Stellar Sets New Records in August—Is Now the Time to Watch XLM Price?

In August 2025, Stellar (XLM) broke records in TVL, user adoption, and exchange supply. These milestones highlight both growth potential and looming market risks.

In August 2025, Stellar (XLM), one of the blockchain industry’s earliest platforms focusing on cross-border payments and financial inclusion, set several records.

What are those records, and what do they mean for XLM price? This article breaks them down in detail.

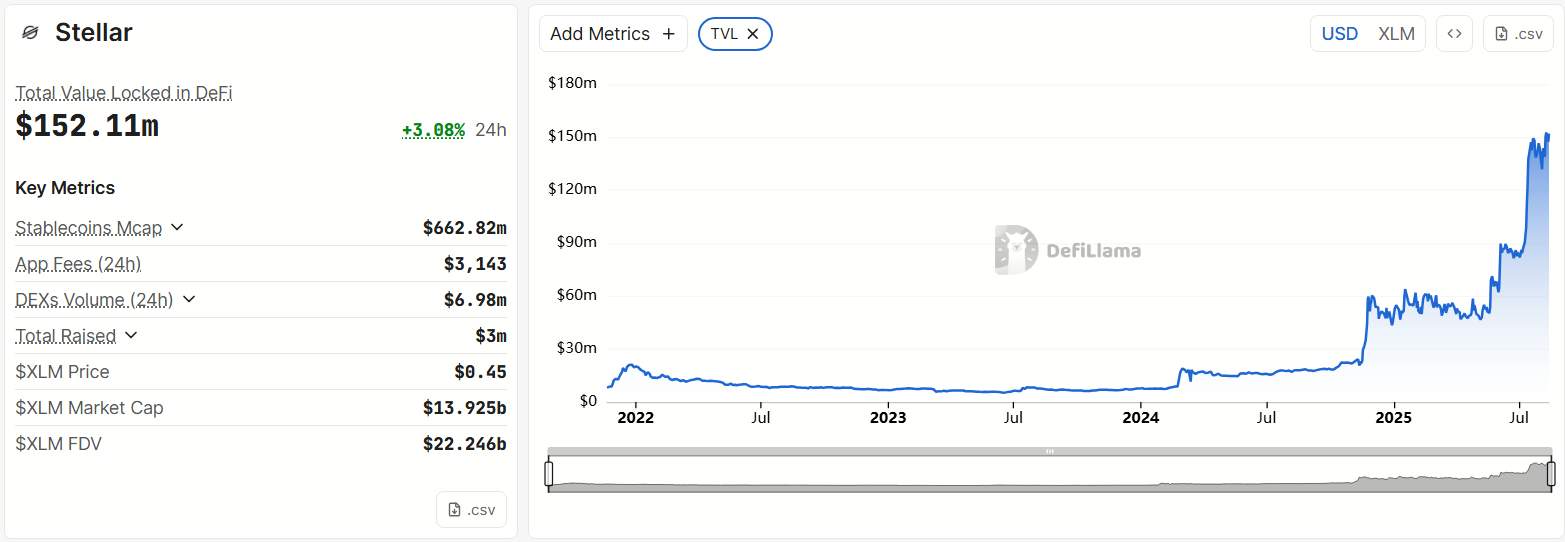

1. Stellar’s Total Value Locked Reached an All-Time High

The first record is Stellar’s Total Value Locked (TVL), which hit an all-time high (ATH) of $152.11 million.

Data from DeFiLlama shows Stellar’s TVL surged from $84 million in July to over $150 million in August—an increase of over 80%.

Stellar’s Total Value Locked. Source:

Stellar

Stellar’s Total Value Locked. Source:

Stellar

Major contributors to this growth include protocols like Blend, Stellar DEX, and Aquarius Stellar. Blend is a modular liquidity protocol that allows anyone to create flexible lending markets. Stellar DEX and Aquarius Stellar are emerging decentralized exchanges on the Stellar network, attracting fresh capital inflows.

While the number is still modest compared to DeFi protocols with billions in TVL, it represents an impressive rise. It reflects growing interest in Stellar’s ecosystem within the DeFi sector.

“Stellar TVL is skyrocketing. If you’re involved in Stellar DeFi before it hits $1 billion in TVL, you’re a legend,” an XLM investor commented.

