Solana Reclaims $200: Surge in New Buyers Signals More Upside After 21% Jump

Solana surges 21%, reclaiming $200. With rising demand, SOL could target $219, but a drop below $195.55 risks a reversal.

Solana has surged 21% over the past seven days, pushing its price back above the $200 mark. This marks a significant recovery for the token, as it signals renewed investor confidence.

As bullish momentum builds across the market, technical indicators on the daily chart suggest that SOL is likely to maintain its position above this key price level.

New Buyers Fuel Solana Rally

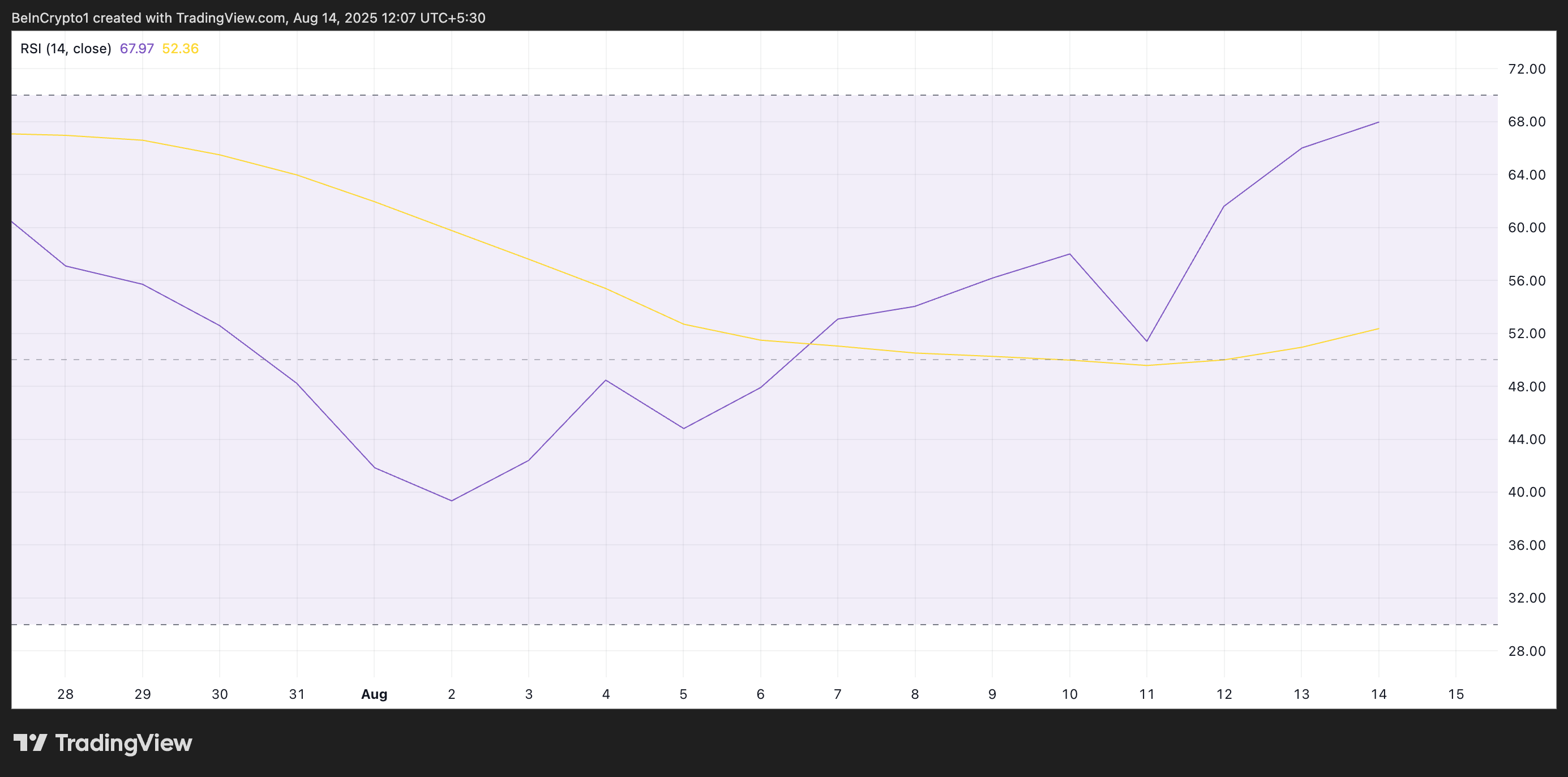

Readings from SOL’s Relative Strength Index (RSI) on the daily chart confirm the likelihood of further price rallies. At press time, this stands at 67.97, pointing to additional room for growth.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

SOL RSI. Source:

TradingView

SOL RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 67.97, SOL’s RSI suggests the token still has room to grow, indicating that bullish momentum remains intact. The steadily rising RSI signals that buyers are increasingly confident, and can push SOL’s price higher before buyer exhaustion sets in.

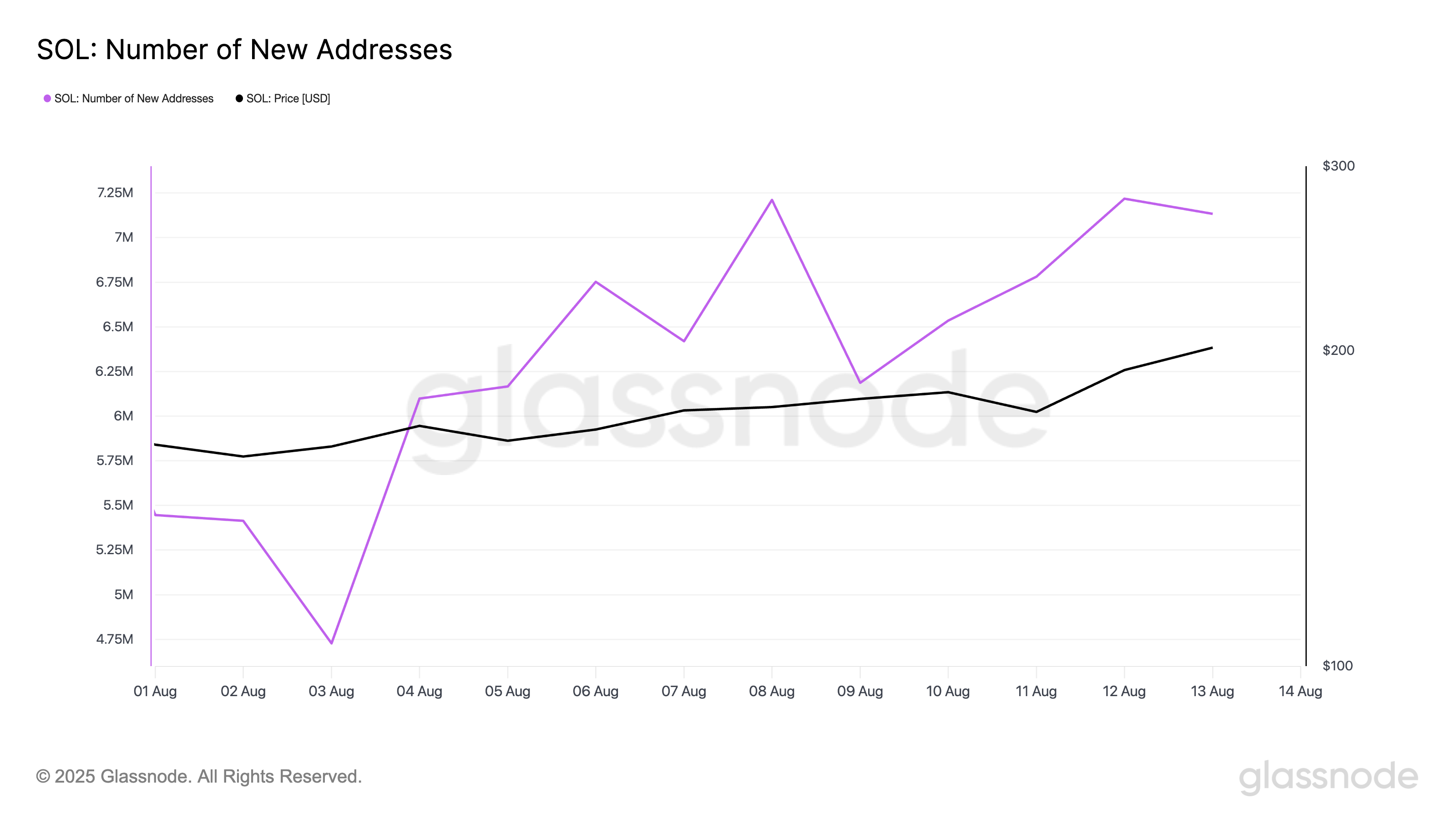

Meanwhile, new demand for SOL has seen a notable uptick over the past 14 days. According to Glassnode, the number of new addresses participating in SOL transactions for the first time has surged by 51% since August 3.

SOL Number of New Addresses. Source:

Glassnode

SOL Number of New Addresses. Source:

Glassnode

An increase in new demand like this suggests that fresh capital is entering this market, reflecting growing investor interest and confidence. This inflow of new participants can help sustain SOL price momentum and support further upward movement.

SOL Eyes $219 as Demand Strengthens Support Above $195

As of this writing, SOL trades at $207.17, comfortably above the support floor at $195.55. Rising demand may strengthen this key support level, which could help propel SOL toward the next resistance at $219.21.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, an uptick in profit-taking could invalidate the bullish outlook. Should selling pressure intensify, SOL may retest the $195.55 support level, and a failure to hold it could see the coin retreat to $171.88.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.

The reason behind the global risk asset "Tuesday rebound": a "major change" at asset management giant Vanguard Group

This conservative giant, which had previously firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to its 8 million clients.