Pennsylvania Bill Proposes Crypto Trading Ban for Officials

- The bill mandates divestment of crypto holdings over $1,000 by officials.

- Includes Bitcoin, Ethereum, and NFTs among affected assets.

- Imposes felony penalties for non-compliance, impacting public service qualifications.

Pennsylvania’s HB1812 proposes a ban on public officials’ cryptocurrency transactions and mandates disclosures. Spearheaded by Rep. Ben Waxman and seven co-sponsors, the bill targets various digital assets, demanding divestment of holdings over $1,000 within 60–90 days.

Pennsylvania Representative Ben Waxman spearheads the introduction of HB1812 to ban public officials from engaging in cryptocurrency transactions, with immediate effects on officials across the state legislature.

The measure could reshape state-level financial transparency, compelling officials to disclose crypto holdings while preventing conflicts of interest.

Introduced by Rep. Ben Waxman, HB1812 bars Pennsylvania officials from holding digital assets, compelling divestment exceeding $1,000. The proposal targets cryptocurrencies like Bitcoin and Ethereum, among others.

“The bill aligns with ongoing federal scrutiny of public officials’ involvement in digital assets.” — Ben Waxman, Representative, Pennsylvania House of Representatives source

The bill’s direct influence on financial markets remains muted, given the small demographic affected. However, its stringent penalties spotlight ethical governance.

Immediate industry reactions are minimal, with no notable shifts in market liquidity. Federal-level analogs are discussed, though not implemented.

Potential outcomes include enhanced regulatory frameworks. Historical comparisons parallel the federal STOCK Act; limited similar state statutes exist. Technological implications remain speculative amidst growing legislative discourse.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

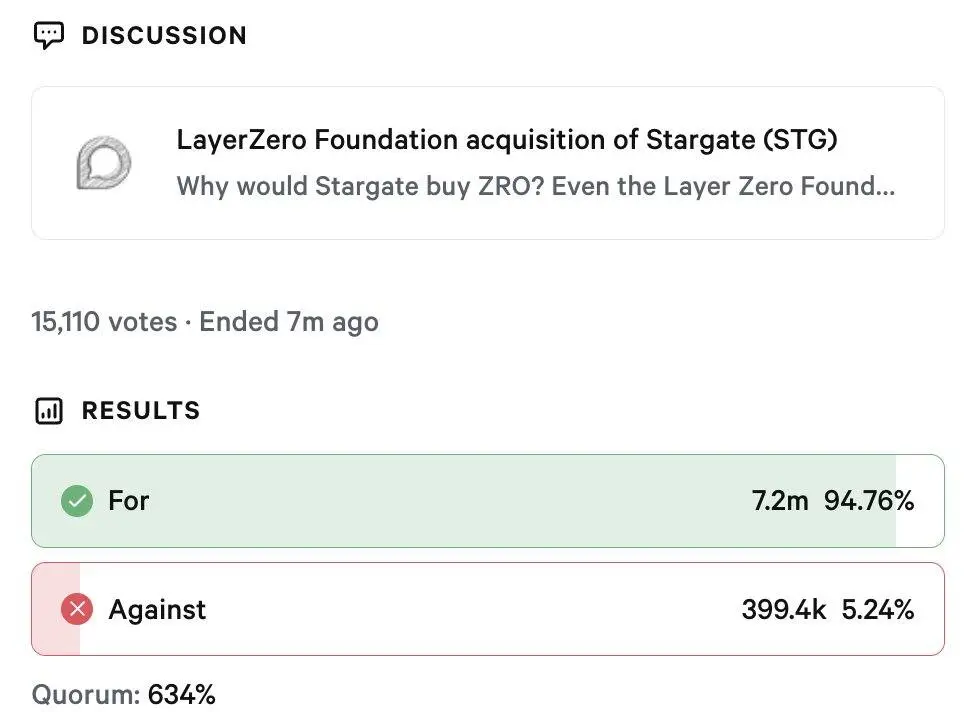

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated