Pantera Capital invests $300M in crypto treasury companies

Pantera Capital disclosed it has invested over $300 million in digital asset treasury (DAT) companies, a growing category of public firms holding crypto reserves on their balance sheets.

The firm’s thesis is that DATs can grow net asset value per share by generating yield, potentially offering higher returns than holding tokens directly or via ETFs.

Pantera has launched two DAT-specific funds, raising over $100 million combined, though a third fund has not yet been decided.

Its DAT portfolio spans Bitcoin (CRYPTO:BTC), Ethereum (CRYPTO:ETH), Solana (CRYPTO:SOL), BNB (CRYPTO:BNB), Toncoin (CRYPTO:TON), Hyperliquid ((CRYPTO:HYPE), Sui (CRYPTO:SUI), and Ethena (CRYPTO:ENA), with companies based in the US, UK, and Israel.

Portfolio companies include BitMine Immersion, Twenty One Capital, DeFi Development Corp, SharpLink Gaming, Satsuma Technology, Verb Technology, CEA Industries, and Mill City Ventures III.

BitMine Immersion was highlighted as the largest Ethereum treasury and the third-largest DAT globally, holding 1.15 million ETH worth $4.9 billion as of Aug. 10.

BitMine grew ETH per share by 330% in its first month, outpacing MicroStrategy’s early Bitcoin growth rate, aided by stock issuance above NAV and staking rewards.

Its share price surged from $4.27 at the end of June to $51 in just over a month, with 60% of the gain from ETH-per-share growth, 20% from ETH’s price rally, and 20% from a NAV multiple expansion to 1.7x.

Pantera likened strong DATs to top banks trading at a premium to book value, citing JPMorgan’s >2x multiple as an example.

At the time of reporting, Bitcoin price was $119,369.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

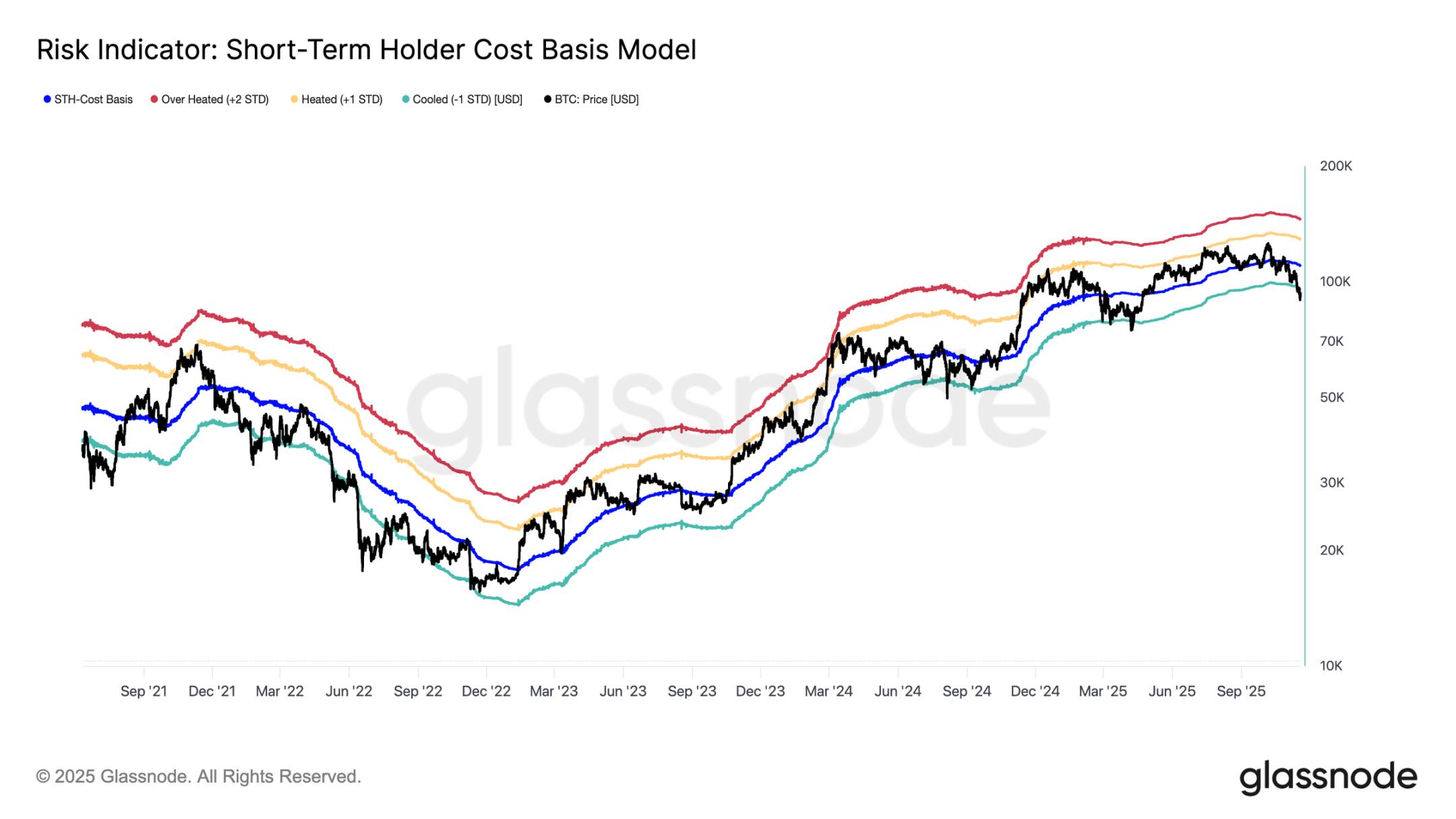

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin