BCH Price Holds Steady During Market Slide — What Next for Bitcoin Cash?

Bitcoin Cash holds firm amid market sell-off, with a key liquidity zone at $603 potentially triggering more upside.

Bitcoin Cash has defied the broader crypto market downturn of the past 24 hours to record a modest 3% gain.

The move marks a continuation of BCH’s recent rally, which began on August 3. Trading at $590.30 at press time, the altcoin’s price has since soared 14% and is poised to keep increasing.

BCH Defies Bears; Key Liquidity Zone Could Unlock Fresh Upside

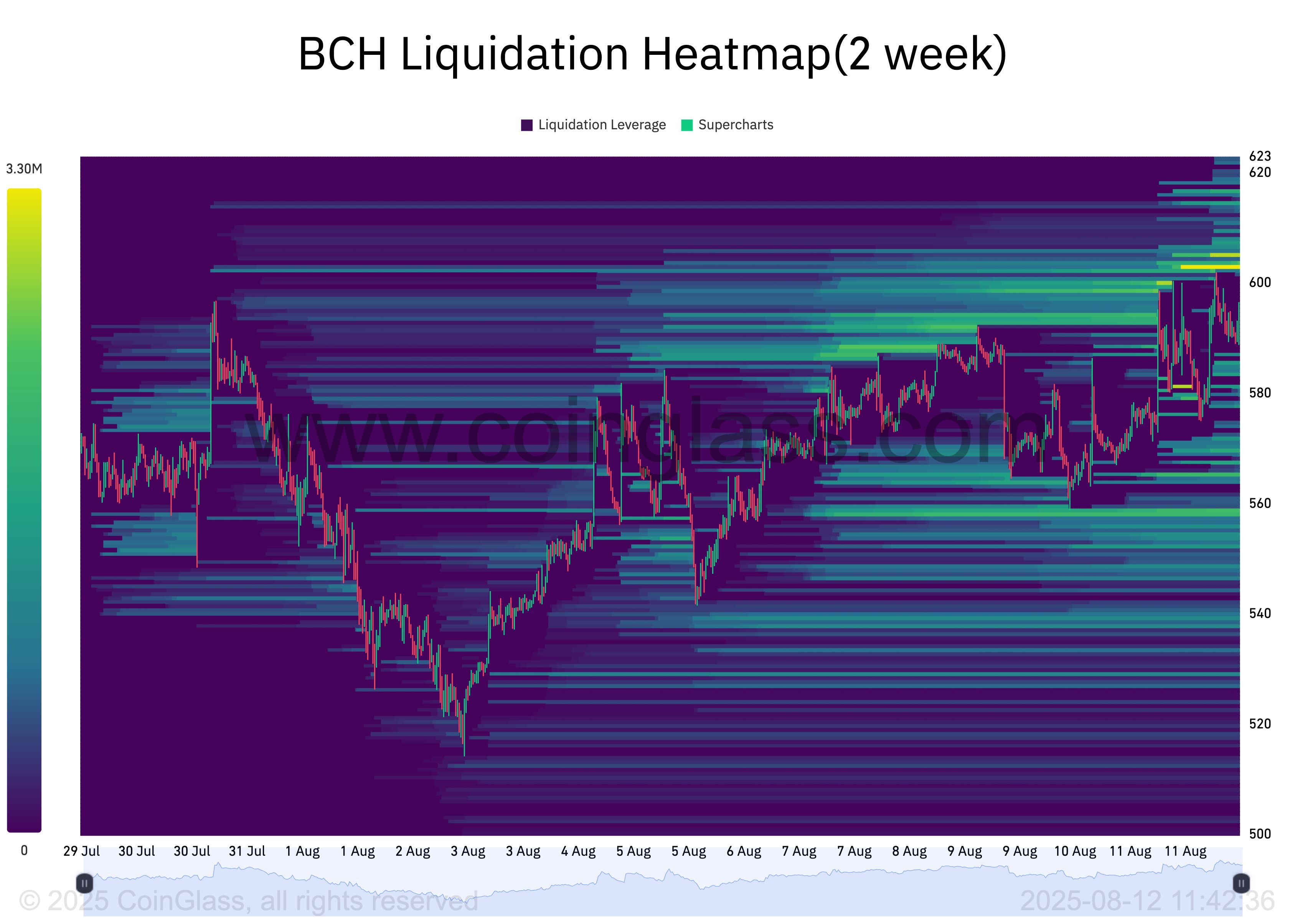

An assessment of BCH’s liquidation heatmap has revealed a concentration of liquidity at the $603 price zone.

BCH Liquidation Heatmap. Source:

BCH Liquidation Heatmap. Source:

A liquidation heatmap tracks clusters of leveraged positions in the market and highlights where large amounts of open interest could be triggered into buying or selling if the price reaches those levels. These areas of high liquidity are often color-coded to show intensity, with brighter zones representing larger liquidation potential.

When liquidity is concentrated above an asset’s current price, it indicates a potential “magnet” effect, where traders push the price upward to trigger liquidations and unlock that liquidity.

For BCH, the $603 zone could act as such a target, fueling further upside if bullish momentum persists.

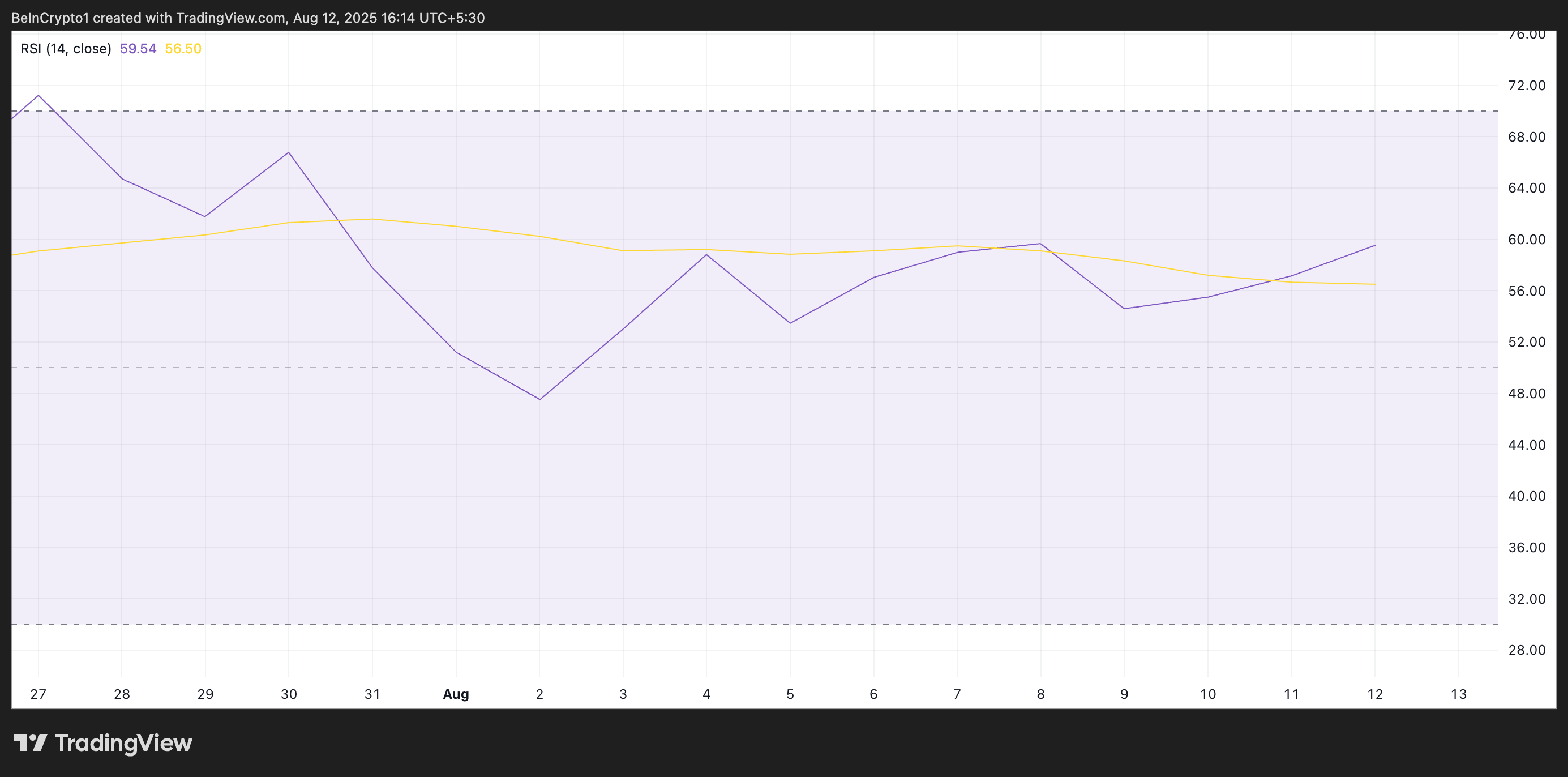

Further, BCH’s climbing Relative Strength Index (RSI), which stands at 59.54 at press time, confirms this bullish outlook.

BCH RSI. Source:

BCH RSI. Source:

The RSI measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and could be due for a price correction, while values under 30 indicate that the asset is oversold and may be primed for a rebound.

At 59.54 and rising, BCH’s RSI reflects strengthening bullish momentum. If it remains below the overbought threshold of 70, a sustained RSI uptrend with improving market sentiment would allow BCH’s price to see further upside.

Bitcoin Cash Poised for Breakout

Sustained buy-side pressure could push BCH’s price above the psychological $600 mark. If the altcoin establishes strong support near this price level, it could extend its rally toward $602.20.

BCH Price Analysis. Source:

BCH Price Analysis. Source:

However, if profit-taking resumes, BCH eyes a decline to $556.40.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terra Luna Classic Shakes the Crypto Market with Surprising Developments

In Brief LUNC experienced a significant price decline following Do Kwon's sentencing. The court cited over $40 billion losses as a reason for Do Kwon's penalty. Analysts suggest short-term pressure on LUNC may persist, despite long-term community support.

NYDIG: Tokenized Assets Offer Modest Crypto Gains as Growth Depends on Access and Regulation

Cardano Investors Split As Market Fatigue Sets In