Bloomberg: Canton Allows Financial Giants to Conduct Repo Transactions Outside Regular Trading Hours

According to a report by Jinse Finance, unlike traditional Wall Street trading methods, some financial giants conducted U.S. Treasury transactions as digital dollars on a crypto blockchain this Saturday. The transaction was executed via Tradeweb on the Canton Network, signaling that future trading may no longer be limited to the standard workweek. The public blockchain Canton, developed by Digital Asset Holdings, served as the bridge for these transactions, enabling standard U.S. Treasury repurchase agreements (or repos) to be carried out outside of regular trading hours. This on-chain transaction connects traditional asset classes with the round-the-clock operation of cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

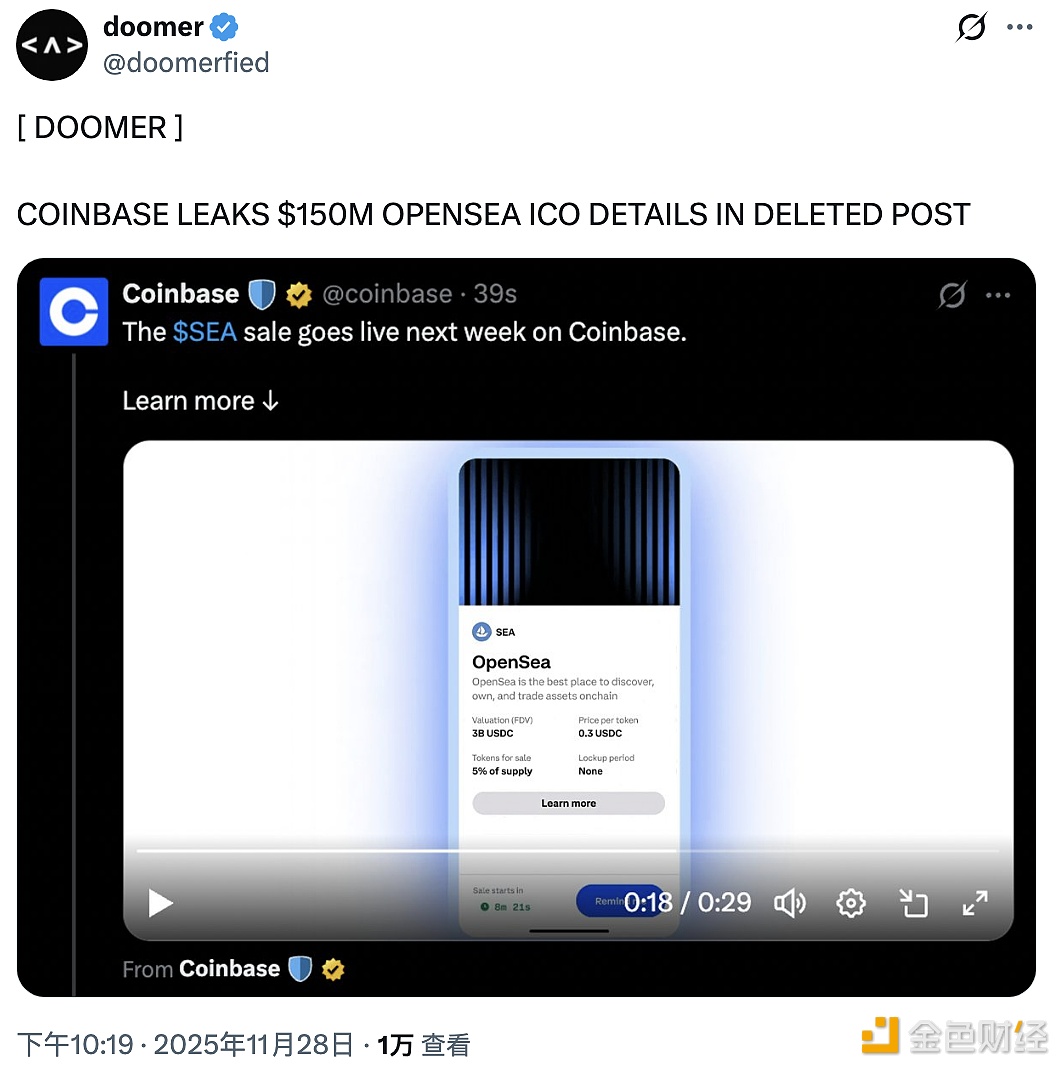

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.