South Korean Actress Faces Trial for Cryptocurrency Embezzlement

- Hwang Jung-eum’s embezzlement trial involves a cryptocurrency investment.

- Prosecutors request a three-year prison sentence.

- Final verdict is set for September 25.

South Korean actress Hwang Jung-eum faces a potential three-year prison sentence for allegedly embezzling 4.3 billion won from her company. The funds were primarily invested in cryptocurrency, with repayment made following asset liquidation.

Hwang Jung-eum, a South Korean actress, faces a potential three-year sentence for embezzling 4.3 billion won to invest in cryptocurrency. The final verdict is expected on September 25.

This case highlights concerns over celebrity involvement in cryptocurrency speculation, emphasizing financial oversight importance.

Background and Trial Details

Hwang Jung-eum, a prominent South Korean actress and owner of Hoonminjeongeum Entertainment, has been accused of moving 4.3 billion won from her agency funds into cryptocurrency. Prosecutors are seeking a three-year prison sentence with a verdict expected on September 25.

As the sole controller of Hoonminjeongeum Entertainment, Hwang allegedly diverted her company’s earnings into cryptocurrency during 2022. She has acknowledged poor financial management, attributing her actions to encouragement from acquaintances to invest in digital assets without proper knowledge.

“I established and operated my agency to support my career as an entertainer. With hopes of growing the company, I was encouraged around 2021 by acquaintances to invest in cryptocurrency. Believing it could increase the company’s funds, I made the poor judgment to invest, even though I lacked proper understanding.”

There have been no significant impacts on cryptocurrency markets following Hwang’s investments. No evidence shows market fluctuations or disruptions associated with major digital currencies due to this case, according to available on-chain data.

Hwang’s situation has not prompted official responses from South Korean regulatory authorities or financial institutions. Her actions remain an isolated event within her personal agency, without implications for broader market or governmental concerns.

This incident underscores potential financial and legal risks associated with individual investments in digital currencies. As regulations continue evolving, this case may influence discussions around monitoring celebrity crypto activities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

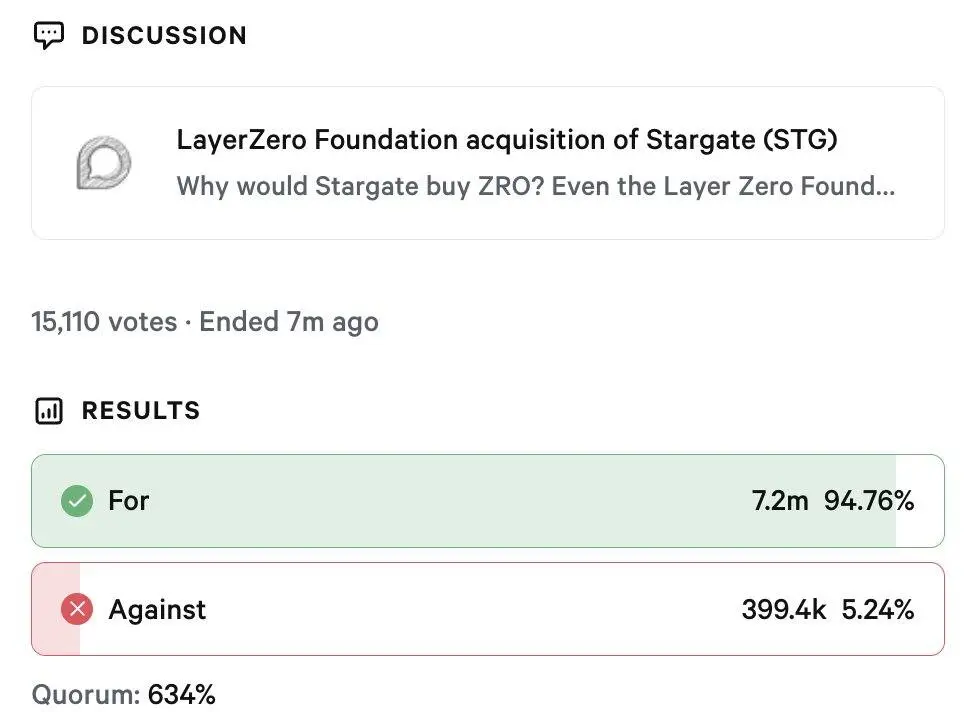

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated