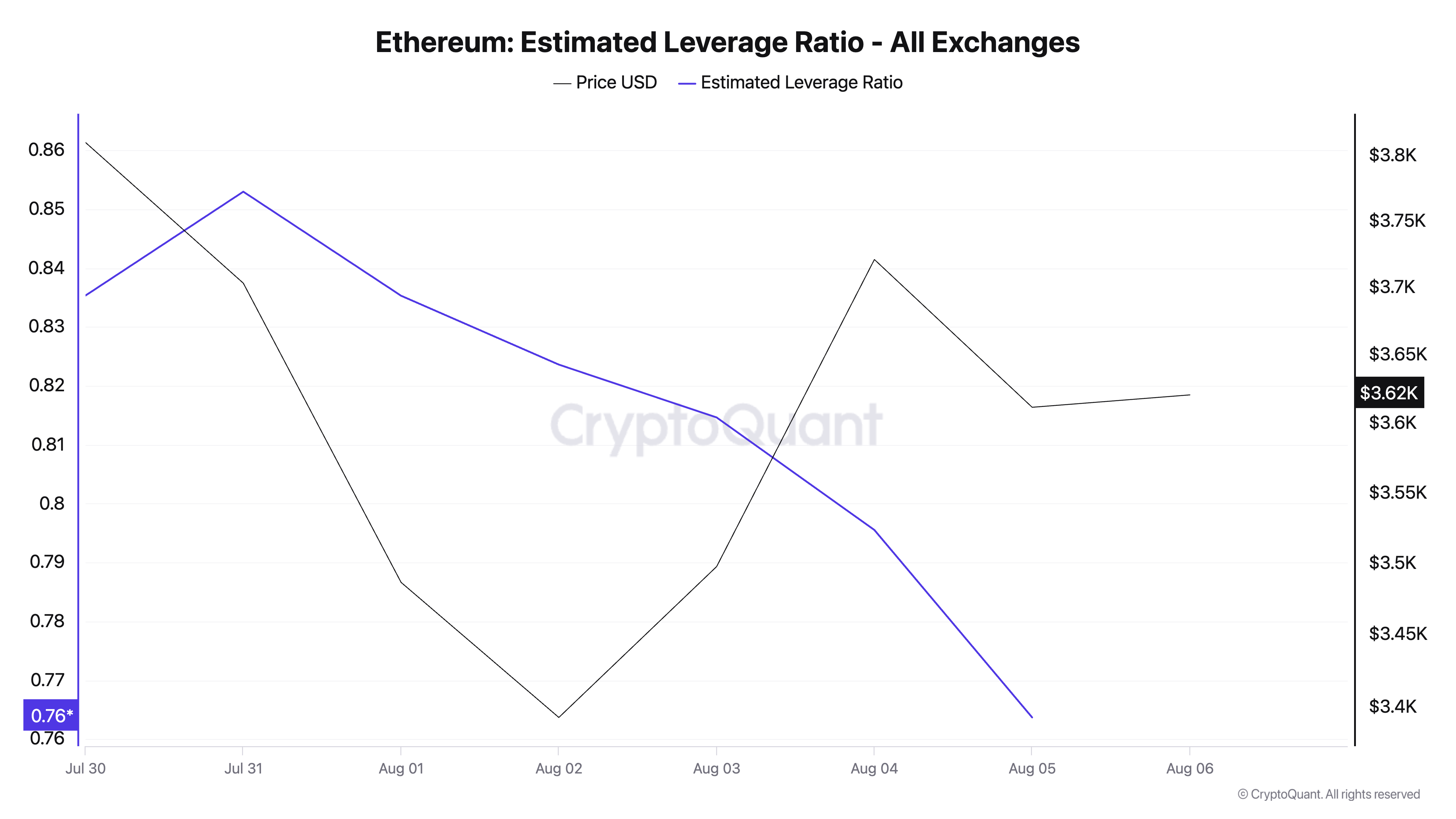

According to CryptoQuant’s data, ETH’s falling estimated leverage ratio (ELR) across all cryptocurrency exchanges reflects waning investor confidence and a declining appetite for risk among its futures traders. Per the data provider, ETH’s ELR now sits at a weekly low of 0.76.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum ELR. Source:

CryptoQuant

Ethereum ELR. Source:

CryptoQuant

The ELR metric measures the average amount of leverage traders use to execute trades on an asset on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

ETH’s declining ELR signals a market environment where traders avoid high-leverage bets. Its investors are growing cautious about the coin’s short-term prospects and are not taking high-leverage positions that could amplify potential losses.

If this pullback in speculative activity continues, it will reduce the likelihood of a near-term breakout and increase the chances of ETH remaining range-bound.

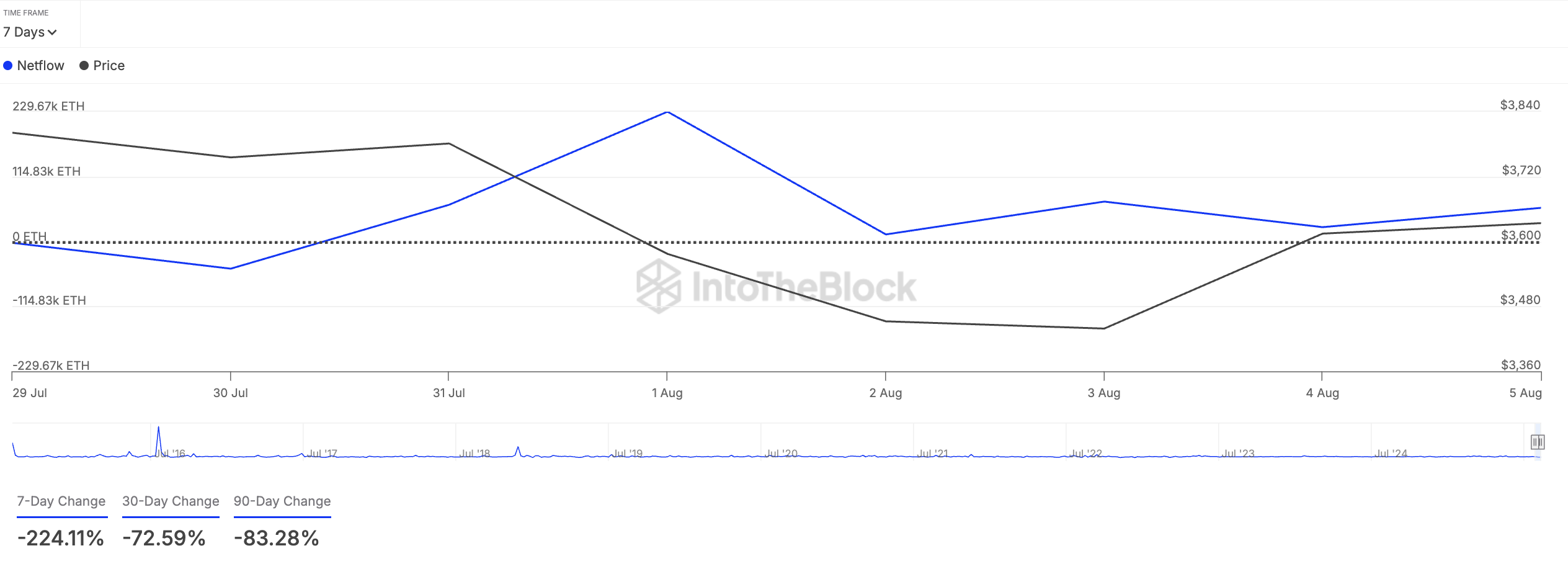

Furthermore, ETH whales have also reduced their accumulation over the past week, possibly to lock in profit. According to IntoTheBlock’s data, the coin’s large holders’ netflow is down 224% in the last seven days, showing the retreat from ETH’s key holders.

ETH Large Holders’ Netflow. Source:

IntoTheBlock

ETH Large Holders’ Netflow. Source:

IntoTheBlock

Large holders are whale addresses controlling over 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, whales are buying more of its coins/tokens on exchanges, potentially in anticipation of a price rally.

On the other hand, as with ETH, when it declines, it signals reduced activity and profit-taking among these key investors.

ETH Bulls and Bears Face Off: Will $3,524 Hold or Break?

The metrics above highlight waning confidence in ETH’s near-term price gains and a reluctance among its key holders to commit significant capital to the market right now. If this persists, bearish pressure on the coin will increase, potentially triggering a breach of support at $3,524.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If this happens, the coin could extend its dip to $3,067.However, if the bulls regain dominance, they could drive a break above the resistance at $3,859. If successful, ETH’s price could climb above $4,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.