Bitcoin Stabilizes in $110k–$116k Trading Range Awaiting Demand

- Bitcoin holds between $110k and $116k; market awaits new demand.

- Tether and Coinbase accumulate 30,000 BTC.

- Increased volatility expected if Bitcoin doesn’t rise above $116k.

Bitcoin is consolidating between $110,000 and $116,000, forming an “air gap” in liquidity after dropping from July’s all-time high of $123,000. Major institutions like Coinbase and Tether have accumulated 30,000 BTC, signaling potential future market movement.

This price range is significant as institutional investors assess buying opportunities while awaiting demand resurgence. Market reactions are closely watched for potential breakout or continuation patterns.

Bitcoin has settled between $110,000 and $116,000 following its sharp decline from the July peak of $123,000. The consolidation occurs within a liquidity “air gap” , noted by Glassnode analysts. Major entities like Coinbase and Tether have acquired approximately 30,000 BTC since the downturn. Despite these moves, significant statements from major industry CEOs remain absent. This development highlights the importance of institutional actions.

The financial landscape is impacted as over $922 million in leveraged positions were liquidated, indicating a reset open to new accumulation. Institutional buying has the potential to affect related markets, such as Ethereum. The on-chain data suggests new investor interest, as seen in the acquisition of 120,000 BTC, pushing BTC values upward. This demand trend is critical for assessing future market directions. Analysts indicate a potential volatility increase if BTC remains below $116,000, with Alva, On-Chain Analyst noting ,

“BTC is in a classic squeeze zone…if BTC doesn’t reclaim the $116k mark soon, oversold indicators like the CRSI could invite volatility and a swift drop to lower support levels.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

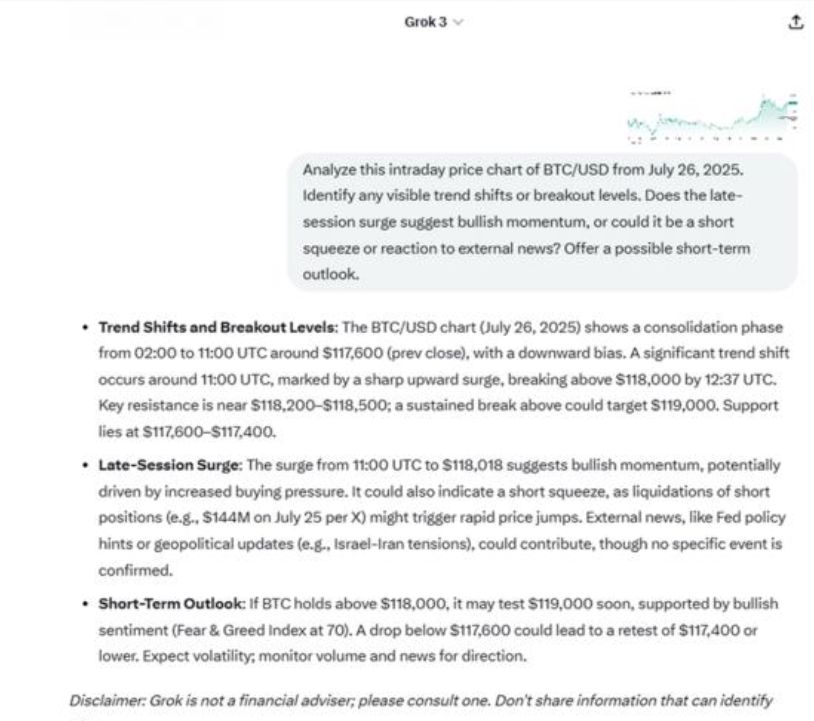

ChatGPT and Grok shift crypto trading to sentiment, now explains “why” behind moves

Share link:In this post: Crypto traders have turned to ChatGPT and Grok for real-time context, sentiment analysis, and narrative framing. In charts, Grok gives a more detailed and information-packed breakdown, pointing out resistance and support levels, liquidation events, and possible outside causes. Experts say that over-reliance on the bots without checking the ideas against standard charts or news causes traders to have false confidence.

Trump’s Fed chair shortlist grows longer than expected

Share link:In this post: President Trump, through Treasury Secretary Scott Bessent, is moving forward with interviews for 11 potential replacements for Fed Chair Jerome Powell, whose term ends in May. The list includes current Fed governors, past officials, and top financial executives. Philip Jefferson, the current vice chair, is also in the running. If selected, he would become the first Black Fed Chair in U.S. history.

Pennsylvania House sees bill to ban public officials from owning Bitcoin and digital assets

Share link:In this post: A new bill (HB1812) introduced in the Pennsylvania House of Representatives could impose jail time on public officials who fail to divest their Bitcoin holdings. Officials who do not comply with the divestment requirement could face civil penalties of up to $50,000, and violations may be classified as felonies. Similar proposals, especially at the federal level, are growing as more officials express discontent with Donald Trump’s relationship with crypto.

Wyoming launches FRNT stablecoin with Visa support across seven blockchains