Bitcoin slides, Ether, XRP, Dogecoin move lower ahead of Fed Chair’s final Jackson Hole speech

Key Takeaways

- Bitcoin and altcoins fell in a broad crypto market decline ahead of the Fed Chair's Jackson Hole speech.

- Market volatility increased as investors anticipated possible Fed rate changes and reacted to ongoing inflation concerns.

Bitcoin slipped under $113,000 on Tuesday, triggering a market-wide downturn that sent Ethereum, XRP, and Solana lower. The total crypto sector fell to $3.8 trillion, down 3.5% on the day.

The price of Bitcoin dropped nearly 3% in the last day to $112,696, marking a return to levels not seen since the beginning of the month, CoinGecko data shows.

Ether dropped more than 4% to $4,100 after flirting with record highs in the past few days. Losses are spread across major altcoins, with XRP down nearly 6%, Dogecoin and Chainlink off over 5%, and Sei and Cardano plunging 8%.

The pullback comes ahead of the Fed’s Jackson Hole symposium on Friday, where Chair Jerome Powell is scheduled to deliver his keynote address. Markets are bracing for whether he signals a September rate cut or doubles down on inflation concerns, especially after US inflation data offered mixed signals in July.

The headline CPI slowed to 2.7% but core inflation edged up to 3.1% and PPI climbed 3.3%. The combination of weakening job growth and persistent price pressures has raised stagflation fears, which could complicate the Fed’s decision-making.

“Higher‑than‑expected PPI numbers (producer prices jumped 0.9% month‑on‑month against a 0.2% forecast) have complicated the Fed’s policy framework, so the market will be looking for hints on the Fed’s thinking ahead of its September policy meeting,” said QCP Capital analysts in a statement . “Last year, Powell used Jackson Hole to telegraph an easing bias; this year, Trump’s tariffs and political pressure create a much more contentious backdrop.”

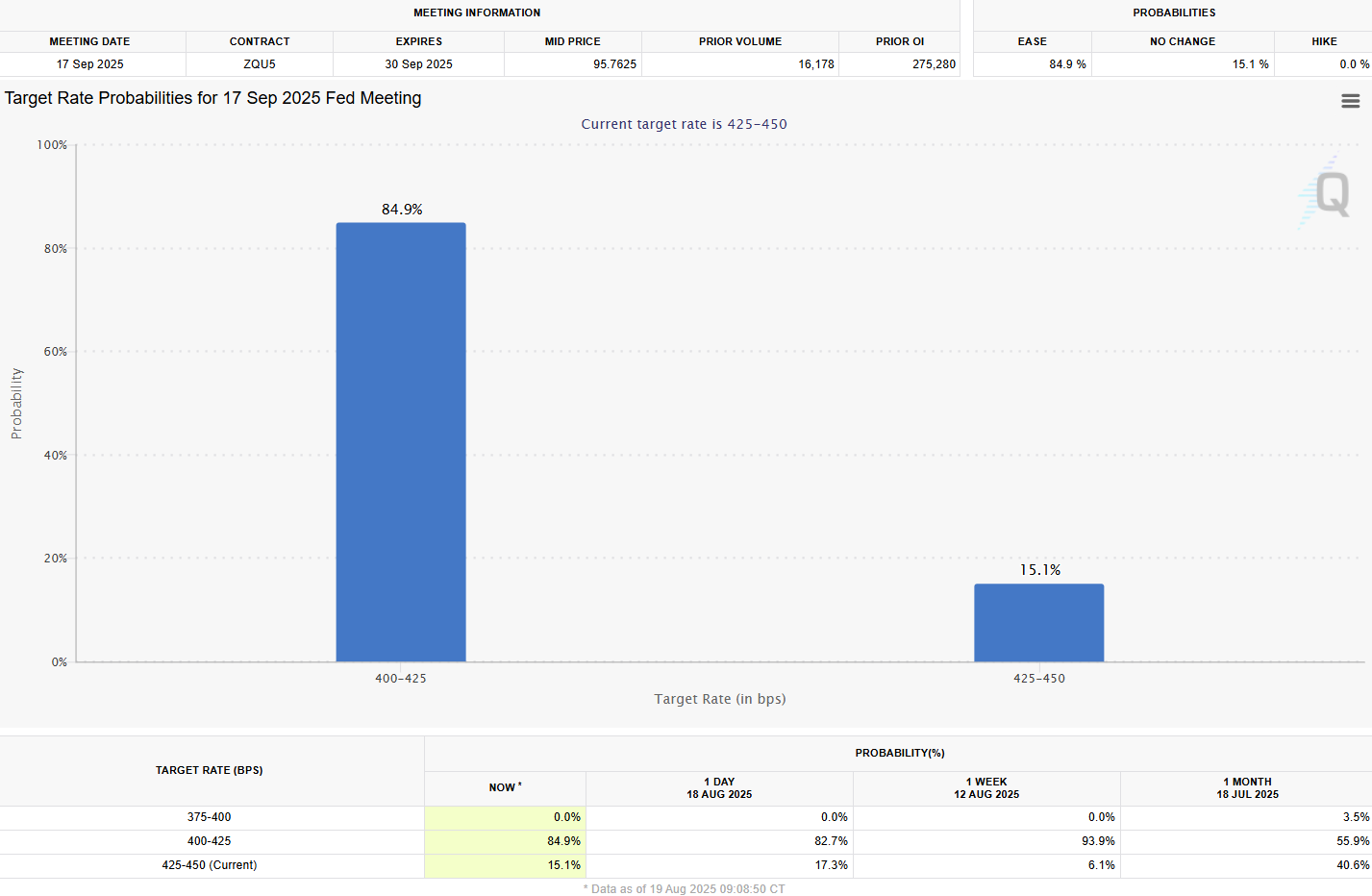

Traders are still pricing in a 25-basis-point cut at the September 17 FOMC meeting, though odds have eased following hotter-than-expected inflation readings.

Analysts predict Powell will be cautious during his final Jackson Hole speech. The Fed Chair may acknowledge that risks to employment and inflation are balancing, suggesting a cut could be appropriate if trends continue, but he is unlikely to commit to a specific policy action.

Since expectations for a September cut are already priced in, any hint that action might be delayed could feel like a tightening of policy for investors.

However, signals that quantitative tightening may end or that regulatory shifts are coming could boost liquidity and potentially reignite Bitcoin’s rally toward year-end, analysts suggest.

Elsewhere, US stocks also reflected uncertainty at Tuesday’s market close.

The SP 500 fell nearly 0.6% and the Nasdaq Composite dropped around 1.5%, while the Dow Jones Industrial Average edged up.

Tech and chipmakers led losses, with Nvidia down 3.5%, AMD off 5.4%, and Broadcom lower by 3.6%. Palantir sank 9%, the worst SP 500 performer, while Tesla, Meta, and Netflix also slipped.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.