BlackRock Spot Ethereum ETF Buys $233.6M Worth of ETH

- BlackRock’s ETF bought 53,890 ETH worth $233.6M.

- Major capital flows signal institutional interest.

- Ethereum’s role in digital finance expands rapidly.

BlackRock’s spot Ethereum ETF, the iShares Ethereum Trust ETF (ETHA), gained prominence since its Nasdaq debut in July 2024, buying 53,890 ETH ($233.6M) on Aug. 21, 2025, illustrating strong institutional interest and substantial liquidity. Management by industry-leader BlackRock enhances its appeal.

BlackRock’s spot Ethereum ETF, the iShares Ethereum Trust, purchased 53,890 ETH valued at $233.6 million on August 21, establishing itself as a key player in institutional Ethereum investing.

BlackRock’s acquisition underscores Ethereum’s growing institutional adoption, positioning it as a critical asset in digital finance transformation.

Ethereum ETF Launch and Impact

Managed under the iShares brand, BlackRock’s spot Ethereum ETF was launched on Nasdaq in July 2024. This transaction not only solidifies BlackRock’s leading role in cryptocurrency markets but also highlights strong institutional interest in digital assets. Jay Jacobs, BlackRock’s U.S. Head of Thematic and Active ETFs, noted Ethereum’s potential to significantly influence financial systems. He emphasized the importance of liquidity and transparency in exchange-traded products (ETPs).

“Our clients are increasingly interested in gaining exposure to digital assets through exchange-traded products (ETPs) which provide convenient access, liquidity and transparency. Ethereum’s appeal lies in its decentralized nature and its potential to drive digital transformation in finance and other industries.” — Jay Jacobs, U.S. Head of Thematic and Active ETFs, BlackRock

The purchase highlights increasing institutional demand for Ethereum, as evidenced by substantial asset flows and trading volume in Ethereum ETFs. With notable inflows seen recently, including $500 million recorded on August 19, Ethereum’s market resilience is evident. This activity reflects how institutional capital shifts impact traditional and crypto markets.

Market Activity and Observations

Financially, the influx of capital into Ethereum ETFs drives enhanced liquidity, comparable to top-tier equities. Bloomberg’s Eric Balchunas remarked on the trading activity, likening the combined trade volume of BlackRock’s Bitcoin and Ethereum ETFs to that of Apple.

“Combined trade volume for BlackRock’s spot Bitcoin and Ether ETFs on Thursday reached $11.5 billion, a figure roughly equivalent to Apple’s daily trading volume.” — Eric Balchunas, Bloomberg ETF Analyst

Potentially, Ethereum’s status as a “reserve asset” could lead to significant structural market changes. Institutional investments foster Ethereum’s integration into broader financial systems, altering asset allocation strategies. This transition may impact governance tokens and Layer 1/Layer 2 scaling solutions within the Ethereum ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

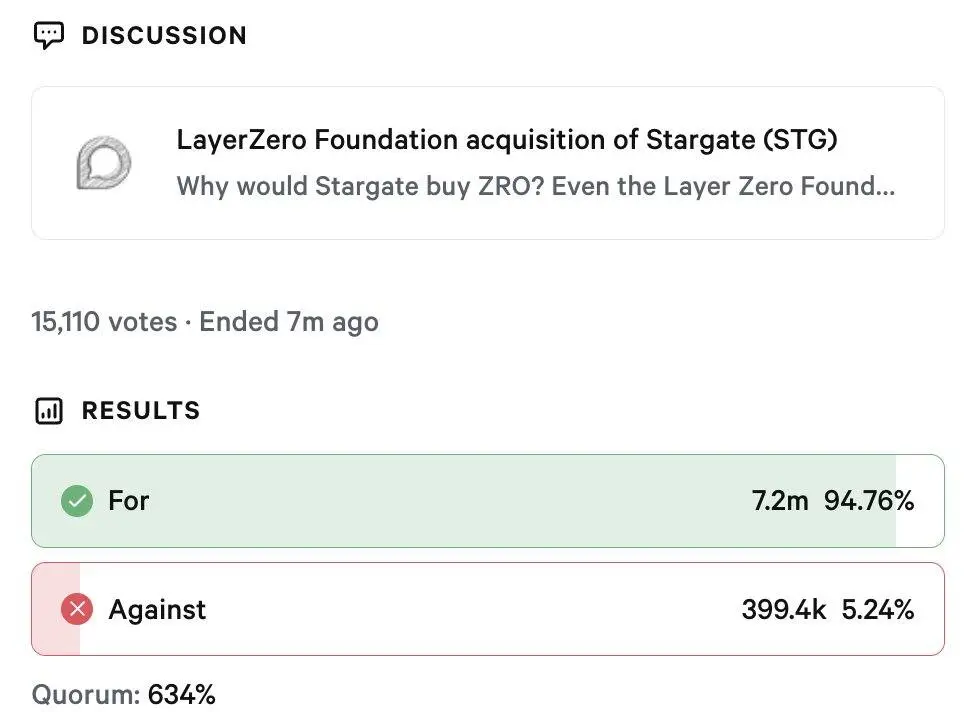

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated