Ethereum Temporarily Surpasses Mastercard in Market Valuation

- Ethereum briefly surpassed Mastercard in market valuation, marking a notable crypto milestone.

- The event signals Ethereum’s growing financial influence.

- Potential implications for cryptocurrency and traditional finance sectors.

Ethereum briefly surpassed Mastercard in market capitalization, becoming the world’s 22nd largest asset according to recent data shared by prominent cryptocurrency figures on X.

This market cap surge underscores Ethereum’s growing financial presence and potential investor interest, highlighting its competition with traditional financial giants like Mastercard.

Ethereum Surpasses Mastercard

On August 10, 2025, Ethereum overtook Mastercard by market capitalization. This brief flip, captured by crypto influencer Crypto Rover, marks Ethereum as the 22nd largest asset globally at the time, verified through live market cap data.

Key players involved include Ethereum’s leadership and the crypto community. Vitalik Buterin, Ethereum co-founder, did not comment on the event, urging stakeholders to verify using real-time market data from top exchanges and trackers.

The market reaction to Ethereum’s milestone was significant. Increases in Ethereum’s price and trading volumes accompanied the news, although official figures from exchanges are necessary for exact data. Immediate effects spotlight cryptocurrency’s increasing role in global finance.

Financially, the flip highlights Ethereum’s market strength and growth potential. While no regulatory responses accompanied the event, it underscores possible shifts in market dynamics where cryptocurrencies challenge traditional equities. Crypto Rover highlighted this shift with a statement:

“Ethereum (ETH) has surpassed Mastercard by market capitalization, becoming the world’s 22nd largest asset as of August 10, 2025.”

Ethereum’s flip above Mastercard signifies a momentary strengthening of crypto assets. Historical precedents show such flips can influence investor sentiment and market trends, demanding ongoing analysis of long-term effects on financial markets.

Potential financial outcomes include increased interest and investment in Ethereum. Analysts anticipate continuing challenges for traditional finance as blockchain technology matures. Market data and historical examples illustrate both volatility and promise in the crypto-economy landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

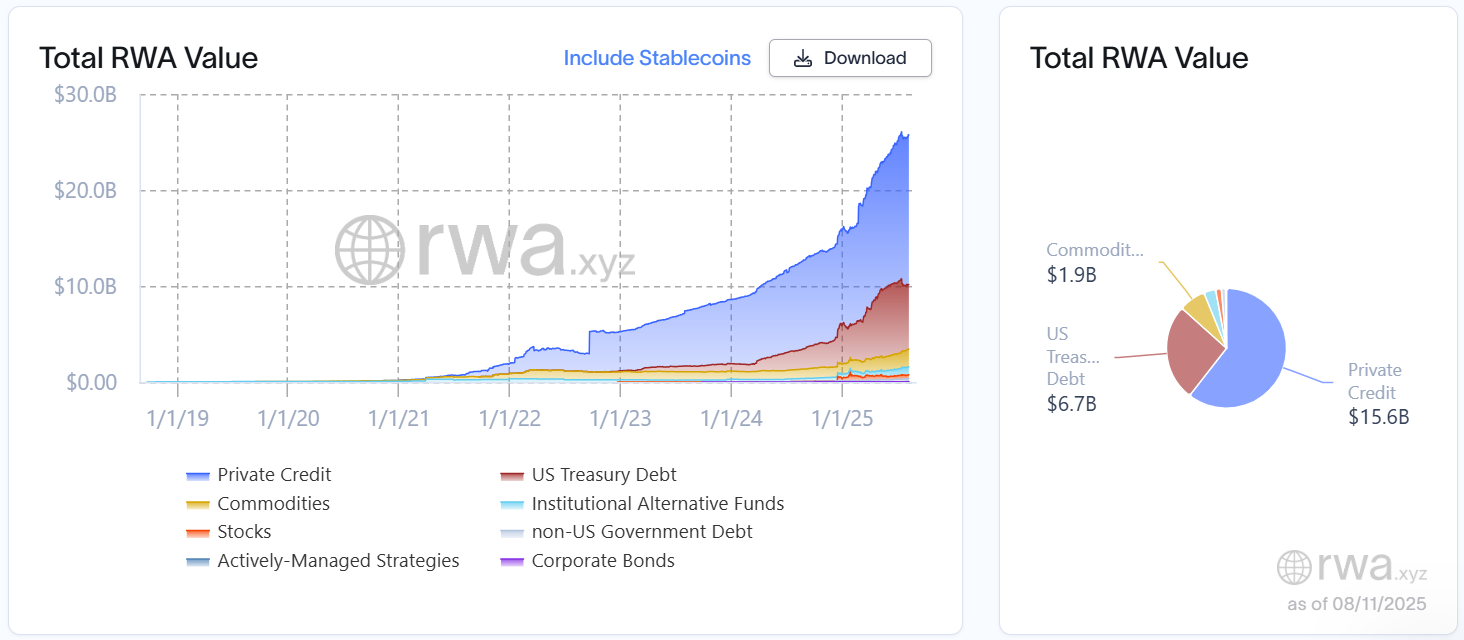

Chainlink Partners with ICE for Real-Time Market Data

Chainlink and ICE join forces to bring live FX and metals prices from 300+ global markets to blockchains.Why This Matters for Blockchain AdoptionThe Future of On-Chain Finance

ENS Token Transfer: Unpacking a Massive $4M Crypto Exchange Movement

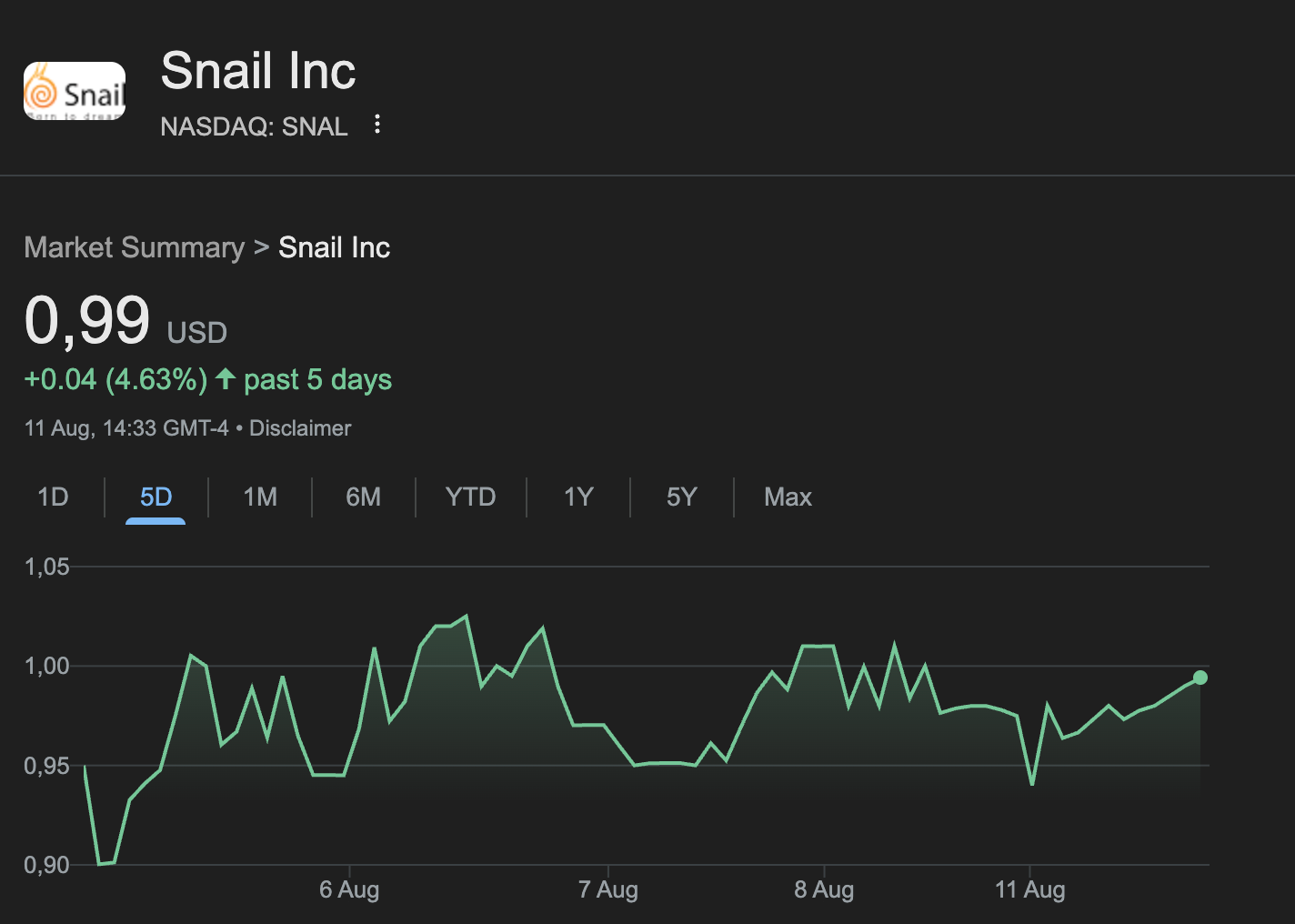

US Subsidiary of Early Chinese Game Dev Snail Digital Explores Stablecoin

GENIUS ban won’t stop institutions from seeking stablecoin yield — ex-Standard Chartered exec