Solana (SOL) is currently holding crucial support at $185, which analysts believe is vital for a potential rally toward $360, supported by strong liquidity and ETF developments.

-

Key support levels are identified between $185 and $188, crucial for upward momentum.

-

Solana has formed an ascending triangle pattern since April, with resistance near $210 and significant market liquidity.

-

Recent developments include $30 million in short liquidations and positive ETF progress, enhancing Solana’s bullish outlook.

Stay informed on Solana’s price movements and potential rally opportunities as analysts predict a rise toward $360. Join the conversation today!

What is Solana’s Current Price Outlook?

Solana (SOL) is currently experiencing a steady uptrend, maintaining crucial support levels. Analysts suggest that the asset may present a final buy-the-dip opportunity before advancing toward $360, driven by strong liquidity and market conditions.

How Does Solana’s Price Structure Look?

According to an analysis prepared by Ali Charts, Solana has maintained an ascending triangle pattern since April, forming higher lows while testing a resistance level near $210. Fibonacci retracement levels indicate support zones at $178, $151, and $139, with the latest rally starting around $175.

Frequently Asked Questions

What are the key support levels for Solana?

The key support levels for Solana are identified between $185 and $188, which analysts consider essential for a potential price rally.

How can I invest in Solana?

Investing in Solana can be done through various cryptocurrency exchanges. Ensure to conduct thorough research and consider market conditions before investing.

Key Takeaways

- Support Levels: $185–$188 is crucial for upward momentum.

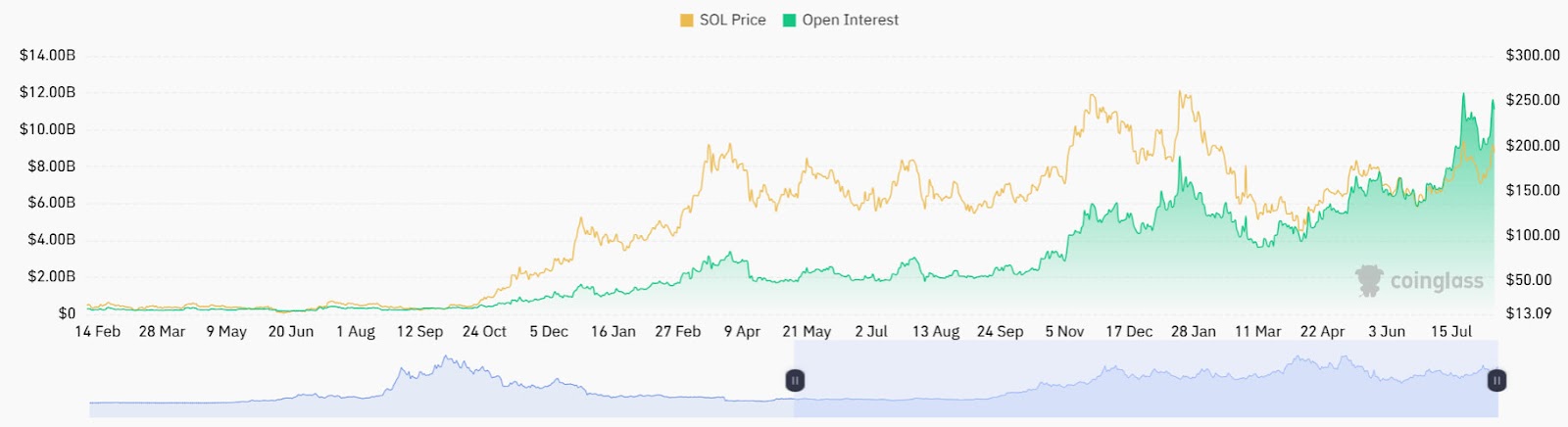

- Market Activity: Open interest data shows a steady rise, indicating strong market engagement.

- ETF Developments: Progress in Solana ETFs could attract institutional investment, enhancing price potential.

Conclusion

In summary, Solana’s price outlook remains positive, with key support levels at $185–$188. Analysts anticipate a potential rally toward $360, driven by strong liquidity and ETF developments. Stay updated on market trends to make informed investment decisions.

Source: CryptoVIPSignal

Source: CryptoVIPSignal

Source: Coinglass

Source: Coinglass