Google Acquires 8% Stake in TeraWulf

- Google acquires an 8% stake in TeraWulf. Market reactions follow.

- Significant share surge for TeraWulf.

- Institutional backing highlights Bitcoin mining sector.

TeraWulf shares soared nearly 48% after Alphabet Inc.’s Google acquired an 8% stake, committing to a $3.7 billion, 10-year data center project.

Google’s investment highlights institutional confidence in TeraWulf’s AI-infrastructure expansion, triggering notable stock market activity and potential impacts on related cryptocurrency assets.

The announcement that Google has secured an 8% equity stake in TeraWulf led to a significant stock surge. The agreement involves a substantial financial commitment for expanding data and AI hosting infrastructure .

Key companies involved include TeraWulf, an environmentally-focused bitcoin miner, and Google, serving as the financial and strategic partner in this expansion. This agreement involves warrant-based ownership of approximately 41 million shares.

In the immediate aftermath, TeraWulf’s stock price increased notably, indicating a positive market response to Google’s involvement. The strategic emphasis on high-performance computing and AI hosting is central to the collaboration.

Financially, TeraWulf stands to gain $3.7 billion over 10 years, with Google backing $1.8 billion in lease payments. This arrangement lowers capital risk, benefiting all parties involved, including Fluidstack, the AI cloud platform.

The agreement signifies a robust move toward blending AI and cryptocurrency mining infrastructure, potentially setting precedents for future industry collaborations. It may encourage increased institutional interest in crypto-related ventures.

Experts cite historical tech-industry partnerships, noting the parallels to previous investments in digital infrastructure. Google’s stake in TeraWulf provides a validation boost for the wider Bitcoin mining sector.

Paul Prager, Chief Executive Officer of TeraWulf, commented, “This is a defining moment for TeraWulf. We are proud to unite world-class capital and compute partners to deliver the next generation of AI infrastructure, powered by low-cost, predominantly zero-carbon energy….”

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can you receive a Polymarket airdrop by using AI agents to execute end-of-day strategies?

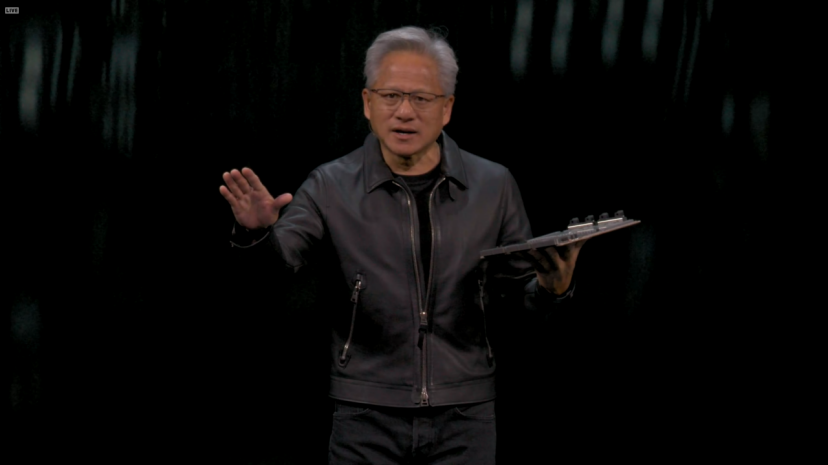

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.