HBAR Whales Accumulate Over 60 Million Tokens: Why the Price Still Isn’t Responding

Hedera’s HBAR token is up nearly 2% today, but the broader trend still looks shaky. Over the past week, HBAR has dropped close to 10%, and its overall structure continues to raise questions. Despite the Layer 1 network, designed for enterprise-grade applications, showing clear bullish patterns and heavy whale accumulation, the price hasn’t managed a … <a href="https://beincrypto.com/hbar-price-breakout-delay-whale-buying/">Continued</a>

Hedera’s HBAR token is up nearly 2% today, but the broader trend still looks shaky. Over the past week, HBAR has dropped close to 10%, and its overall structure continues to raise questions.

Despite the Layer 1 network, designed for enterprise-grade applications, showing clear bullish patterns and heavy whale accumulation, the price hasn’t managed a convincing move upward.

Whale Wallets Keep Growing, But HBAR Price Stalls

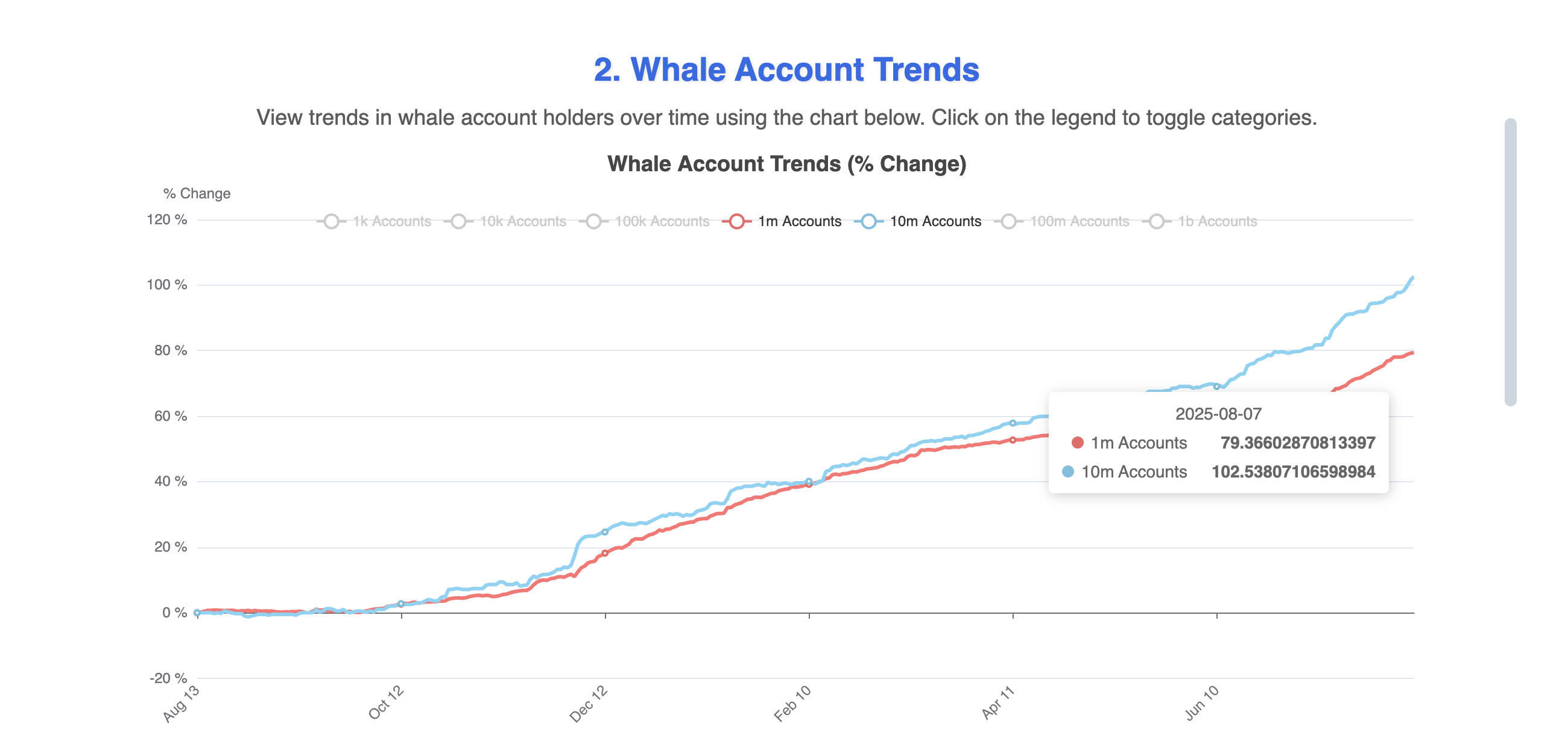

Over the last three weeks, whale wallets holding between 1 million and 10 million HBAR have steadily increased. From early August, these wallet cohorts jumped from 77 and 96 to 79 and 102, respectively. That alone represents a minimum of 62 million tokens soaked up from the circulating supply, assuming the lowest holding threshold per wallet.

HBAR whales accumulating:

HBAR whales accumulating

HBAR whales accumulating:

HBAR whales accumulating

At the same time, net exchange flows have stayed negative throughout August and even half of July. That typically indicates a supply crunch as tokens move off exchanges into self-custody wallets. However, the price hasn’t responded to this bullish behavior.

HBAR weekly netflows continue to be negative:

HBAR weekly netflows

HBAR weekly netflows continue to be negative:

HBAR weekly netflows

One possible reason? These outflows may be entirely whale-driven. In other words, whales may be rotating HBAR from exchanges into cold storage; accumulation, yes, but without fresh demand entering the market. No retail participation, no price lift.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Retail and Smart Money Still Not Convinced

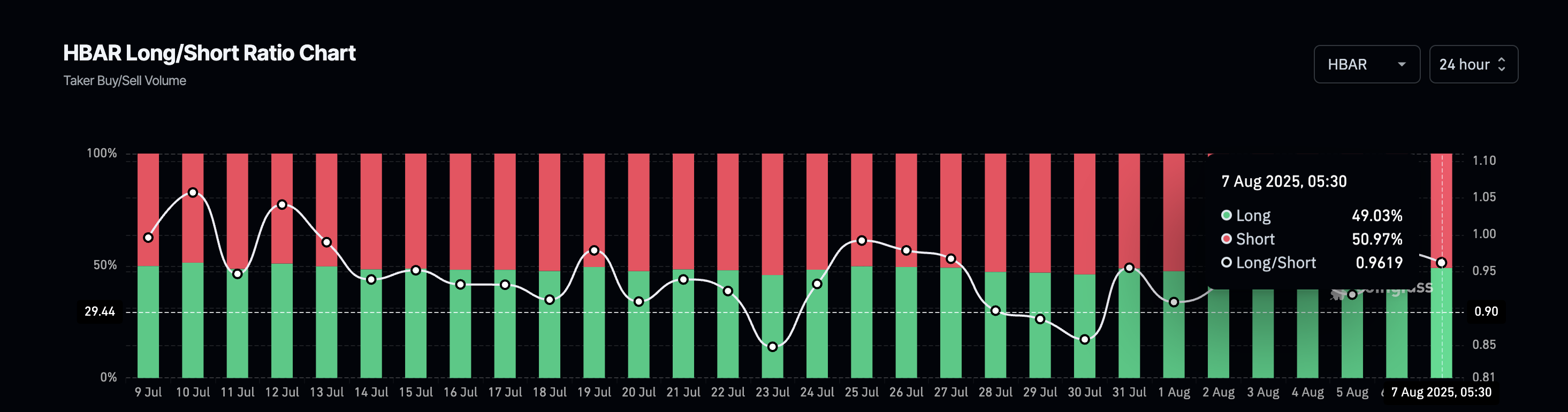

That theory checks out when looking at the broader sentiment. The long/short ratio shows that 50.97% of positions are still shorting HBAR. This short bias is minimal, but it still means the market is betting against the price moving up.

HBAR price bias is still Short:

HBAR price bias is still Short

HBAR price bias is still Short:

HBAR price bias is still Short

Without a clear rotation of traders flipping long or new buyers stepping in, HBAR continues to struggle for momentum. Even with bullish supply signals, the sentiment remains bearish. Until the short-side conviction breaks, retail may sit on the sidelines.

CMF Divergence Adds Pressure to the Ascending Triangle And The HBAR Price

Technically, the HBAR price is still holding above the ascending trendline visible on the 2-day chart. But there are cracks forming. The Chaikin Money Flow (CMF) indicator, which measures fund inflow momentum, has been printing lower highs even as price has attempted higher highs.

This divergence suggests fading buying strength, a red flag. And this aligns with the lack of retail and smart money participation.

HBAR price analysis:

HBAR price analysis

HBAR price analysis:

HBAR price analysis

If price fails to break above the $0.26 resistance zone, the pattern could lose steam. A move below $0.23 would invalidate the current structure, confirming that smart money isn’t pushing HBAR forward despite the whale-led accumulation.

However, if the upper trendline of the triangle is breached, followed by the HBAR price reclaiming $0.30, we could expect all the bearish sentiments to vanish in thin air. That would also ignite the possibility of a fresh HBAR price rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years