Willy Woo Sells His Bitcoin Stash, Says BTC Flashing 2013-Style Bearish Divergences

Analyst Willy Woo says he has exited his Bitcoin position and is warning that BTC is flashing similar 2013 bearish divergence signals.

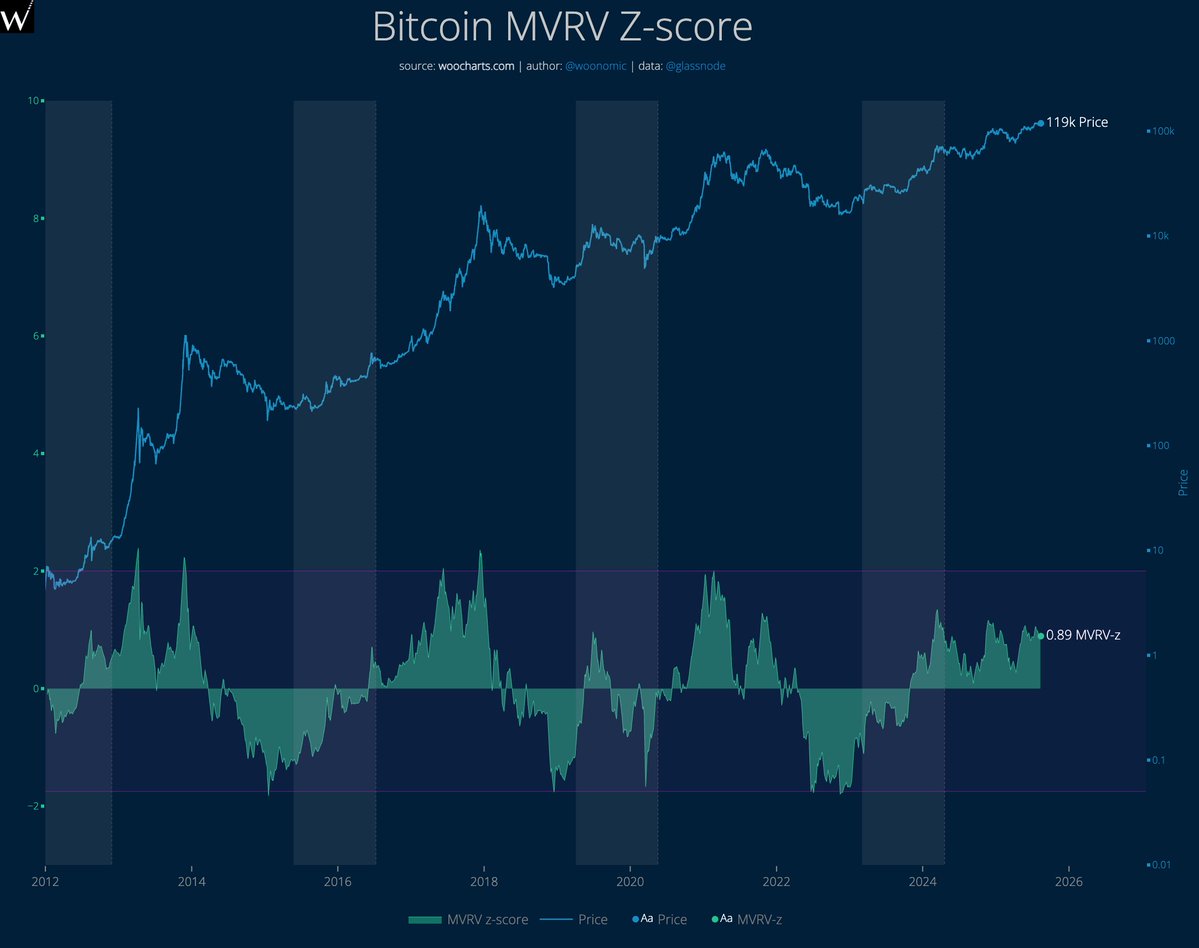

Woo tells his 1.2 million followers on the social media platform X that Bitcoin’s market value to realized value (MVRV) Z-score is signaling a possible downtrend .

The MVRV Z-score metric compares the market cap of BTC to the value of each coin the last time it was moved to gauge whether Bitcoin is undervalued, overvalued, or at fair value.

“MVRV tracks how BTC is valued vs the capital that’s been invested. We like to ask ‘what’s different this cycle?’ Let me ask you. What did you see change in each past cycle, what’s different this cycle?…

We’re seeing more bearish divergences for sure. Unseen since 2013’s double top.”

Source: Willy Woo/X

Source: Willy Woo/X

A bearish divergence with the MVRV Z-score occurs when the price of Bitcoin makes higher highs, but the MVRV Z-score makes lower highs.

Woo also responded to one X user who asked why he sold his BTC.

Says Woo,

“It was a rotation to higher up the risk curve to support the picks and shovels behind BTC. I’ll talk more about it in some podcasts that got recorded, mostly it’s personal to my situation and not about exiting Bitcoin.”

Lastly, Woo says that Bitcoin’s market is currently being driven largely by investments from high-net-worth individuals (HNWIs), a stark difference from previous market cycles.

“[Retail traders] are there. Just 10x deemphasized. What moves price now are the large pools of capital inside the $900 trillion buckets of wealth assets. We are in a whale phase of HNWIs. Future flows will be retail money, but managed by gatekeepers: sovereigns and pension funds.”

Bitcoin is trading for $119,664 at time of writing, down marginally in the last 24 hours.

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jito Foundation Returns to US: A Hopeful Signal for Crypto’s Regulatory Future

Revolutionary XRP Algorithmic Trading Service Launches for Accredited Investors