XRP may remain structurally weak unless whale wallets see daily inflows above 5 million tokens, with a risk of a 30% price crash.

-

Whales have offloaded 640 million XRP tokens in the past month, valued at $1.91 billion.

-

Bearish divergence on the charts indicates weakening momentum for XRP.

-

Analysts suggest XRP must hold above $2.65 to avoid a significant price drop.

XRP faces potential structural weakness as whale distribution raises concerns about market momentum. Read more for insights and analysis.

| Whale Outflows | 640 million XRP | $1.91 billion |

What is the Current Situation of XRP?

XRP may face structural weakness due to significant whale sell-offs, with over 640 million tokens offloaded recently. Analysts warn that without daily inflows exceeding 5 million tokens, XRP’s price could drop significantly.

How Have Whales Affected XRP’s Price?

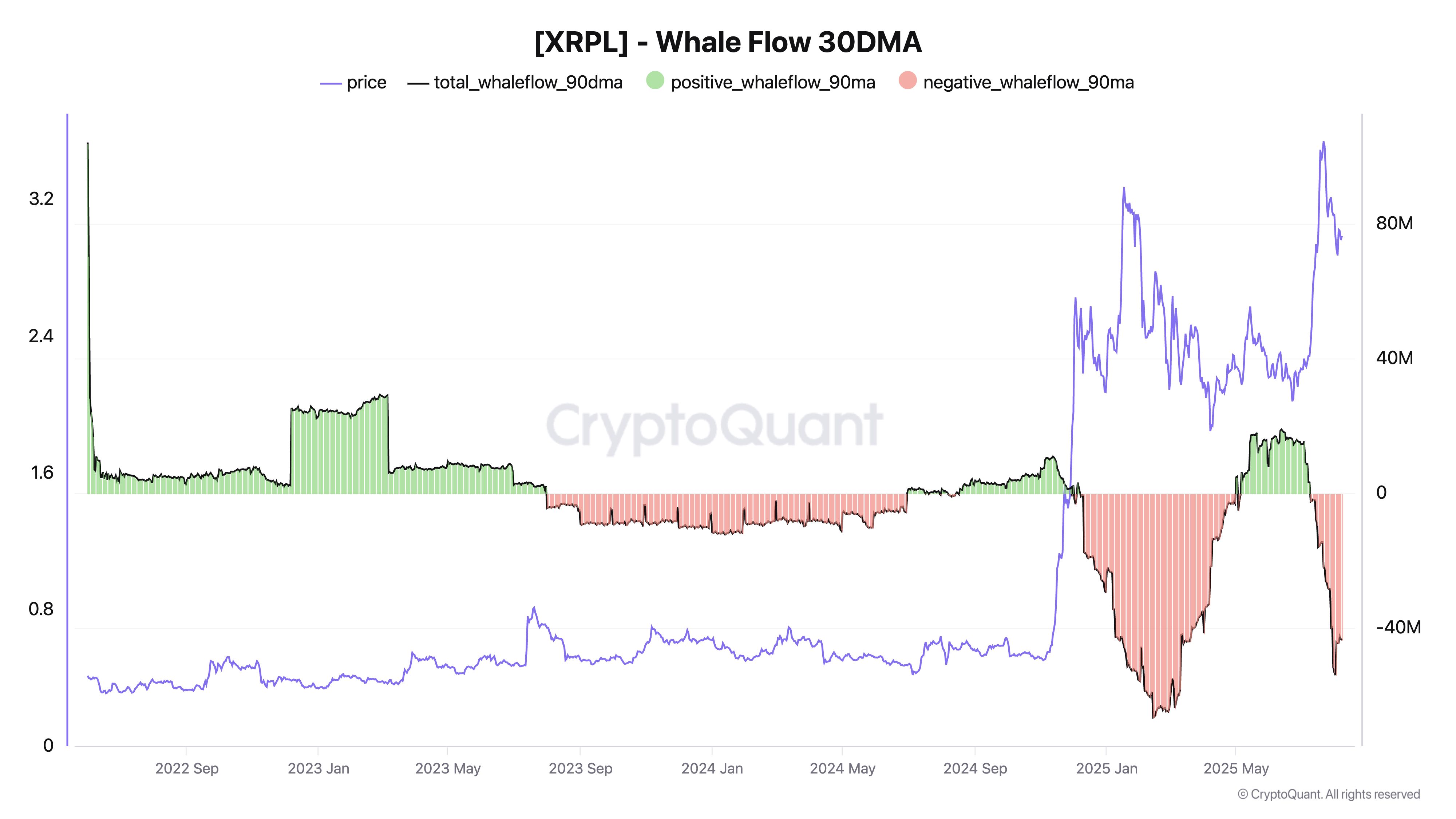

Since July 9, XRP whales have distributed approximately 640 million tokens, according to on-chain data from CryptoQuant. This distribution occurred while XRP traded between $2.28 and $3.54, indicating a potential risk for retail investors.

XRPL whale flow 90-day moving average. Source: CryptoQuant

XRPL whale flow 90-day moving average. Source: CryptoQuant

Despite these outflows, some may reflect internal reshuffling rather than outright selling. However, the trend suggests that large investors are accumulating during market corrections.

Why Must XRP Hold Above $2.65?

XRP must maintain above the $2.65 support level to avoid a potential crash towards $2. A bearish divergence between rising prices and declining momentum signals risks of a deeper price drop.

XRP/USD weekly price chart. Source: TradingView

XRP/USD weekly price chart. Source: TradingView

The current market dynamics show a weakening upside momentum, similar to patterns observed during previous market tops. Analysts suggest that a break below the $2.65 support could lead to a drop towards the 50-week EMA at $2.06.

Frequently Asked Questions

What are the implications of whale selling on XRP?

Whale selling can lead to increased volatility and price drops, as seen with XRP’s recent offloading of 640 million tokens, which raises concerns for retail investors.

How does XRP’s price movement relate to whale activity?

XRP’s price often reflects whale activity; significant sell-offs can indicate bearish trends, while accumulation during corrections may signal potential price recoveries.

Key Takeaways

- Whale Distribution: XRP whales have offloaded 640 million tokens, raising concerns about market stability.

- Price Support: XRP must hold above $2.65 to mitigate crash risks.

- Market Momentum: Bearish divergence suggests weakening momentum, indicating potential price corrections.

Conclusion

In summary, XRP’s market outlook remains precarious as whale distribution raises concerns about its price stability. Holding above the $2.65 support level is crucial for preventing a significant downturn. Investors should remain vigilant as market dynamics evolve.