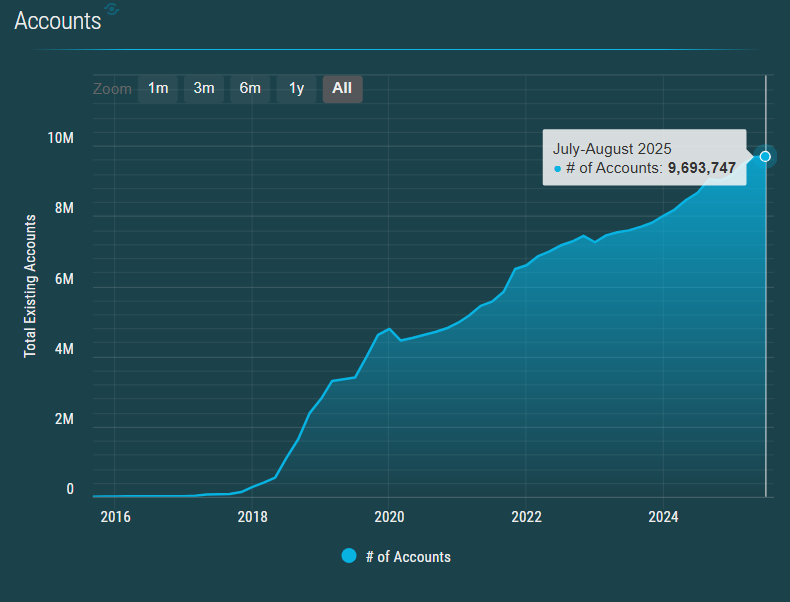

2. XLM Accounts Hit an All-Time High

The second record is the number of XLM accounts reaching a new peak of over 9.69 million.

Data from Stellar Expert indicates the network has expanded significantly. Despite major market ups and downs since 2016, Stellar continues demonstrating wide adoption.

Number of accounts on Stellar. Source:

stellar.expert

Number of accounts on Stellar. Source:

stellar.expert

Additional data from Artemis shows that around 5,000–6,000 new addresses are created daily, adding to the growing account base.

A recent BeInCrypto report notes that XLM has a strong correlation with XRP. The investor base of these two altcoins overlaps considerably. As a result, XRP’s boom in 2025 has also helped attract new users to XLM.

This record is important to Stellar’s mission. It shows the platform is on track toward democratizing finance, with millions of new users joining to transfer money, store value, or participate in DeFi.

However, the rapid increase in accounts challenges the network to improve scalability to avoid congestion — especially if transaction volume spikes.

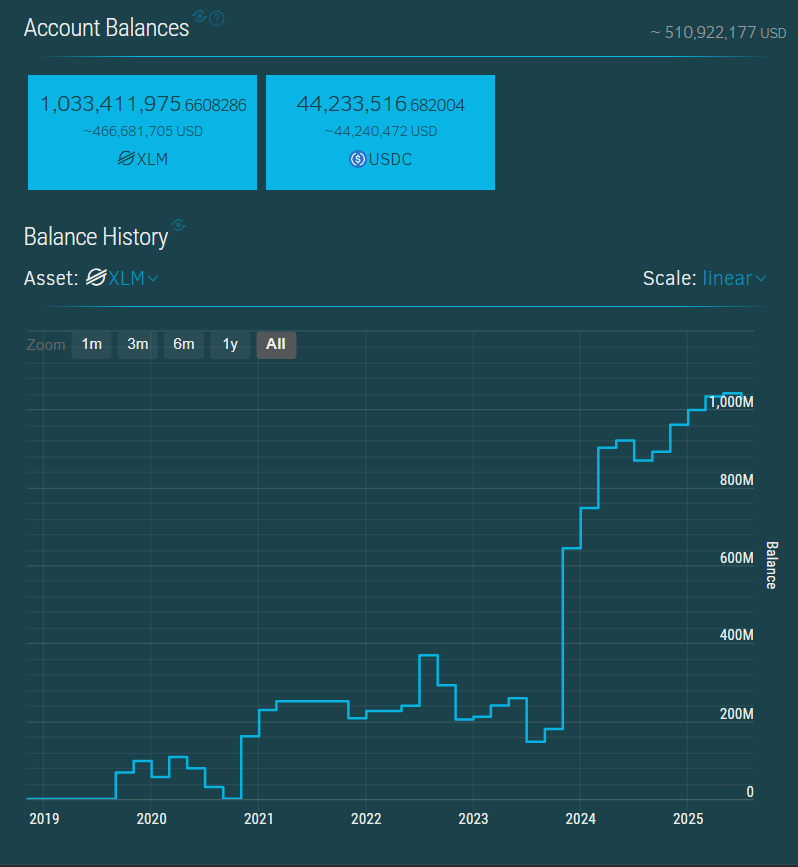

3. XLM on Exchanges Hit a Record High in August

Not all records are positive. The third record is the amount of XLM on exchanges reaching an all-time high, with over 1.03 billion XLM ready for sale.

Binance’s Proof of Reserves report publicly disclosed its XLM wallet address as “GBAI…GPA.” According to Stellar Expert, the balance of this address spiked from 2024 to 2025, peaking at 1,033,411,975 XLM in July–August 2025.

XLM Reserve on Binance. Source:

Stellar.expert

XLM Reserve on Binance. Source:

Stellar.expert

“XLM supply on exchanges at all-time high — 1.03 billion ready to sell. Should we be worried?” Steph Is Crypto commented on X.

This record serves as a warning. A large supply of XLM on exchanges could trigger sell-offs, especially if the market faces turbulence or negative news.

In this context, Stellar’s Protocol 23 upgrade plays a crucial role. According to an announcement on X, the schedule includes a testnet reset on August 14 and a mainnet upgrade vote on September 3.

Protocol 23 is expected to deliver significant performance improvements, lower costs, and expand the capabilities of the Stellar blockchain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.