Ethereum Outperforms Bitcoin as Analysts Signal Early Altseason Shift

Recent market data suggests the cryptocurrency sector may be entering the early stages of altseason, with Ethereum leading the charge against Bitcoin.

Recent market data suggests the cryptocurrency sector may be entering the early stages of altseason, with Ethereum leading the charge against Bitcoin.

Ethereum (ETH) is trading at $4,502.81, up 4.6% in the past 24 hours and more than 40% over the last month. The ETH/BTC ratio has climbed for five consecutive days to 0.037, marking its strongest run since early 2024. Technical indicators show momentum building, with ETH’s MACD firmly bullish and its RSI nearing overbought levels.

Analysts point to a confirmed breakdown in the BTC/ETH technical setup — a pattern that in past cycles has preceded capital rotation from Bitcoin into Ethereum, and subsequently into other large- and mid-cap altcoins. Bitcoin dominance is slipping, and Ethereum’s bullish crossover on the MACD aligns with historical triggers for broad altcoin rallies.

Altseason is knocking, but the door isn’t wide open yet. ETH leading the charge with a strong ETH/BTC breakout, bullish MACD, and rising institutional flows hints at the early stages, but the classic confirmation needs BTC dominance <60% and broader alt surge.

Sentiment is…

— Alva (@AlvaApp) August 12, 2025

Institutional demand is adding fuel to the trend, with recent Ethereum purchases totaling around $19 million. Social sentiment is also turning sharply positive, with discussions on X (formerly Twitter) centred on Ethereum’s role in decentralized finance and expectations of a larger market move.

The Altcoin Season Index still shows Bitcoin in control, but analysts say sentiment is shifting. Key confirmation signals would include ETH/BTC holding above 0.035–0.036 and Bitcoin dominance dropping below 60%.

While Bitcoin remains near record highs at $119,831.96, its slower growth rate compared to Ethereum is prompting some traders to rotate into higher-beta altcoins. Rising market cap and open interest for ETH indicate growing investor conviction.

Market strategists describe the current environment as a prelude to altseason — with Ethereum’s surge setting the stage for potential large-scale altcoin gains if liquidity and technical conditions continue to align.

CoinGecko’s data confirms ETH is currently outperforming BTC by 4.4%. Peter Thoc, founder of House of Crypto, describes the current setup as a “perfect asymmetry window,” where small, high-risk allocations could produce outsized returns. Market strategists see Ethereum’s surge as the likely precursor to wider altcoin gains if liquidity and technical conditions continue to align.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter , LinkedIn , Facebook , Instagram , and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

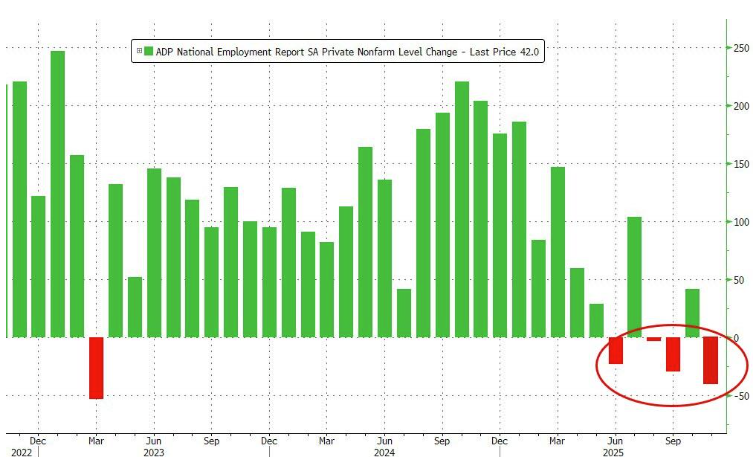

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.