Why Novogratz Says a Million-Dollar Bitcoin Would Be Bad News

Bitcoin bulls love to dream about a million-dollar price tag, but Galaxy Digital CEO Mike Novogratz says that kind of rally next year wouldn’t be a victory lap for crypto—it would be a warning sign for the United States. In his latest remarks, Novogratz explained that such a surge would only happen if the U.S. economy was in chaos, with the dollar collapsing and debt spiraling out of control. For him, a stable nation with a modest Bitcoin price is far preferable to a sky-high valuation born out of crisis.

The Hype Around a $1 Million Bitcoin

In the crypto world, few predictions get people talking like the idea of Bitcoin hitting one million dollars. To some, it represents validation of Bitcoin as the ultimate store of value. But according to Galaxy Digital CEO Mike Novogratz , cheering for such a price point in the near future misses the bigger picture. Speaking on the Coin Stories podcast, Novogratz warned that if Bitcoin climbs to $1 million next year, it would likely signal deep trouble in the U.S. economy rather than a healthy crypto victory.

Stability Over Skyrocketing Prices

Novogratz put it bluntly: he would rather see Bitcoin stay lower if it meant the United States remained stable. A soaring Bitcoin price often signals weakness in traditional financial systems, especially the U.S. dollar. When national currencies lose value, investors flee to alternatives like gold or Bitcoin to protect their wealth. That kind of move, he said, comes at the expense of civil society, often fueling inflation, social unrest, and broken trust in government institutions.

Concerns Over U.S. Debt and Policy

A key part of Novogratz’s caution lies in America’s worsening debt picture. He pointed out that the appointment of Treasury Secretary Scott Bessent by President Trump hasn’t delivered the expected fiscal improvements. Despite Bessent’s intentions, debt-to-GDP ratios are still climbing. Novogratz warned the U.S. deficit is on track to grow, not shrink, adding pressure to the economy. In that environment, Bitcoin could rise fast, but only as a hedge against a failing system.

The Risk of a Bitcoin Treasury Bubble

Another concern is the rush of corporations adopting Bitcoin on their balance sheets. Galaxy Digital, Novogratz revealed, now gets about five calls a week from companies looking to add BTC to their treasuries. While corporate adoption was once considered a bullish signal, Novogratz said it’s starting to feel more like mania. He compared it to classic bubble signals—when even cab drivers start asking about balance sheet strategies. He’s not alone. VC firm Breed recently issued a warning that most Bitcoin treasury companies could face a “death spiral” if market conditions turn, leaving only a handful of strong players intact.

What This Really Means for Investors?

Novogratz’s comments highlight a key tension in the crypto narrative. Bitcoin’s role as “ digital gold ” works best when it provides stability in uncertain times, not when its price skyrockets as economies crumble. If BTC were to hit a million dollars in the next year, it wouldn’t be because adoption suddenly exploded—it would be because the U.S. dollar collapsed, debt spiraled, and confidence in traditional finance evaporated. In his view, that’s not a win for crypto, it’s a red flag for society.

Final Takeaway

Novogratz’s warning is a reminder that Bitcoin’s strength is tied to the broader financial system, not separate from it. For long-term believers, slow and steady adoption supported by a healthy global economy is far more sustainable than a sudden price explosion caused by crisis. A million-dollar Bitcoin might grab headlines, but if it happens in 2026, it will likely mean the U.S. is in a place no investor should celebrate.

$BTC, $Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

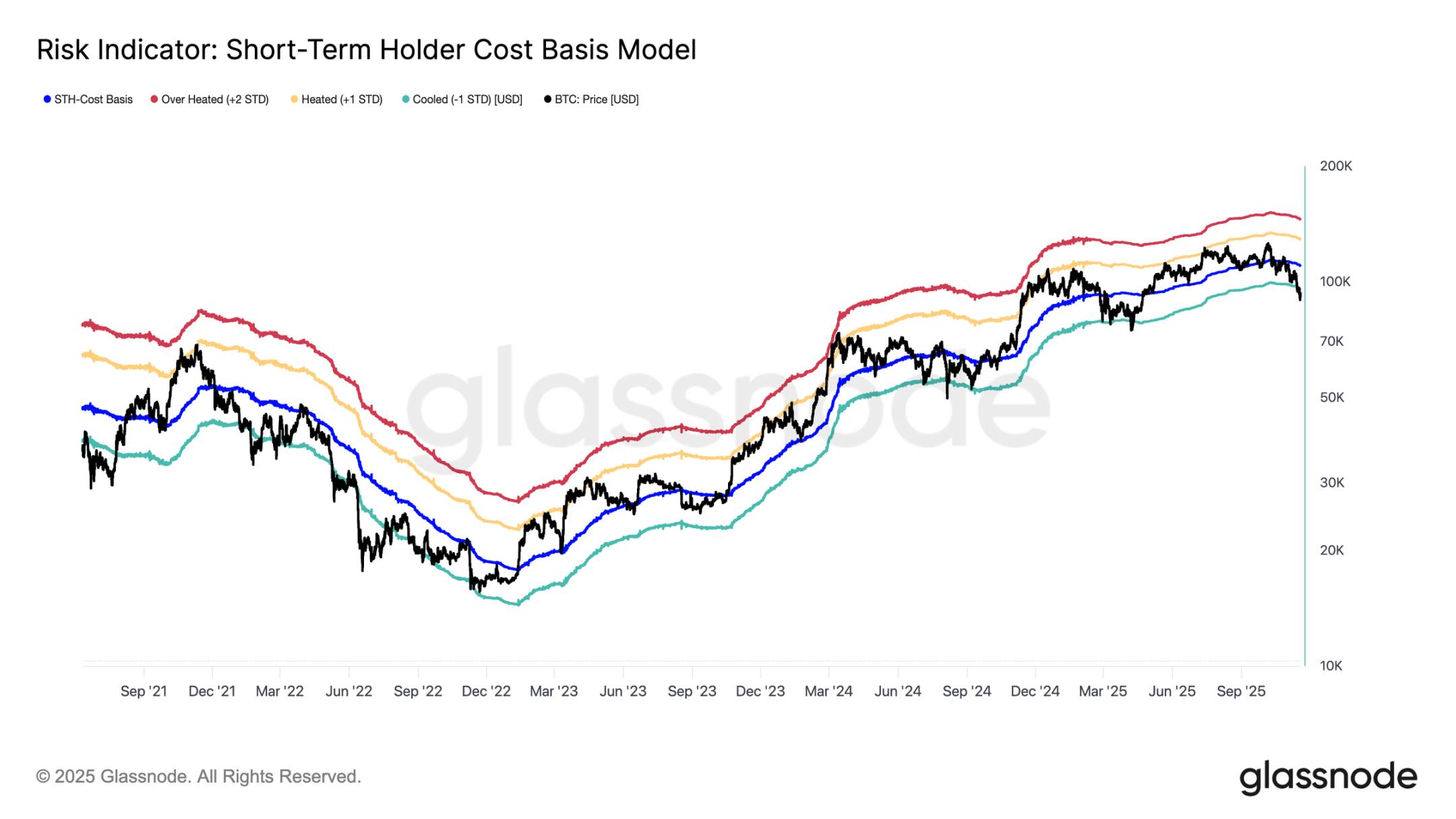

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin