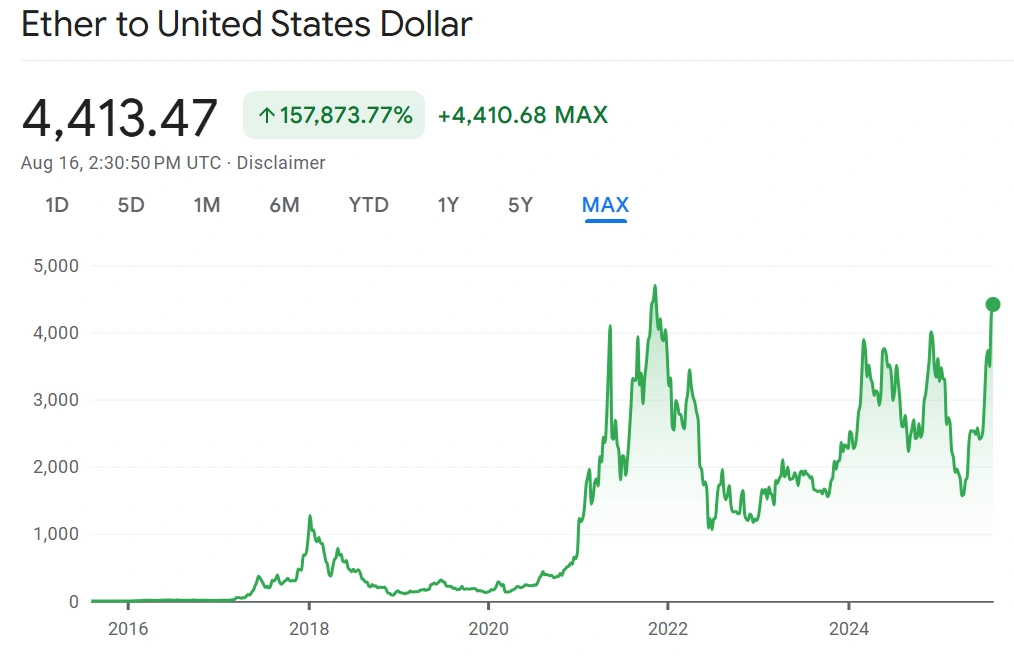

The recent rally around Ethereum is pushing its token price towards its all-time high from before the 2022 market crash. And that momentum is backed by the total value locked in decentralized finance (DeFi) across Ethereum, which is also moving toward a level not recorded since the peak of the last cycle.

Recent weeks have seen ETH move aggressively toward the record $4,800 level set in November 2021. The token is currently valued at $4,405 at the time of writing. It has gained more than 40% over the past month, outpacing much of the crypto market, including Bitcoin , and bringing about renewed speculation about price discovery ahead.

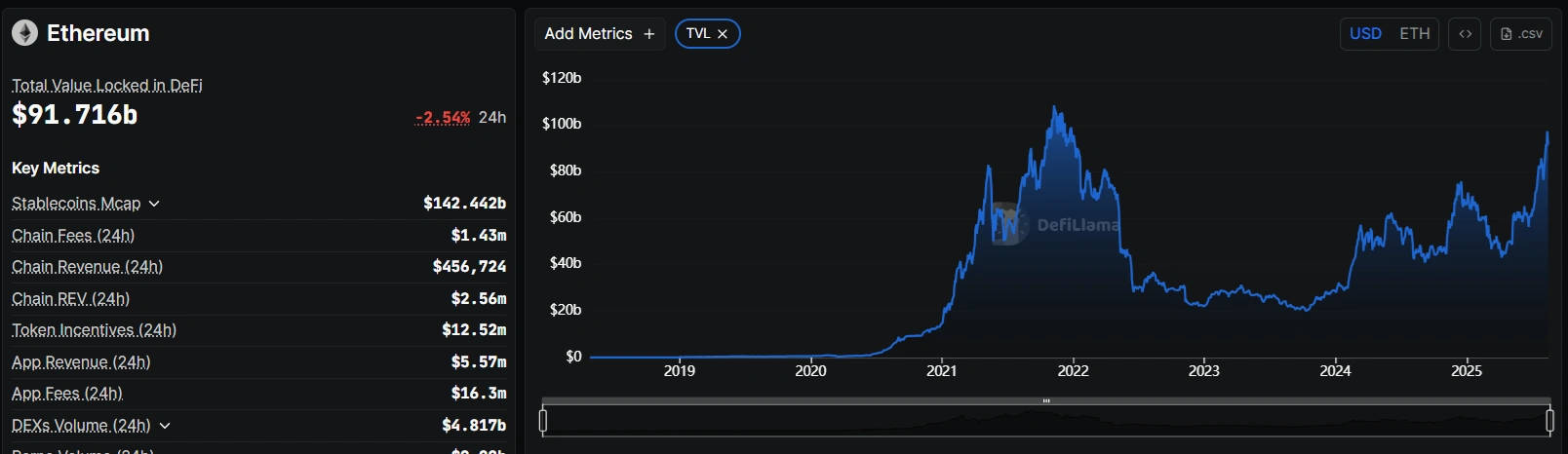

Ethereum TVL nears peak levels from early 2022. Source: Defillama

Ethereum TVL nears peak levels from early 2022. Source: Defillama

Price momentum nears historical peak

Some of the drivers of the latest momentum are increasing institutional demand, inflows into spot Ether exchange-traded funds, and a generally more supportive macroeconomic backdrop compared to the bear market of 2022.

Options traders have positioned for ETH to break above $5,000, a level that many in the market now see as a near-term catalyst for further speculative inflows. Some strategists have gone further, projecting prices as high as $13,000 if capital rotation from Bitcoin into Ethereum accelerates.

ETH/USD price. Source: Google Finance

ETH/USD price. Source: Google Finance

The rally has also been supported by a wave of institutional endorsements. Inflows into U.S.-listed Ether ETFs topped $2.9 billion last week, surpassing the previous week’s record of $2.1 billion, which it has maintained since it hit that high in mid-July. This marks one of the strongest stretches since their approval earlier this year.

DeFi locks in capital at pre-crash levels

Beyond the headline price, Ethereum’s DeFi ecosystem has staged a significant rebound. Total value locked has surged past $90 billion in recent days, hitting as high as $95 billion at some point. This brought it within striking distance of the $108 billion peak recorded in late 2021, just before the cascading liquidations and collapses that marked the 2022 crash.

Much of this capital has flowed into liquid staking. Lending and restaking protocols, collateralized stablecoin platforms, RWAs, and yields, among others, have also seen inflows.

Observers point to Ethereum’s steady network upgrades as part of the reason behind this resilience.

Still, not all observers are convinced that the TVL stat should be taken at face value. A recent academic study argued that TVL metrics often involve double-counting and may exaggerate the true size of DeFi activity. That caveat has not stopped capital from flowing in. However, DeFi users are routinely undeterred by methodological debates as long as liquidity and yields continue rising.

The future looks bright for Ethereum

Market observers are watching as ETH moves, especially as it approaches the $4,700–$4,800 range. Should ETH scale above that level, it could trigger a wave of speculative demand.

In the longer term, the outlook appears relatively promising thanks to regulatory clarity in major markets, the growing role of Ethereum ETFs in institutional portfolios, and the steady adoption of staking, all pointing to a maturing asset class.

Also, developers continue to prioritize scaling and efficiency of the blockchain, which could keep Ethereum competitive even as rival blockchains seek to capture DeFi market share.