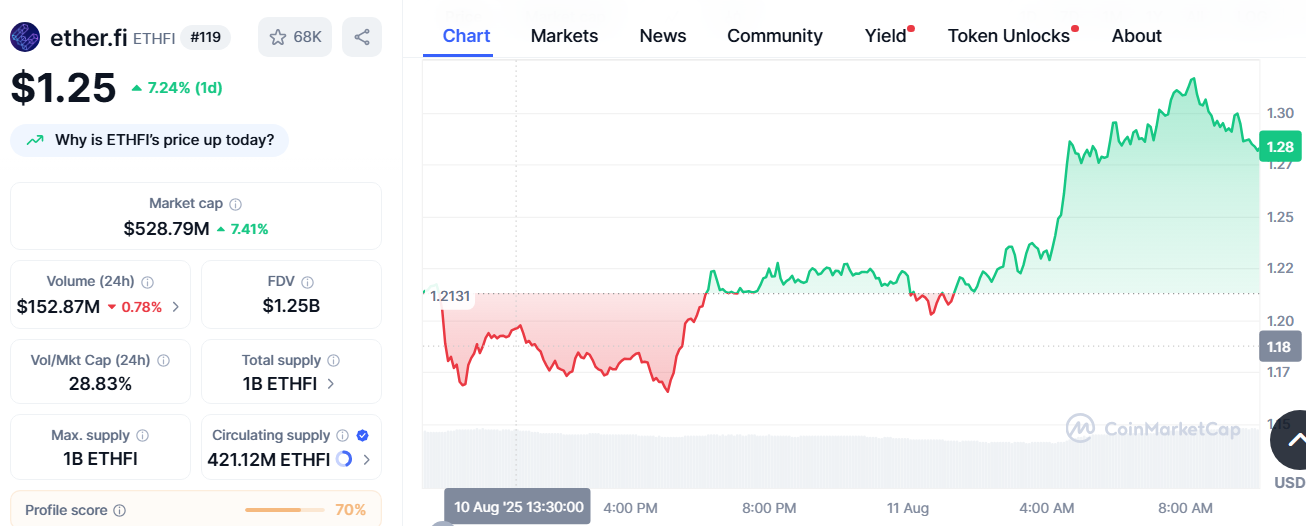

- ETHFI trades at $1.28 after a 6.21% daily gain, maintaining a bullish pennant formation since May.

- Stable volume and higher lows since April suggest building momentum toward a potential breakout with a $1.90 target.

- Circulating supply is 42.1% of the maximum, with a $156.69M daily volume and strong market participation.

Ether.Fi (ETHFI) has recently entered a critical technical phase after a prolonged consolidation within a bullish pennant pattern. The asset’s price behavior over the last several months shows consistent resistance and support converging into a tightening structure. This consolidation has formed a classic pennant, typically known for breakout potential.

Source: CoinMarketCap

Source: CoinMarketCap

ETHFI is currently trading at $1.25, up 7.24% in the last 24 hours, with strong market participation supporting the move. According to recent chart analysis, a confirmed breakout from this structure could yield a rally of over 50%, potentially pushing prices toward the $1.90 range. This expectation aligns with historical performance when similar formations have played out in other assets.

ETHFI Holds Bullish Pennant Formation Ahead of Key Breakout

The 17-hour ETHFI/USDT chart reveals a clearly defined bullish pennant. The price has oscillated within converging trendlines for over three months, starting from May through early August. Notably, the asset recently tested the upper resistance trendline and has begun moving upward again, suggesting growing bullish pressure. The projected target after a breakout, based on the height of the pennant’s pole, places the potential price level at approximately $1.90.

During this consolidation period, volume remained relatively stable, a characteristic often seen before major breakouts. Price is now pressing against key resistance, with a breakout target set at a 1.535-point move, translating to 113.93% from the consolidation low. The upward structure remains intact, with higher lows forming consistently since April.

ETHFI Trading Activity Rises as Circulating Supply Reaches 42.1%

Supporting this technical outlook, current market data shows a daily volume of $156.69 million, reflecting a 2.3% increase. The market cap stands at $541.7 million, while the fully diluted valuation (FDV) is $1.28 billion. ETHFI’s volume-to-market cap ratio of 28.83% highlights active trading and investor interest.

Additionally, the token’s circulating supply is 421.12 million ETHFI out of a maximum 1 billion. This represents 42.1% of the total supply now circulating, providing a moderate supply inflation environment. The combination of growing trading interest and stable tokenomics supports the ongoing move toward the top of the pattern.

ETHFI Rebounds Sharply, Nears Key Pennant Resistance

Over the past 24 hours , ETHFI has experienced a sharp price recovery from the $1.22 level to $1.28. This intraday surge confirms the asset’s strong buying interest and growing momentum. If this buying pressure continues, the chart pattern indicates a potential continuation move toward higher levels.

The recent price increase has now brought ETHFI closer to a major resistance level that coincides with the upper trendline of the pennant. A breakout above this level would validate the bullish setup and activate the measured move target, which projects a significant price expansion.